RI billionaires club a lonely place. See who's a member.

Meetings of the Rhode Island billionaires club would not be very crowded affairs.

The Ocean State has only one resident billionaire, though a couple more of the uber rich have ties to the state, so they might be allowed into club meetings.

Jonathan Nelson, of Providence Equity Partners, is worth $3.1 billion and lives in Providence, according to the 2023 Forbes list of billionaires worldwide .

Forbes says that he founded Providence Equity in 1989, was CEO until 2021 and is currently executive chairman. His firm has invested in more than 170 companies, many in the media, communications, education and information industries, according to forms.

Alahverdian on 'Dateline': 'Dateline NBC' to cover story of RI fugitive Nicholas Alahverdian. Here's the story.

According to Stacker.com , a data journalism organization that has examined the Forbes list of more than 2,540 billionaires worldwide, Nelson is the only one who lives in Rhode Island.

But here are others that might not be kicked out of the Rhode Island billionaires club meetings:

Larry Ellison, chairman and co-founder of software giant Oracle, ranks No. 4 worldwide on the Forbes list (behind fashion and retail magnate Bernard Arnault, Tesla and SpaceX chief Elon Musk and Amazon founder Jeff Bezos) with a net worth of $107 billion. He owns several mansions in Newport.

Real estate sales: Want a home with water views in Portsmouth? It may cost you a million dollars

Two others have ties through the sports teams they own, which, while not actually located in Rhode Island, are part of the state's culture: Robert Kraft, owner of the New England Patriots, worth $10.6 billion, and John Henry, owner of the Boston Red Sox, worth $4 billion.

- Share full article

Advertisement

Supported by

The Private Equity Firm That Grew Too Fast

By Julie Creswell

- April 24, 2015

Jonathan M. Nelson, the billionaire media mogul and founder of Providence Equity Partners, enters the room — limping.

The brace on his right leg is a souvenir from his private equity firm’s annual ski outing to Alta, Utah. Mr. Nelson ripped his A.C.L. while heli-skiing. Because Masters of the Universe never just trip.

It has been a bumpy few years for Mr. Nelson and Providence. In February, one of the firm’s biggest investments, the security screener Altegrity, filed for bankruptcy in the face of fraud accusations. Providence had its entire $800 million stake wiped out, the largest loss in the firm’s 26-year history.

Altegrity was the latest in a string of bad bets for the firm. Last summer, it lost its entire $460 million investment in a for-profit college company after that company faced multiple investigations. Hundreds of millions of dollars were erased when the film studio Metro-Goldwyn-Mayer went bankrupt in 2010. A $675 million stake in an Internet retailer has been written down to zero, as has the $400 million it spent on a Dutch child-care group. The spate of poor investments caused Providence to deliver dismal returns in back-to-back funds.

Just days before he was to have knee surgery, Mr. Nelson, 58, sat in a small, dark wood-paneled conference room in the firm’s Rhode Island headquarters. He briefly closed his eyes while pondering what had gone wrong.

“We grew too fast. We were managing too much money,” Mr. Nelson said. “That was the hallmark of that era, but it doesn’t make me less disappointed in our results.”

He acknowledged that the firm made too many investments at precisely the wrong time, in 2007 and 2008, just as the private equity boom was cresting. “That was an absolute killer,” he said. “If you look at our terrible deals, they were done in that time period.”

And Providence, which rose to prominence on the strength of its telecom and media holdings, began buying companies outside its area of expertise. “One of our mistakes was definitely style drift,” Mr. Nelson said, using financial jargon for a firm’s straying from its stated investment style. “Altegrity was a good example of that.”

In the ego-filled world of Wall Street, it is rare to find an executive who readily acknowledges errors, let alone a series of them. But that’s not what Mr. Nelson wants written. Instead, he sees his firm’s story as one of recovery and redemption. The past is past. Providence has owned up to all of its problems and fixed them, he says.

“Everyone made mistakes,” he said. “The key is who learned from it? I like to think we did.”

Providence finds itself at a critical juncture. Despite poor performance in its two prior funds, the firm managed to raise $5 billion in 2013 for its latest vehicle. Some attribute that feat to Mr. Nelson’s gifted salesmanship and earlier track record. Others note Providence continues to benefit from extremely low interest rates, which have forced pension funds and others to seek returns in so-called alternative investments like private equity and hedge funds, which charge higher fees than traditional stock or bond funds. (Private equity firms like Providence invest in companies, mostly with borrowed money, that they hope to later either sell or take public at a profit for themselves and their investors.)

Providence’s future very much rests on the success of its current fund. The firm must post strong results, and it will have to do so while beginning to transition to a new generation of leaders.

A close look at Providence’s stumbles illustrates the perils of success and serves as a case study for what can happen when an investment firm — or any company, for that matter — grows too fast during a bull market and there is too much money chasing expensive deals.

