Catamaran Insurance: Reported Costs, and What Impacts!

As an Amazon Associate, we earn from qualifying purchases. We may also earn commissions if you purchase products from other retailers after clicking on a link from our site.

Calculating the costs of your catamaran involves considering more than just the purchase price. You also have to consider maintenance, marina costs and the insurance fees of your boat, which can be hefty, especially for larger vessels. So what are the catamaran insurance costs, and how do they differ with the size of your boat?

The standard insurance cost for most sailing catamarans is 1.5% of its value. However, this rate can go as high as 3% or more. Some factors that influence cost include sailing area, length and age of the catamaran, surveyor’s findings.

In this article, I will discuss the various insurance costs for different- sized catamarans , providing examples of how much you would need to pay for some popular catamarans. I will also discuss the insurance costs associated with charter use, ocean crossings, and private use in different parts of the world.

Table of Contents

How Much Are Catamaran Insurance Costs?

A Lagoon 380 Catamaran valued at $399 000 will cost between $6000 and $12 000 per year considering that insurance costs are between 1.5% to 3% of the value of the boat.

On average, therefore, insurance costs will be approximately 2% of your catamaran’s value. Unless your catamaran has a negative past loss experience or you are sailing in a limited market or politically restricted zones, your cost of insurance should be roughly 1.5% of the cost of your catamaran.

These costs also vary by supply, location, and demand.

The table below summarizes the insurance costs you would expect based on the value of your catamaran.

Summary of expected insurance costs at 1.5% and 3%

As shown in the table above, owners of a Lagoon 380 can expect to pay between $5,997.36 and $11,994.72. The latter figure considers the higher limit for insurance costs and the former the lower limit.

As evident from the above table, the cost of insurance will be significantly affected by the value or the price of the catamaran.

As explained by Yacht International , catamaran owners may sometimes enjoy a premium of only 1.2% if the value of the catamaran exceeds $500,000. Accordingly, you may pay lower fees in terms of insurance when your boat is valued over this price.

Other factors such as your relationship with the insurer may also lower the insurance premium rates.

Ultimately, the insurance cost will vary across different underwriters and will be affected by factors such as the age and condition of the boat and the specific areas you want to sail in.

For second-hand catamarans, the percentage for insurance will be based on the survey-assessed value.

Other Factors That Influence Catamaran Insurance Cost

It is vital to pay keen attention to ensure that the insurance also covers ocean crossings, storms, and more. Below, I will discuss how this insurance may vary across ocean crossings, charter use, and private use worldwide.

Ocean Crossings

Based on cost or surveyor-finding, the standard 1.5% to 3% of the catamaran’s value will apply for catamarans insured for ocean crossings. However, you will be required to pay a one-time crossing fee. For instance, the Pacific Ocean crossings require a one-time fee of $500 to $1,000 .

You, therefore, have to consider this figure when computing your total insurance fees.

Charter Use

Catamarans under charter use are generally covered under a fleet policy . This policy tends to have better rates as compared to ocean crossings and private use , but this rate will vary from company to company. On average, this rate will fall between 1.5% and 3% of the boat’s value.

Private Use

The annual premium for private catamaran use ranges from 1.5% to 2% of the boat’s declared value. Like charter use and ocean crossings, this will vary across underwriters and regions. With insurance, it is most often worth to seek out several quotes to get the best possible rate.

Regional Differences

The regional differences play a major part in a catamaran’s insurance cost, primarily due to the risks associated with hurricanes and other natural disasters.

There are four main regions insurers consider when setting their premiums and the impact this may have on your insurance costs. They include:

- California and pacific islands

- Mediterranean regions

- Hurricane zones

- Non-hurricane zones

I’ll look at each of these a little closer down below.

California and Pacific Islands vs. the Mediterranean Region

The insurance rates in California and the Pacific Islands region are higher than the insurance rates and costs in the Mediterranean region.

While you may expect to pay approximately 1% of your catamaran’s value in insurance costs for the Mediterranean region, this rate doubles for the California and Pacific Islands region.

Hurricane Zone

Your navigation area will play a significant role in the cost of insurance, especially when you sail through the hurricane zone during the hurricane season. This includes the areas south of the Florida and Georgia border, the Bahamas, and the Caribbean.

The hurricane season starts from 1st of june to the 1st of November, during which insurance rates will be significantly higher.

Insurance for navigation areas will generally have higher rates than non-hurricane areas. It is important to note that you may also pay higher rates if you intend to sail in areas prone to strong winds.