Just a decade ago, Providence was one of Wall Street’s hottest firms. Mr. Nelson started it in 1989 and was later joined by Glenn M. Creamer and Paul J. Salem, all three graduates of Brown University and Harvard Business School. The firm reveled in its Rhode Island roots and “stealth mogul” status far from Wall Street and its brand-name rivals.

“I love the fact that we’re not covered,” Mr. Nelson told The New York Times in 2003 . “If you think our profile is low in New York, it’s even lower here.”

But a succession of hugely profitable telecom investments brought Providence’s partners prodigious wealth and attention. Among its most lucrative deals was VoiceStream Wireless, a company cobbled together through the acquisition of wireless spectrum. In July 2000, just before the telecom sector crashed, VoiceStream agreed to be acquired by Deutsche Telekom for $50 billion.

Providence’s timing seemed impeccable. It got in and out of a big bet on competitive local telephone exchange carriers before that market collapsed. Investors in a 1996 fund more than tripled their money after fees. A 2000 fund made nearly two and a half times its investments.

The media investor Haim Saban recalled his first meeting with Mr. Nelson in 2003, shortly after he had led a group in a successful bid for a German broadcaster. “I was so impressed by his ideas that, frankly, I reduced my share in the deal and asked the other private equity firms to reduce their shares so Providence Equity could invest,” he said.

Providence had established itself as the smartest media and telecom private equity player. That reputation would serve it well as private equity entered its golden age. Providence and its peers became major beneficiaries of a post-Sept. 11 economy of low bond yields and loose lending standards. Institutions, having had their stock portfolios crushed by the dot-com bust and ensuing bear market, began pouring money into private equity.

In 2000, Providence oversaw just $3.6 billion. A single fund raised in 2005 amassed $4.26 billion. Two years later, it raised $12 billion more — in just three months. By 2007, the firm had nearly $21 billion in private equity assets under management. It also started a credit arm, which quickly attracted billions to invest in fixed-income securities.

“The interesting thing about getting bigger is that when you’re in the middle of it, you’ve always been getting bigger. The relative increase was no different than the other ones,” Mr. Nelson said, shrugging. “We were doubling with every fund.”

The money catapulted Providence from a boutique into a megafund, allowing it to compete for deals with larger firms. Providence charged into the fray, investing half of the $12 billion fund in just two years.

This was the apex of buyout mania. Private equity firms, flush with cash, were paying top dollar for companies that would struggle during the coming financial crisis and Great Recession. Providence delved into areas like health care, Internet retailing and child care, often paying hefty sums for companies in sectors in which it had scant experience.

“The risk during this time wasn’t just style drift, it was quality drift,” said Peter Keehn, the head of private equity at Allstate Investments, who wasn’t speaking specifically about Providence. “After raising these big funds, if you couldn’t find assets that were exactly what you were dying to own, then you started to look at assets that were close to what you’d like to own.”

As Providence grew, Mr. Nelson looked to expand the firm’s Manhattan offices. The firm was outgrowing its space in the Lever House, a glass-box skyscraper on Park Avenue. (It’s nicknamed “the leverage house” for the numerous private equity and hedge funds housed there.)

Mr. Nelson moved the firm to the swooping tower at 9 West 57th Street, among the world’s most prestigious business addresses. The firm leased the entire 47th floor, placing it several floors above rivals like Apollo Global Management (43), Kohlberg Kravis Roberts & Company (42) and Silver Lake Partners (32). It was hardly a subtle message: Providence had entered the big leagues.

In the summer of 2007, Providence struck what would have been the largest buyout deal in history, the $51 billion takeover of BCE, parent of the phone giant Bell Canada. Not long afterward, Mr. Nelson appeared on the cover of Fortune magazine alongside the headline “The Biggest Deal Ever.”

That Fortune issue became a collector’s item — because the deal never happened. The BCE buyout fell apart in the ensuing credit crisis.

Still, during the height of the frothy markets, Providence completed a number of deals, and none was worse than Altegrity.

In 2007, Providence paid $1.5 billion for U.S. Investigations Services, a former branch of the federal government. Privatized in the 1990s, it provided background checks for government employees requiring security clearances.

Providence began adding related businesses onto USIS to create a bigger, more diverse entity it renamed Altegrity. First came the commercial background-checking firm HireRight. Next, in 2010, it bought the investigative firm Kroll for $1.1 billion.

The three business entities coexisted, albeit not always peacefully. Several Altegrity managers interviewed for this article said they butted heads with Providence partners over everything from strategy to acquisitions to sales of business lines.

That was the least of Altegrity’s problems. In 2011, a former USIS manager in Alabama filed a whistle-blower lawsuit that the government later joined asserting that 40 percent, or 665,000, of the investigations USIS turned in to the government between 2008 and 2012 were incomplete. USIS said the accusations did not fit the company’s record but noted that it had appointed a new leadership team and improved control protocols.

Altegrity took a major public relations hit after revelations that it had performed the background checks on Edward J. Snowden, the former National Security Agency contractor who leaked documents to journalists, and Aaron Alexis, the Washington Navy Yard shooter who killed 12 people in 2013. USIS said the background checks were conducted in strict accordance with a government-dictated contract.