Out of the Hurricane Zone

Unlike the hurricane zones, areas falling outside the hurricane zone will have lower insurance costs than those in the hurricane zone. This is especially true for the North of Florida, where insurance costs for catamarans can fall below 1% of your catamaran’s value.

As a rule of thumb, it is essential to discuss with the underwriter your navigation area for more information on what changes it may have on your insurance premiums.

The cost of insuring your Catamaran averages at about 2% of your catamaran’s value. The main factors affecting your insurance costs include the price or value of your catamaran, its age and condition, and your navigation area.

Areas with limited coverage or areas prone to storms or strong winds will generally attract higher rates as compared to non-hurricane areas. Therefore, it is essential to discuss your navigation area with your insurance broker to ensure that you are adequately covered wherever you decide to sail.

- Aeroyacht: Catamaran Insurance

- The Multihull Company: How Much will That Catamaran Really Cost Me?

- YouTube: Cost Considerations when Buying Catamarans

- The Catamaran Company: Sold Catamaran 2019 Lagoon 380 (38 ft)

- Cruising World: Leopard 42 Boat Review

- The Catamaran Company: Sold Catamaran 2019 Lagoon 450F (45 ft)

- The Catamaran Company: Sold Catamaran 1996 Fountaine Pajot Venezia 42 (42 ft)

- The Wayward Home: How Much Does a Sailboat Cost? Examples and Buying Tips

- Catamaran Guru: Yacht Insurance: Know the Pitfalls!

- Book2Sail: How Much Does a 60 Foot Catamaran Cost?

- Discover Boating: Boat Insurance Guide: Costs

- Boating Geeks: How Much is Boat Insurance in California?

Owner of CatamaranFreedom.com. A minimalist that has lived in a caravan in Sweden, 35ft Monohull in the Bahamas, and right now in his self-built Van. He just started the next adventure, to circumnavigate the world on a Catamaran!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name and email in this browser for the next time I comment.

Recent Posts

Must-Have Boat Gear for Catamaran Sailors!

Sailing is probably the most gear-intensive activity I've ever done; there are so many decisions to be made about what gear to buy now, for tomorrow, and what to definitely never buy. The gear on...

6 Best Trailerable Trimarans For Bluewater and Coastal Sailing

Having a boat costs a lot of money, even when you are not using it, marina fees, etc. And once it is in the water most sailors never go very far from their "home marina" and sailing will be somewhat...

Yacht Insurance: Know The Pitfalls!

Yacht insurance policies are different for every yacht owner. There is no “one size fits all” solution like with home or car insurance. So buying yacht insurance is quite a bit more daunting to research for coverage and price. While we all hope that insurance is something that we will never need to use, we expect the policy we choose to either fix the yacht or to be fairly compensated when needed.

However, from our own experience and according to a recent BoatUS report, you may not be entitled to a payout with some common types of claims. In this article we will discuss the most common things to look out for when choosing your insurance.

Before the closing of your yacht purchase, your lender will require you to have insurance on your vessel. If you are buying a pre-owned yacht, the lender will generally require a marine survey to use to establish base coverage from the value and replacement value reported on the survey. As a very general rule, the annual premium for private yacht use coverage is 1.5% – 2% of the declared hull value. So, a $100,000 yacht will cost $1,500 to $2,000 per year to cover for Florida-Bahamas “private” use. However, this varies from region to region. Yachts in charter will typically be covered under a “fleet” policy with preferential rates that differ for each charter management company.

Insurance for yachts has been getting harder to obtain because there are many more claims than before. And it’s not just because of hurricanes. Actually, some of the most common types of claims are lightning strikes (Florida and Bahamas) and “sinkings at the dock”. Because of all this, underwriters want to “personalize” the process much more than before and scrutinize every possible negative aspect of the application process.

Tips for Your Yacht Insurance Application Process

- Your Sailing Resume. Expound on your experience in “comparable boats”. If you only have experience with 15ft Boston Whalers and you want to buy a 60ft sailing yacht to cruise to Bora Bora, then securing affordable yacht insurance…or at all…will be difficult. Get some experience on a sailing boat similar to what you plan to purchase. Take some lessons, sail with friends’ boats, and and book bareboat charter being sure to log your hours. The very best way to provide this information is to keep a sailing resume up to date so that when yacht insurance renewal time rolls around, you can make a quick update with the latest new nautical miles or boat experience and hand it over to your broker to arm him or her with the information that enables them to go to bat for you.

- Detailed Description of Current State of Your Vessel. Having this information ready to hand over to your yacht insurance broker is an often-overlooked source of information that improves the accuracy of your coverage and if well-maintained with safety in mind, reduces rates. Much like your sailing resume, create a document or collection of documents and images that describes your boat in detail, calling out all safety features and any renovations or upgrades with dates. Include recent images as proof of these features. Remember, that yacht insurance buying is a very personal experience and the underwriter is looking for ways to assure risk of loss is the lowest possible. The lower the risk, the lower your rates.

- Declaring Your Navigation Area. Carefully declare your navigation area. The best thing to tell the insurance company is that the “navigation area” will be a relatively small area like Florida-Bahamas. (After all, you will, if you are smart, get sailing lessons to operate your new boat in relatively secure waters closer to home). Mention your experience in coastal waters or bareboat charters that have been further afield in more challenging sailing conditions than the navigation area you are declaring. Unfortunately your experience on inland lakes does not count for much. Underwriters don’t count experience in inland lakes unless that is where you will keep your boat.

- Mention Only Current Sailing Plans. Insurance rates vary depending on use and navigation area. If you plan on crossing the Atlantic in the distant future (outside of the policy period you are researching) or if you are considering but not yet committed to living on-board, don’t tell your insurance company now. You want your rates to reflect your current plans, not something you might do. Wait until your plans are 100% confirmed. You will likely owe an additional upcharge to cover the increased navigation area coverage. To save money, delete the old navigation area coverage and replace it with a new coverage area.

- Changing Your Navigation Area/Sailing Plans. When the you are ready to move outside the initial navigation area, note, that changing your navigational area during your policy period is not as affordable as it once was. It is best to plan ahead when you are renewing as that gives you the most flexibility in choosing the yacht insurance company that offers the best rates and coverage in that navigation area. If you lock in to a company that does not support South Pacific sailing with affordable rates, or at all, you will cause yourself much grief. If you have tentative plans to go outside your navigation area in the upcoming year, ask your broker during your insurance selection process about these additional areas without declaring you are going there. Do not put this on any application, but rather have an informal conversation. Even better, talk with your fellow cruisers and yacht owners! Knowing about whether your insurance company covers a contemplated use or area can give you an indication of upcharge costs and potential for coverage of that area.

- Seven Seas Cruising Association yacht insurance recommendations for cruisers

- Our yacht insurance recommendations .

- Relocate During Hurricane Season. Most boat insurance companies offer discounts for moving the yacht outside of the “hurricane belt” during the official hurricane season (June 1 to November 1), so make your hurricane plans for your boat early. You could save quite a bit of money. Just be sure you execute your plans and actually move the boat.

- Try to Work with Insurance Companies You Know. If you already have homeowner’s or auto coverage with State Farm, Allstate, Progressive, or another major insurer, explore the possibility of adding the boat to the policy. You may be pleasantly surprised, but these policies are usually only valid in the U.S. and Bahamas.

- Covering Personal Belongings. Cover your personal belongings with a separate policy, not under your yacht insurance. This is another good opportunity to reach out to your existing home/auto insurer to see what type of renter’s insurance they offer to cover your personal items aboard your vessel.

- Your Address Matters. Underwriters consider an address from a non-coastal state a red flag and considered you an “absentee-owner”, even if you are living on the boat and are really NOT an absentee owner. The address on the application is what counts. So, if you are from land-locked Iowa, do not list that address. Get a mailing address in Florida or another coastal state. Most cruisers get mailing addresses from a mail service where they get their mail sorted and forwarded to their next destination.

- Early Bird Gets the Policy at the Best Rates. Apply for insurance at least two weeks before you need it bound. Do not wait until the last minute. What used to take 45 minutes, now takes several days because underwriters are so, so very cautious. Note that this does NOT include your research time which probably takes at least a month so plan ahead so you have plenty of time to get quotes from several insurance brokers.

- Research, research, research. Get quotes from several yacht insurance brokers including at least one that specializes in your type of vessel and/or navigation area. If you already have a quote from an insurance company, let the broker know so time will not be wasted getting you a duplicate quote

A Few Insurance Terms To Know

Actual Cash Value: In the event of a total loss, the market value, determined by age and condition of the boat at the time of the loss. Boating industry reference materials (NADA Book, BUC Used Boat Guide, ABOS Marine black Book) are often used to determine market value.

Agreed Value: Determined and agreed upon by both owner and insurance underwriter at the time the policy is purchased.

Bind: To start coverage by accepting the quotation offered and meeting the special conditions and agreeing on a date to start coverage.

Binder: Immediate, temporary coverage or proof of insurance until a policy can be issued. Usually good for a 30 day term.

Constructive Total Loss: C ost of a boat’s recovery and repair exceed the insured value.