The final straw was a hacking attack on USIS, which led the government to withdraw its contracts. With the loss of that business, and buckling under $1.8 billion in debt, Altegrity filed for bankruptcy protection this February.

Providence executives blame events largely outside their control for Altegrity’s failure. But they also all agree the firm shouldn’t have made the deal in the first place. “We didn’t have a particular expertise in that area,” Mr. Nelson acknowledged.

Not all of Providence’s investments during the boom were missteps. A $724 million investment in the German cable company Kabel Deutschland netted more than $3 billion. A stake in the AutoTrader Group, an advertising website, returned three times its money. The same holds true for a small education deal, Archipelago Learning.

But Providence and its investors are still paying for the firm’s overreaching into areas outside media and technology. The performance of the 2005 fund is abysmal. With an annual return of 3.5 percent after fees, it sits near the bottom of its peer group.

The 2007 $12 billion vehicle is also struggling, returning about 6 percent annually. For now, those two funds rank in the bottom quartile of other similarly sized global funds from the same year, according to an analysis by the research firm PitchBook. But some investors expect that performance to improve on potential gains on several investments including Asurion, a cellphone insurer; ZeniMax Media, a video gaming company; and wireless tower companies in India and Latin America.

For a lesser private equity player, back-to-back bottom-quartile funds would have spelled a firm’s demise. Providence survived, though raising a new fund was a slog. Several past investors declined, including the California Public Employees’ Retirement System and the California State Teachers’ Retirement System, which had a total of $1 billion invested in the 2005 and 2007 funds, according to the online fund-raising firm Palico.

But others, including pension funds in Washington, Florida and Illinois, increased their investments in the new fund. A handful of others, including Florida and the State Teachers Retirement System of Ohio, went a step further, taking an ownership stake in Providence itself.

"They have proven over many years their ability to create significant value for their investors,” said Michael Rees, the head of Dyal Capital Partners, in an emailed statement. Dyal, a unit of the investment manager Neuberger Berman, took a stake in Providence last fall.

Peter Chernin, the former president of News Corporation, received an investment from Providence in his new company, the Chernin Group. “There is no one in that arena who is as knowledgeable about media, technology and communications as he is because he’s been focused on it for 30 years,” Mr. Chernin said of Mr. Nelson.

Mr. Nelson sounds energized when discussing the future of media. The firm has been betting on demand for premium sports content, leading to investments in Major League Soccer, the company that runs the Ironman triathlon races, and Learfield Sports, which owns rights to college sports programming. While still in its early days, Providence’s 2013 fund has posted annual returns of 20 percent on paper.

Like many of the world’s largest private equity companies that started in the 1980s and 1990s, Providence is also dealing with succession issues. A nagging problem it has faced is how to retain top talent when its leaders show no signs of moving on.

In recent years, the firm saw talented people leave, some for new jobs, others because they specialized in areas Providence was no longer focusing on. Still others were frustrated that the firm’s leaders, including Mr. Nelson, Mr. Creamer and Mr. Salem, continued to reap much of the profits in the 2013 fund.

That is changing. This year, Mr. Creamer announced internally his intentions to take no profits from the next fund. As for Mr. Salem, he is currently on a six-month around-the-world vacation with his family, but he plans to return to his leadership role.

Mr. Nelson, who has no intention of stepping down from his chief executive post, has spent the last several years fighting to get his firm back on track from its bungled investments. Meanwhile, competitors like Blackstone and Carlyle have grown ever larger — selling shares to the public, putting a new generation of leaders in place and morphing into global asset management businesses.

From Mr. Nelson’s perspective, the Providence of old has returned. The firm is back to investing in what it knows. He noted that 700 budding financiers applied for just a handful of job openings last year.

“The culture is back to where it used to be in the early days,” Mr. Nelson said, leaning back in his chair and smiling, though in obvious discomfort from his injured knee. “People are happy to be here and are proud of the work we’re doing.”

Explore Our Business and Tech Coverage

Dive deeper into the people, issues and trends shaping the worlds of business and technology..

Paper Checks Refuse to Die: It’s hard to avoid hassle — or fraud — when you’re required to pay with paper and ink. Here’s why checks persist .

Silicon Valley Democrats Are Invigorated: Elon Musk, Marc Andreessen and others have endorsed Donald Trump. But President Biden’s withdrawal has re-energized Democrats across the tech industry and may blunt that momentum.

Barbie’s Failed Promises: In the 12 months since the movie’s release, little has changed in Hollywood. Buffeted by dual labor strikes and a general retrenchment by entertainment companies, the industry has retreated to its usual ways of doing business.

Motels Are Having a Moment: What’s old is new again, and the humble roadside motel that an older generation might dismiss as outmoded is appealing to a new group of younger fans attracted to hit-the-road adventures.

Software to Set Rents: Antitrust cases contend that use of RealPage’s algorithm, which lets property owners share private data, amounts to collusion .

Nelson Motor Yachts are currently building the ‘Nelson 18’ tailored to your specification – including fit out options, propulsion types: electric & diesel

When Commander Peter Thornycroft, who lived in Bembridge on the Isle of Wight, took over ‘Keith Nelson & Company’ he started to produce the Keith Nelson 18s which were wooden clinker built harbour launches. These were being produced alongside the early wooden Keith Nelson Motor Yachts such as the 23, 26 and 30.

The 18 foot long launches were soon in great demand and when John Askham joined Keith Nelson & Company (and later, ‘TT Boat Designs’) as Commander Thornycroft’s Naval Architect in 1961, one of his first jobs was to re-design the ‘Keith Nelson 18’ so that it could be reproduced in, the then very new, GRP (polyester) material – see John’s ‘Keith Nelson 18’ drawing 12b below. Both companies ran alongside one another, under the Commander’s control.

The origins of the company name ‘Keith Nelson & Company’ were from Keith Butt and Arthur Nelson Compton, both Bembridge boat builders, who formed the limited company with an amalgamation of their two names. Thereafter the boats built at the yard were called Keith Nelsons (KN for short) and later this name became the legendary ‘NELSON’ brand.

Back to the Nelson 18 then. Halmatic produced the first GRP hulls and later a GRP superstructure. The demand was such that Tyler Mouldings were asked to produce the same hull, although with a slightly different, more rounded, superstructure. The two moulders of Nelson vessels were Halmatic and Tyler, both of which became synonymous with the ‘Nelson’ brand.

Hundreds of Nelson 18s have been produced over the last 60 years and have been fitted out/completed by a number of different yards.

In addition to producing the updated version of the classic Nelson 18, we have now developed this vessel further for heavy duty commercial use in our ‘Nelson 20 Zero Emission’ workboat.

Ideal uses:

Marina Operators ❖ Yacht Club safety vessel ❖ Harbour, estuary or river launch ❖ Harbour Master, Conservancy or Workboat ❖ Inland Waterways support or Charter vessel

BENEFITS OF THE NELSON 18 DESIGN:

- Excellent seaworthy design

- The ‘long’ keel enhances directional stability, and protects the propeller

- All round Protective ‘D’ fendering

- Long Endurance – Up to 16 hours on one charge

- Easy to charge from any standard 16A Marina mains socket

- Marine specification Lithium Batteries for safety & long life

- Low maintenance Electric drives

- Part of the proven Nelson range of Pilot & Workboats from TT Boat Designs

- Individually built by Craftsmen

Safety Rating

- RCD category C – up to 8 people

PROPULSION OPTIONS

Nelson 18 Gallery

© 2024 Nelson Motor Yachts Limited, No. 13680906, Emsworth Yacht Harbour, Thorney Road, Emsworth, Hants PO10 8BP

Vitters’ 42.6m Mediterranean charter yacht ‘Sarissa’

- Inspiration

Related News

Popular news this week, popular news this month, latest news.

- Yacht Charter & Superyacht News >

Written by Eva Belanyiova

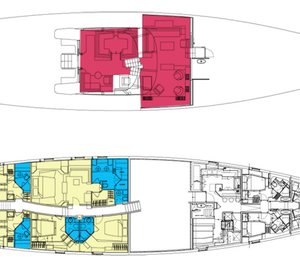

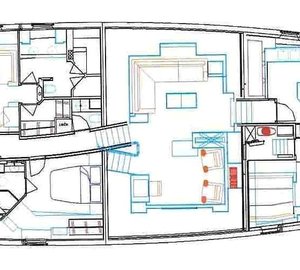

The wonderful 42.6 metre charter yacht Sarissa is a 2011 delivered carbon fibre sloop constructed by the prestigious Dutch shipyard Vitters. She is also the largest carbon fibre sloop built to date in the Netherlands. Her naval architecture features an excellent design by Bill Tripp with a fully contemporary hull shape, sail plan and foils. Elegant and timeless interior design of the superyacht Sarissa was created by Rhoades Young Design and the Owner’s representative Jens Cornelsen Yacht Consultant GmbH. Sarissa yacht guarantees matchless luxury Mediterranean yacht charter holiday experience for 8 guest accommodated in 5 cabins catered for by a crew of 6 professionals.

Vitters' 42.6 metre charter yacht Sarissa - Photo Tom Nitsch

Charter yacht Sarissa available in the Mediterranean - built by Vitters - Photo Tom Nitsch

Naval Architect Bill Tripp states: “Sarissa is exactly at the point where the state-of-the-art large sailing yacht world lies. She is a modern, technical boat whose design was guided by close client input and involvement. She will be used to sail all over the world with the family in tow, and will take part in the established superyacht regattas. Technology and modern design merge within Sarissa, providing the owner with luxurious comfort, accessible and easy sailing, integrated design, advanced performance, and confidence to sail anywhere in safety.”