Cruising Area: The geographic area or waterway where the boat is used as defined on the policy. If the boat is taken outside this cruising area, a cruising area extension is required to continue coverage.

Cruising Area Extension: Required when boat is taken outside the cruising area defined on the policy. Prior notification and approval is required and a fee will apply based on the length of the extension.

Damage Avoidance: Loss prevention, preparation that prevents or minimizes a loss.

Deductible: The portion of a claim to be paid out of pocket. The higher the deductible, the lower your insurance premium will be.

Depreciation: measured decrease in value of the boat, parts and equipment due to age and condition.

Hull ID: Series of letters and numbers uniquely identifying an individual boat.

Loss Payee: The person and or institution paid in a claim settlement, appearing on the boat’s title.

Named Insured: The person or person(s) whose name appears on the insurance policy.

Named Storm: Tropical storm or hurricane as designated by the National Oceanic & Atmospheric Administration (NOAA).

P & I (Protection & Indemnity): Coverage for third-party property damage, bodily injury, or death caused by you or your boat for which you’re found legally liable.

Partial Loss: Any claim incurred that has not resulted in the total loss of the boat.

Salvage: Successful rescue of insured boat from a perilous or dangerous situation.

Wreck Removal: Remove and dispose of the remains of an insured boat when legally required.

MORE ARTICLES ON MARINE INSURANCE

- Latent Defects: A Little Understood Term Results in Boat Owners Not Taking Advantage of Insurance Coverage

- The Seven Seas Cruising Association has a lot of information on insurance, so be sure to check in with them.

Yacht Insurance Shopping Considerations

Most yacht insurance policies are for an “agreed-upon” value. That is, if there is a total loss, then you are paid the “agreed-upon value” with no deductions. Beware of the tricky “actual cash value” policies wherein the underwriter can deduct substantially for depreciation and other reasons. See our interview with yacht insurance company, Hanham Insurance Agency , in which Hugo Hanham-Gross explains ACV policies’ risks in more detail.

- Always buy an “All Risk” policy (vs. a “Named Peril” policy). Some policies exclude coverage in areas like the Bahamas, Florida, and Caribbean and will require you to take the yacht out of the hurricane belt during hurricane season for named and numbered storms and it can be very restrictive. However, companies like our recommended marine insurance companies will cover your yacht with relatively low deductibles.

- Beware of “exclusions” and “clauses” that allow the insurer to disallow payment.

- You will need “Consequential Damage” coverage that will cover losses that often start with a failed part. Unfortunately, many “sinkings” occur at the dock when some small part below the waterline fails like hoses, stuffing boxes, and sea strainers due to corrosion or wear and tear. This is considered a “lack of maintenance” issue, so you won’t be paid for the hose or sea strainer and some policies won’t cover the sunken yacht either as they exclude any “consequential” damage as a result of wear, tear, and corrosion.

- Some policies only pay the cost of cleaning up a fuel spill if it occurs due to a “covered loss.” So if your sunken boat wasn’t covered because of a failed part, the resulting fuel spill won’t be either. Sometimes fuel spill coverage is subtracted from other liability payments. A better policy separates out fuel-spill liability and provides coverage up to the maximum amount you can be held liable for under federal law, which currently is $854,000.

- In every hurricane, yachts drag and get blown off their moorings and need to be salvaged. Retrieving the yacht may require cranes, travel lifts, and other heavy equipment costing hundreds of dollars per foot of boat length. However, some policies subtract the money paid to salvage the boat from what you get paid to fix the boat, while others only offer salvage coverage up to 25% or 30% of the insured value. Look for separate salvage coverage up to the insured value of the boat in addition to any payments to fix the boat or replace equipment.

- If your boat gets destroyed completely by fire or some other reason, you end up with a “wreck.” Most insured yacht owners assume their policy will cover the cost of cleaning up what’s left, but some policies will give you a check for the insured value and only a specified percentage for wreck removal – 3% to 10% – nowhere near enough for the clean-up job. Better policies pay up to the liability limit, usually $100,000 or more.

There are other things to look out for like dinghy coverage, medical coverage, trip interruption, liability, and more. But generally, the above mentioned are the “tricky” parts and you should make sure that you understand each clause.

Estelle Cockcroft

Join our community.

Get the latest on catamaran news, sailing events, buying and selling tips, community happenings, webinars & seminars, and much more!

2 thoughts on “Yacht Insurance: Know The Pitfalls!”

Outstanding suggestions. I have heard: It is best to hire a Insurance Agent to “shop” multiple Companies Most Insurance Companies want full payment at the time of issuance.

Be well & Thank You.