Sailing yacht Sarissa available for yacht Charter around Europe - Photo Tom Nitsch

“Following our previous carbon high performance sailing yachts, this increase in size is not the only development.” Adds Louis Hamming of Vitters. “Her hydraulic and deck systems provide improved reaction speed, load and stiffness to safely facilitate the sailing performance she was designed for.” Other custom technical features are a Vitters’ developed hydraulic steering system with rudder feedback, as well as a unique system of back stays and running stays to operate both her cruising and racing sail configurations.

Rhoades Young Design and Vitters sailing yacht Sarissa - Photo Tom Nitsch.jpg

The interior design brief requested for a modern and spacious interior, yet warm and inviting like a family home. Jonathan Rhoades: “Within the length and the yachts fine performance hull lines, our goal was to create the feeling of a much larger interior. We have therefore visually borrowed volume and length from other spaces and integrated double use of certain areas. By staggering the accommodation blocks diagonally, we have stretched the visual length of the interior and effectively making the interior feel 1.5 times bigger. Tripp Design paired the vertical port lights creating a unique window that floods the interior with light. Our design capitalizes on the ample natural light below deck and spectacular views of water and sky.”

Beautiful sailing charter yacht Sarissa - Photo Tom Nitsch

Specifications

Length hull overall 42.6 m (138 ft)

Beam (max) 8.6 m (28 ft)

Draft 4.0 m (13 ft) keel up / 6.2 m (20 ft) keel down

Ballast 38 tonnes

Hull Carbon composite by Green Marine

Mast 56 m (184 ft)

Main engine Caterpillar C12, DI-TA, C-rating

Power 490 bhp (366 kW) at 2300 rpm

Fuel tank capacity 12.000 litres

Naval Architect Tripp Design Naval Architecture LLC

Interior Designer Rhoades Young Design Ltd.

Owner’s Representative Jens Cornelsen Yacht Consultant GmbH.

Stunning sailing yacht SARISSA - available for yacht charter - Photo Tom Nitsch

Vitters Charter Yacht Images

Yacht NELSON Layout

Sailing Yacht Sarissa (now Sharlou) By ...

The 42m Yacht BELLA RAGAZZA

Vitters Sarissa Yacht

More: Vitters Image Gallery

Please contact CharterWorld - the luxury yacht charter specialist - for more on superyacht news item "Vitters' 42.6m Mediterranean charter yacht 'Sarissa'".

- Charity & Fund Raising

- CharterWorld News

- Classic Yachts

- Coronavirus

- Cruise Ship

- Ecological Yachts

- Expedition Yachts

- Expert Broker Advice

- Feature Superyachts

- Interior Design

- Legal & VAT Yacht Issues

- Luxury Catamarans

- Luxury Gulet

- Luxury Phinisi

- Luxury Trimarans

- Luxury Yacht Design

- Luxury Yachts

- Marinas & Harbours

- Marine Ecology

- Marine Electronics

- Marine Equipment

- Mega Yachts

- Modern Yachts

- Motor Yachts

- New Launch Yachts

- New To Charter

- Open Style Sports Yachts

- Private Jets

- Sailing Yachts

- Social Media

- Sports Yachts

- Superyacht Crew

- Superyacht Photographers

- Superyacht Products & Supplies

- Superyacht Refits

- Superyacht Reviews

- Superyachts

- Uncategorized

- Yacht Builders

- Yacht Charter

- Yacht Charter Destinations

- Yacht Charter Picks

- Yacht Charter Specials

- Yacht Delivered to Owner

- Yacht Designers

- Yacht Events & Boat Shows

- Yacht Fashion

- Yacht Industry News

- Yacht Photos

- Yacht Racing

- Yacht Racing & Regattas

- Yacht Safety Equipment

- Yacht Support Vessels

- Yacht Tenders

- Yacht Videos

- Yachting Associations

- Yachting Awards

- Yachting Business

- Yachts For Charter

- Yachts For Sale

Quick Enquiry

Superyacht news:.

Email Your Yachting News to: news @ charterworld.com

86M SAILING YACHT

The Mediterranean

Video of the 42.6m charter yacht SARISSA by Vitters

Piet brouwer’s special led lights in the 42m charter yacht sarissa’s swimming platform, take a glimpse at majestic sailing superyacht sarissa by vitters, beautiful and sleek vitters sailing yacht sarissa in west papua, indonesia.

Award winning 80m Bilgin superyacht LEONA scoops another accolade

Countdown to the Thailand Charter Show 2024

38m Palmer Johnson motor yacht LEVERAGE is available in New England this summer with a special offer

Luxury charters in the Western Mediterranean on board 27m motor yacht GLASAX

Cantiere Delle Marche launches and delivers 45m Flexplorer 146 superyacht MAT

Iconic sailing yacht HANUMAN arrives at Holterman Shipyard for refit

Sailing yacht GALMA – the first wallywind110 – is launched by Wally Yachts

37m Gulf Craft Majesty superyacht OPTIMISM available for charter on both sides of the Atlantic

Royal Huisman delivers Project 406, the world’s largest true sportfish yacht SPECIAL ONE

34m motor yacht ONE (ex.111.11) is launched by Van der Valk Shipyard in the Netherlands

Feadship announce superyacht PROJECT 713: another milestone in their journey to environmental neutrality

Superyacht SONICIAN available for charter in the Bahamas

Columbus Yachts announce the launch of 43m motor yacht FRETTE

- Boats for Sale

New and used Nelson boats for sale

- Netherlands

- United Kingdom

- Nelson Humber 35

Search for a Nelson on TheYachtMarket today. We have Nelson brokers and sellers from around the world at great prices.

History of Nelson

Established initially as a family business in the 1960s, Nelson has etched its name in the annals of boat building industry in the United Kingdom. The company was started in the Isle of Wight, an island notorious for the choppy waters of The Solent and the English Channel. The founder, Peter Nelson, who was originally an engineer, decided to venture into the boat building industry with safety and performance in mind. His expertise, coupled with that of Naval Architect, Arthur Mursell, led to the production of the first-ever Nelson boat, a sturdy sea boat designed for the local fishermen who frequently contended with unforgiving sea conditions.

Over the years, the Nelson brand has remained a stalwart of trust and quality for boat enthusiasts across the globe. The company has overseen a continuous evolution of designs and models, ensuring their boats always meet the needs and tastes of customers. Nelson's reputation has also attracted the commercial and military markets. Their boats are home to many Maritime Agencies, Police Forces, and Harbor Authorities across Europe.

In later years, the business was relocated to the South Coast of England, where it continues to thrive today under the Nelson Yacht Services banner. Despite numerous ups and downs, it's continued to maintain the quality and standard for which Nelson boats are known. Still, its vessels garner recognition for their unique sea-keeping, durability, and elegant yet practical designs. Whether for leisure, commercial, or military use, a Nelson boat still remains a symbol of style, class, and reliability.

Which models do Nelson produce?

Nelson produce a range of boats including the Nelson 42 and Nelson 18 . For the full list of Nelson models currently listed on TheYachtMarket.com, see the model list in the search options on this page.

What types of boats do Nelson build?

Nelson manufactures a range of different types of boats. The ones listed on TheYachtMarket include Cruiser , Motoryacht , Express cruiser / sports cruiser , Coastal cruiser and Aft cockpit .

How much does a boat from Nelson cost?

Used boats from Nelson on TheYachtMarket.com range in price from £17,500 GBP to £405,000 GBP with an average price of £99,100 GBP . A wide range of factors can affect the price of used boats from Nelson, for example the model, age and condition.

Sign up to our newsletter

By submitting this form, you agree to our Privacy & Cookie Policy

Change units of measure

This feature requires cookies to be enabled on your browser.

Show price in:

Show lengths, beam and draft in:

Show displacement or weight in:

Show capacity or volume in:

Show speed in:

Show distance in:

Global site navigation

- Celebrity biographies

- Messages - Wishes - Quotes

- TV and Movies

- Fashion and style

- Music and singers

- Capital Market

- Celebrities

- Relationships

Local editions

- Habari za Kenya Swahili

Jonathan Nelson's biography: wife, nationality, parents, and siblings

Gospel musicians don't use music for entertainment only. The tracks are soothing, emotional, and ingeniously crafted in a way that brings people closer to God. Jonathan Nelson is one of those gospel musicians who have mastered this art, and he is making it big in the contemporary gospel music sector. Through his songs, many souls have come closer to God and turned their lives around for the better. So, how much do you know about him?

Jonathan Nelson is a minister, gospel singer, songwriter and producer from Baltimore, Maryland, United States. Some of his popular hits are I Believe, How Great is Our God , Praise is my Weapon , and My name is Victory. Additionally, he is the director of worship and arts at New Birth Missionary Baptist Church in Atlanta.

Jonathan Nelson's profile summary

| Jonathan Andrew Nelson | |

| Male | |

| 10 November 1974 | |

| 48 years old (as of 2022) | |

| Scorpio | |

| Baltimore, Maryland, United States | |

| Baltimore, Maryland, United States | |

| American | |

| African-American | |

| Christianity | |

| Straight | |

| Black | |

| Black | |

| Bishop James D. Nelson | |

| Bessie Nelson | |

| Anthony, Janice, Jason, James Jr. | |

| Married | |

| Christina Marie Nelson | |

| J. Andrew, Julianna | |

| Baltimore City Public School | |

| Baltimore School of The Arts, Morgan State University | |

| Singer, songwriter, producer | |

| $1 million-$5 million | |

Is Steve Howey gay? His dating history, wife, and children

Jonathan Nelson's biography

Where is Jonathan Nelson originally from? Jonathan was born on 10 November 1974 in Baltimore, Maryland, United States. He is currently 48 years old as of 2022. His parents are Bessie (mother) and James D. Nelson (father).

His dad served as a pastor at Greater Bethlehem Temple Church USA for over thirty years while his mother was the church's, first lady. Nelson was raised alongside his three elder siblings, Anthony, Janice and James Jr. Additionally, the famous musician has a twin, Jason Nelson, who is also a gospel artist.