Thank you! Yes, it is advisable to use an agent like Hugo Hanhamm Gross. See his details in our favorite links / partners. Some insurance companies will allow partial payments and we have had a good experience with Hugo. He almost always can pull something off for us. However it depends on where you will cruise, your experience as a sailor among other things.

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Recent Posts

First-Annual Virgin Islands Boating Exhibition (VIBE)

VIBE – It’s a Destination Boat Show! Join us May 10 – 12 at

BALI Catamarans Unveils The New Bali 5.8 Flagship

CATANA GROUP launches its 14th BALI CATAMARAN model, the BALI 5.8, for the brand’s

Love Stories At Sea…because it’s valentine’s day

Because it’s Valentine’s day, we wanted to celebrate all the couples that we helped

Your Go-To Resource for all your Catamaran Needs!

Check out our brochure to learn about all we have to offer and why

For more than 30 years, we have been a part of the catamaran community and created Catamaran Guru™ to encourage and educate all the aspiring sailing out there. We understand the dream of traveling the world by catamaran and created a one-stop-shop to make that dream a reality for you.

- Stephen & Estelle

- Testimonials

Get Started

- Yacht Sales

- Used Yachts

- Charter Management

- Boat as Business Programs

- Seminars & Events

- Boat Reviews

- Press Releases

A Yacht Insurance Primer for First Time Owners

The following article is designed to provide prospective yacht owners with an overview of the yacht insurance process. It should in no way be considered guidance. As detailed below, owners are advised to consult with an experienced marine insurance broker when acquiring or modifying their policie s.

Setting a course for peace of mind

Successful sailing experiences are built on a foundation of preparation and planning. From the boat’s gear and stores to its course and crew, every aspect of the trip must be thought through and squared away.

The same principle applies to yacht insurance, which is, of course, critical to a safe and relaxing journey. Unlike more common coverages, such as auto or home insurance, yacht insurance requires owners (especially first-timers) to prepare and plan for all sorts of eventualities and events.

Prepping for the right policy

Here are some of the issues would-be policyholders should be prepared to address as they seek the right policy for their yacht.

For openers, first-time yacht owners who expect to pilot their own craft must demonstrate a minimum level of boating experience.

“If you don’t have any experience, an insurance carrier will insure you, but you’ll be required to use a [professional] captain every time you go out on your boat,” says Hugo Hanham-Gross, a yacht insurance specialist with the Hanham Insurance Agency in Fort Lauderdale. “That can really limit your cruising options.”

Gaining experience

Fortunately, there are several easy ways to gain enough maritime experience to satisfy insurance carriers, says Hanham-Gross.

“You don't have to take sailing classes,” he says. ”If your friends have boats, get as much experience as you can on their boats. If you are buying a Leopard, this experience doesn't have to be on a catamaran. It can be on a monohull sailboat. It can even be on a motorboat - just get as much experience as you can.”

It’s important to log those hours - when, where, type of boat - in case the insurance carrier asks for confirmation. Hanham-Gross says this record can be as simple as a series of entries on a smartphone, so long as it’s truthful and accurate.

Learn from the best

Newbies can also meet the experience requirement by hiring a training captain and spending a few days on the water with her. When the captain feels the owners are ready to take the helm, she will sign a document certifying their readiness.

Hanham-Gross recommends submitting a sailing resume with a yacht insurance application. This document should provide carriers with background information about the applicant and detail their relevant boating experience and training. As with any resume, padding is a no-no.

“The carrier doesn’t care that you went sailing with your dad for an hour on a Hobie Cat when you were 13,” says Hanham-Gross.

Caribbean cruising?

Insurance carriers will also want to know where the applicant plans to operate their yacht. The answer may impact both the premiums charged and the yacht owners’ ability to wander. A U.S. waters-only policy, for example, would limit an East Coast policyholder’s ability to adventure in the Caribbean or a SoCal owner’s options down Mexico way.

Yacht owners who plan to spend significant time in the Caribbean should expect to jump through a few more insurance hoops. For example, some carriers will not insure yachts for travel in the Caribbean because of the hurricane threat. Those that do write such policies may require (or incentivize) policyholders to stay out of the region during hurricane season, which runs from June through November.

Applications for Caribbean coverage must typically include a hurricane plan . This document should list the places across the region where the yacht owners will seek shelter if a hurricane looms. The more detailed the plan, the better, says Hahham-Gross.

“The carrier wants to know how will you protect the boat, and what is your backup plan,” he says. “With a hurricane coming, you can’t just weigh anchor and sail 500 miles to the one marina on your list. If you give that answer, the carrier won't write the policy because that attitude shows you aren’t taking the hurricane threat seriously.”

What are your cruising plans?

Insurance carriers will, understandably, also want to know how a prospective policyholder plans to use their yacht. If the applicant plans to live aboard their craft, they should disclose that to the carrier. Carriers have different definitions of “living aboard.” That status typically has only an incremental impact on the owner’s premiums. Most policies do not allow the yacht to be rented unless the renters hire a captain.

Finding the right insurance broker

The requirements and complexities of yacht insurance, which vary widely among carriers, can make the application process seem daunting. For that reason, newcomers are well-advised to work with an experienced yacht insurance broker. Such a professional can help owners determine their insurance needs, identify suitable carriers, and advocate for the owner during the application process and beyond. Building a strong connection with a broker is especially valuable for Leopard owners, says Hanham-Gross.

“That relationship is so important with catamarans because people who buy Leopards aren’t looking to sit in the Chesapeake Bay,” he says. “Their dream is to go to the Caribbean or the South Pacific. I probably talked to my Leopard owners five to six times a year because they constantly have to make changes to their policies.

Let there be no surprises

A broker can also help with the weird things that come up for large boat owners. For example, when you go into a marina now with a big boat, like a catamaran, the operator sometimes requires a certificate of insurance that names the marina as an additionally insured party on the policy.”

A broker is like a pilot. His training and unique expertise are invaluable as a new yacht owner navigates the shallows and channels of insurance towards the open waters of full coverage and the endless adventure it makes possible.

Topics: Boat Buying Process , Boating Tips

Leopard Catamarans

Subscribe here.

Published on April 10th, 2023 | by Editor

A-Class Catamaran having it both ways

Published on April 10th, 2023 by Editor -->

The singlehanded A-Class Catamaran has a strong presence in the USA, which was strong enough to host the 2022 World Championship, and strong enough for the country’s Ravi Parent to win the Open division world title.

Scuttlebutt editor Craig Leweck checked in with Florida A-Class sailor Axel Issel for an update:

The A-Class Class rules allow for development, which is good for improving the boat but can get expensive as gear becomes obsolete. How does this impact participation?

The A-Class is divided into two sub-classes separated by different sets of measurement rules; the Foilers (Open) and non-foiling (the Classics). In the case of the Classics that have been around 67 years, most development has occurred in the last decade or so with the change from straight dagger boards to C foils and the deck-sweeper mainsail with curved booms.

Older hulls and masts remain competitive but the newer configurations do provide a slight advantage. Today, Classic boats from 10+ years keep winning Nationals and Continental championships and boats with straight booms and daggerboards still are in the top 5 in the Euro circuit.

The Classic fleet keeps growing in most countries due to the speed and simplicity of the boat; very competitive, tactical, fun races, with plenty of accessible boats around the globe. In many parts of the world, the Classics are very popular with larger numbers than Foilers like in the US/Canada, Italy, France, Australia, etc.

Sailors in Classics are competitive at all ages, many well into their 70s so it is a class where you can grow and be at the top for decades with your same boat for many, many years.

The Foilers have seen the most recent development. Here newer boats (2019-20 and newer) make a difference over older ones since they are easier and more stable to foil. Participation in the class is achieved in Classics due to very even and fun races with skippers with 20 years fighting 70s-year-olds. Participation in Foilers comes from younger sailors trying to master the fastest single-handed catamaran in the world.

Most of the top sailors in the world raced A-Cats at some point, even though it is a non-Olympic class. The A-Cat has consistently proven itself in the international scene whereby the World, European, and North American Championships are frequented by some of the most famous sailors in the world.

However, it’s always taken the dedication of a pure A-Class sailor to win the Championships. This demonstrates the high level of performance within the class and it leads to amazing numbers of entries for such events. Today, almost all top professional regattas are raced in foiling boats, like the America’s Cup, the Ocean Race, SailGP, etc, so learning and growing in a foiling A-Cat gives you experience and advantage, attracting young talents to the fleet.

When was the shift to foiling? How did the class endure that transition? Were there kits? Foilers started around 2015, but in 2018 the class decided to create two sets of rules to keep the non-foiling boats competitive, and two sub-classes were born. I believe this was a wise decision, to make the class appealing to a wider population.

Today you can be competitive in your 20s and into your 70s, with a newer Foiler or with an older Classic. Regattas are usually scored in two fleets, and some, like the North American Championship regatta, have the two fleets + the “Overall NA Champion” who is the best skipper among the two classes.