Educational background

The American gospel artist has a decent educational background as he went to Baltimore City Public School for his high school education. Later, he joined the Baltimore School of The Arts before proceeding to Morgan State University for further education.

Jonathan Nelson's Christian upbringing has shaped not only the man he is today but also his musical journey. The church environment he grew up in made him develop an interest in music at a very young age. Nelson and some of his friends served as backup singers in the church choir before they began practicing and singing together under the stage name Purpose.

Who is James Parker Gibson? Background, career, and family

After a while, Purpose released an independent album which included the song Healed . Nelson's music career improved in 2000 when he met a Grammy-nominated choir leader, Donald Lawrence, at a workshop in Washington, D.C.

Donald heard the song Healed and immediately asked Jonathan for permission to record it. The song became a gospel hit in 2005, and as a result, Nelson won the Stellar Award as songwriter of the year in 2006. The same year, he signed with Integrity Music. Shortly after, he began working on his first full-length studio album.

The American singer released his major debut album, Right Now Praise, in 2008. The album was well-received by his fans countrywide, earning him a Dove nomination for New Artist of the Year. Two years later, he released another significant follow-up label, Better Days.

The album gave him a chance in the Top Ten of Billboard's gospel charts. He has also collaborated and performed with many other gospel artists, such as Cece Winans, Sonnie Badu and Donald Lawrence. Jonathan is an excellent example of a successful gospel artist. He has been featured on the American music charts for over a decade.

Who is Paul Simon? Here's the story of Peggy Harper 's ex-husband

Jonathan Nelson's songs

The American gospel singer has helped create several songs since he began his music career. Some of his hit singles include:

- My Name is Victory

- Anything Can Happen

- I Give You Glory

- I Am Your Song

- Jesus Loves You

- Expect the Great

- How Great is Our God

- Praise is my Weapon

- Fill my Cup Lord

- Jesus Chant

- Jesus, you are my Song

- Name of the Lord

How rich is Jonathan Nelson?

While the gospel artist apparently rakes a considerable amount of money from his music career, there is no official communication about his net worth. However, his net worth is alleged to be between $1 million and $5 million.

Is Jonathan Nelson still married?

Yes, the gospel singer is still happily married to his wife, Christina Nelson. The two got married on 20 December 1998 and have since been together. They have been blessed with two children, J. Andrew and Julianna.

What is Luke James sexuality and who is the singer dating?

On 20 December 2019, Jonathan took to Facebook to flaunt his beautiful wife as they celebrated their 21st wedding anniversary. He shared a photo of himself and his wife with the following beautiful caption:

12/20/98 -Exactly 21 years ago, I married my best friend, Christina Nelson! You saved my life! You're an incredible wife and mom. You have sacrificed so much to make my dreams become a reality. I love you! Wow! We have grown now! #21.

Frequently asked questions about Jonathan Nelson

- Who is Jonathan Nelson? Jonathan is an American songwriter, producer and singer. He is well known for his hit song I Believe . His upbringing surrounded by the sound of music shaped his complex musical vocabulary and expression from an early age.

- How old is Jonathan Nelson? Jonathan Nelson is 48 years old as of 2022. He was born on 10 November 1974 in Baltimore, Maryland, United States.

- Is Jonathan Nelson and Jason Nelson related? Yes, Jonathan is Jason's twin brother. Jason is also a gospel artist.

- What nationality is Jonathan Nelson? Jonathan's nationality is American, and he is of African-American ethnic background.

- How rich is Jonathan Nelson? Jonathan's net worth is estimated to be between $1 million and $5 million as of 2022. He mainly draws his wealth from his music career.

- Is Jonathan Nelson still married? Yes, Jonathan is still happily married to his wife, Christina Nelson. The two have been married since 20 December 1998. They have two children, J. Andrew and Julianna.

- What is Jonathan Nelson's family consist of? Jonathan's family consist of his parents, Bessie and James D. Nelson and his four siblings, Anthony, Janice and James and Jason Nelson.

Why is Bill Russell so famous? Rose swisher relationship, net worth, and racism

Having entertained and brought people closer to God for decades, Jonathan Nelson is considered a great music minister and an enigma in the gospel music industry. His albums speak volumes as he writes and produces hit songs one after another. Apart from music, the star is God-fearing, a character that has led to his success in this industry.

Tuko.co.ke recently published an article about Allegra Edwards . Edwards is an American actress who started her career at a young age. She is widely known for Cindy McCabe's roles in the USA Network anthology series Briarpatch and Ingrid Kannerman in the Amazon Prime Video comedy Upload .

Between 2009 and 2019, Edwards appeared in several movies, but most of them were not a hit. She is married to Clayton Snyder, and there are no reports of them having a child. The two met in 2009 in the line of acting.

Source: TUKO.co.ke

Lilian Wanjala (Lifestyle writer) Lilian Wanjala is a content writer who joined Tuko's team in 2022. She graduated in 2018 from the University of Nairobi with a Bachelor of Arts (Communication and Media Studies). She has worked for many periodicals on a variety of topics like biographies, fashion and lifestyle, guides, and other types of content for over three years. She worked for InformationCradle for close to two years before joining Tuko. In 2023, Lilian finished the AFP course on Digital Investigation Techniques. You can reach her at wanjalalilian875@gmail.

IMAGES

COMMENTS

Jonathan Milton Nelson (born 1956) is an American billionaire businessman. He is the founder of Providence Equity Partners, a global private equity firm based in Providence, Rhode Island, which manages funds with over US$45 billion in commitments.

The Ocean State has only one resident billionaire, though a couple more of the uber rich have ties to the state, so they might be allowed into club meetings. Jonathan Nelson, of Providence Equity ...

The french-speaking Caribbean island of St. Bart's hosts the best New Year's Eve parties on private yachts and in the exclusive beach clubs.

From billionaires to movie stars, this is an inside look at the world's largest superyachts and where they will be celebrating New Year's Eve.

Jonathan M. Nelson, the billionaire media mogul and founder of Providence Equity Partners, enters the room — limping. The brace on his right leg is a souvenir from his private equity firm's ...

SuperYachtFan was informed that #billionaire Jonathan Nelson, CEO of #Providence Equity Partners, is the owner of the #yacht Infinity. Providence has assets worth over US$ 40 million, while Nelson's...

The sailing yacht NELSON is a superyacht of ample proportions. This 43 m (141 foot) luxury yacht was built by Vitters Shipyard Bv in 2004. NELSON was formerly named the project or yacht name Gimla. Superyacht NELSON is a superb yacht that is able to accommodate up to 8 people on board and has a total of 8 crew. The naval architect which delivered her drawings in respect of this ship was Dubois ...

Home of your favorite shadow-banned masterpieces by Jonathan Nelson

Jonathan Nelson from Gateshead won the NEW 2024 ROLEX YACHT-MASTER 40MM PLATINUM or £10,000 on Sat 15th June 2024 with lucky ticket number 2122.

Nelson was born in Baltimore, Maryland to James Nelson, a pastor at the Greater Bethlehem Temple Church, and his wife Bessie Nelson. [when?] He studied at the Baltimore School for the Arts and Morgan State University. During a performance of Karen Clark-Sheard at his church, Nelson and his friends served as backup singers. After that, they continued to practice and sing together under the ...

Nelson Motor Yachts are currently building the 'Nelson 18' tailored to your specification -including fit out options, propulsion types: electric & diesel. When Commander Peter Thornycroft, who lived in Bembridge on the Isle of Wight, took over 'Keith Nelson & Company' he started to produce the Keith Nelson 18s which were wooden ...

The wonderful 42.6 metre charter yacht Sarissa is a 2011 delivered carbon fibre sloop constructed by the prestigious Dutch shipyard Vitters. She is also the largest carbon fibre sloop built to date in the Netherlands. Her naval architecture features an excellent design by Bill Tripp with a fully contemporary hull shape, sail plan and foils. Elegant and timeless interior design of the ...

Discover the journey of Jonathan Rothberg, an esteemed scientist, entrepreneur and investor who has contributed significantly to genomics and biotechnology. Learn about his groundbreaking invention, the Gene Machine, and his dedicated efforts in the field of philanthropy. He is owner of the yacht Gene Machine.

Used Nelson for sale from around the world. Search our full range of used Nelson on www.theyachtmarket.com.

Mr. Nelson is a licensed professional engineer (P.E.) in the District of Columbia, Maryland, New York, North Carolina, Pennsylvania, and Virginia. He is also a member of the National Society of Professional Engineers (NSPE), the National Association of Professional Accident Reconstruction Specialists (NAPARS), the American Boat and Yacht ...

Fearless (Deluxe Edition) by Jonathan Nelson http://amzn.to/2mL48DM available now on Amazon

Come on, everybody, get your feet happy! / Let's go, come on! / Where my Islanders? / Can some of y'all run down here to the front real quick? / I gotta know who's in the building

Jonathan was born on 10 November 1974 in Baltimore, Maryland, United States. He is currently 48 years old as of 2022. His parents are Bessie (mother) and James D. Nelson (father). His dad served as a pastor at Greater Bethlehem Temple Church USA for over thirty years while his mother was the church's, first lady.

Share your videos with friends, family, and the world

Aman has announced the appointment of Jonathan Wilson as CEO of Aman at Sea, which will launch a luxury motor yacht—developed through a joint venture | The former Hilton, Princess Cruises and Cunard Line executive will lead the luxury motor yacht line, debuting in 2027. Learn more here.

Lord Nelson is a yacht builder that currently has 3 yachts for sale on YachtWorld, including 0 new vessels and 3 used yachts, listed by experienced yacht brokers mainly in the following countries: United States. The selection of models featured on YachtWorld spans a spectrum of sizes and lengths, encompassing vessels measuring from 37 feet to 41 feet.

Kyle Kuzma's Guide to Los Angeles — view —