The transition was progressive, initially some folks modified the trunks on the hull to insert the newer foiling blades. Today, to be competitive in Foilers, you need a newer foiling specific boat. Manufacturers build two models: the Foiler and the Classic. The Classic is lighter, simpler and less expensive. The Foiler has a lower hull profile; is heavier due to extra carbon needed to support extreme foiling forces, and needs better physical input.

Has the foiling equipment stabilized or is it still evolving? For the last three years (late 2019-2020), there have been no new developments. The latest one was the rudder differential. Some have been working on differential for center foils with no success. Also, cambered sails with specific masts have been designed, but nothing new has come out. Until measurement rules for Foilers are changed, it will be difficult to see any new significant design improvement.

How is the used boat inventory in North America? Today, there are around 20 used boats for sale. Some used boats for sale are almost new, like a 2022 Foiler and newer Classics. You can buy an old Classic for less than $5K and be competitive in the Classic fleet. Used boats and parts can be found in https://usaca.info/ and in https://www.facebook.com/groups/922063451790001/ .

Who are the suppliers for North America? Are there any in the continent? Boats and masts builders are in Europe. Today, the largest manufacturer of boats is eXploder from Poland (with accessible labor), which provides new Classics and Foilers. Fastboatstuff.com is their representative in the US, and they carry new boats and parts for almost all new and older model boats. North America is getting shipments from Europe usually two times per year with new boats and parts. I have been in the class three years and I always find the parts needed quickly. Top competitive sails are built here in the USA by Glaser, Sail Technologies, etc.

Why do Foilers and Classics race together? Because it is way more fun, and way more competitive. The fleet is well mixed during races. In addition, it is a good way of keeping the fleet growing, making an easy and fun entry point to the class with more options. For example, I started in Classics two years ago and after the Worlds in Houston last year, I sold my Classic and I switched to the Open class.

Usually, the top Foilers will have an advantage but most part of the fleet is mixed. In lighter winds like sub 10 knots, the boats are even and in lighter non-foiling conditions, Classics are faster. Top light sailors can start foiling downwind around 8 knots but most of the foiling fleet foils closer with 10 knots of wind 100% air time, and upwind foiling is mastered only by the ultra-top sailors, and usually they need 12-13 knots of wind to make real gains over the top Classics going upwind.

For us, the newer foiling sailors, learning to foil (like me!), will always have Classics around showing how much ground is lost while we are trying to fly……and once on air, if we do not do the correct angle, Classics will pass you by. .Racing with 50 boats on the line, is always more fun than 20-30 boats, and chances are you always will have someone next to you on every mark.

What is the ideal sailor weight for the A-Cat? I believe 170-195 pounds is the ideal range, NED 007 Mischa Heemskerk won the world championship several times and he is 225+ lbs; the latest World Champion USA 76 Ravi Parent (2022 Rolex Yachtsman of the year) weighs around 165lbs . Who knows….!

Where are the hubs of class activity in North America? Florida concentrates 30% of the fleet, with Key Largo, and the Sarasota/Tampa Bay area being the most popular spots, followed by Fort Walton and Melbourne, FL. Lake Lanier in Georgia has one of the largest fleets, Annapolis/West River area is popular as well.

Lake Carlyle in Illinois, where we raced the 2021 North Americans, have several active boats. Also, there are 10 boats in Alamitos Bay in California, and there is a large fleet in Ontario Canada where we raced the 2022 North American Championship.

I heard a new fleet will grow soon in Mexico City as well. This year we are all looking forward to race in October the ‘Alter Cup’ in Pensacola, Florida, only for Classic boats, where skippers from other multihull fleets join the A-Catters to determine the best multihull skipper!

Tags: A-Class Catamaran , Axel Issel , Craig Leweck

Related Posts

Cole Brauer: Right place, Right time, Right person →

Living in the Scuttlebutt World →

Only for those with Olympic aspirations →

Progress for world’s oldest yacht club →

© 2024 Scuttlebutt Sailing News. Inbox Communications, Inc. All Rights Reserved. made by VSSL Agency .

- Privacy Statement

- Advertise With Us

Get Your Sailing News Fix!

Your download by email.

- Your Name...

- Your Email... *

- Name This field is for validation purposes and should be left unchanged.

- About Aeroyacht

- Aeroyacht Design

- Aeroyacht TV

- Mission Statement

- Aeroyacht Racing

- Favorite Links

- Customer Testimonials

- Office Location

- BUY A MULTIHULL

- Specifications

- Photo Gallery

- Try Before You Buy

- Yacht Ownership and Demo Sails

- BUY A POWER CATAMARAN

- Yacht Business Ownership FAQ

- MULTIHULLS FOR SALE

- Aeroyacht Superyacht Catamarans

- Global Multihull Search

- Buy A Multihull

- Sell a Multihull

- Multihull News

- Publications & Articles

- Commissioning & Delivery Services

- Catamaran Insurance

Helpful advise about insuring your cruising catamaran:

The world wide acceptance of cruising catamarans and the understanding that most of them are at least as safe- if not safer than monohulls, has made finding insurance for them an easy task. There is nothing special about catamarans as a class of vessel regarding current yacht markets.

In the past 10- 20 years catamarans were harder to insure since the underwriters were not as familiar with them. The good news is -allot has changed since then. The risks and frequency off capsizing has been a thing of the past. In fact the risk of a catamaran capsizing (and floating if she is built with foam) is less than a monohull sinking and disappearing to the bottom of the ocean.

While some insurance companies cover only certain catamaran manufacturers others may cover a different group. It can be confusing, which is why you must do the proper research to find adequate catamaran insurance coverage.

Racing catamarans are still in same class of risk as racing monohull as they are boats which are often pushed beyond safe limits. The underwriting market for trimarans is slightly more limited than catamarans but a little research will result in proper coverage.

There are many factors that affect the actual cost of boat insurance. There are however some rules of thumb. Insurance typically runs 1.5% to 3% of the cost of the catamaran.

Catamaran Insurance Underwriting Criteria:

- Generally catamarans will have the same underwriting requirements as similar length monohulls. Owner and operators must show history and/or past experience for which insurance companies will give them credit for.

- Past loss experience: Usually a major factor and an operator with a recent total loss or number of major incidents will have a hard time placing coverage.

- Navigation area: Sailing your catamaran South of Florida / Georgia border during hurricane season (from July 15 to November 1st) will have a more limited market and reflect higher rates. This does not mean that you cannot sail in the Caribbean in August, but the premium might be higher.

- Storm coverage for your catamaran: Special plans are required in wind storm areas. It is very important to conform to your insurance plan submitted to underwriters.

- Politically restricted zones: Sometimes navigation of your multihull in areas such as Cuba, Haiti , Venezuela are more restricted. Colombia is being more accepted lately.

- Charter insurance for your catamaran: If your catamaran is to be operated as part of a business or in charter, underwriting will be slightly higher but you may benefit from the savings of a fleet policy negotiated by a charter company. See if you can get on to their policy.

- Catamaran Surveys for Insurance: Underwriters require surveys when you first purchase a catamaran with the exception if the boat is brand new. Usually a major manufacturers Builder’s Certificate will serve as proof of seaworthiness. Catamarans should be surveyed every 5 to 10 years. All pre-owned catamarans will require surveys.

- Surveyors findings: All surveys of catamarans will have recommendations that the surveyor will note on his report. Underwriters normally require all recommendation to be complied with. This is because the insurance companies rely on a surveyors recommendation for the vessel’s seaworthiness.

- Length, age and condition of your catamaran: Bigger and more expensive cats are sometimes less costly to insure as a percentage of the boat’s value.

- Be very careful in filling out insurance applications for your catamaran. Any factual errors or misrepresentations can void coverage.

- Transatlantic crossings: For catamaran ocean crossings, insurance underwriters normally require a minimum of 3 crew with offshore experience. This is the same for monohulls.

- Check to see if your newly purchased catamaran has a clean title. If it doesn’t, getting it insured may become a problem

- Go with a reputable well-known boat insurance company to insure your catamaran. You will be more certain to get claims paid against your insurance with a reputable, well-known marine underwriter.

- Avoid lesser known or small marine insurance companies. You may run into trouble if you should ever have to file an insurance claim for your catamaran.

- Don’t skimp on your catamaran’s insurance; doing so could result in higher out-of-pocket costs if repairs to the catamaran are necessary.

Catamaran Resources

- MULTIHULLS & CATAMARANS App for Iphone

- Catamaran Sailing Schools

- Catamaran Charter Business and Tax Savings

- Ask the Owner

- 5 Valuable Tips

- Survey Checklist

- Sea Trial Checklist

Catamaran News

Planet Sail tests a McConaghy Multihull

Charles Caudrelier wins Arkea Ultim Challenge

Nautitech 48 – Control of the Wind

Boat Test: Nautitech 48 Open catamaran

NEEL 52 Trimaran VIDEO – Sailing at 17 knots

- Catamaran Steering Positions

- Catamarans vs. Monohulls

- Catamaran Learning Center

- Catamaran Speed

- Catamaran Efficiency

- Catamaran Stability

- Catamaran Safety

- Catamaran Shallow Draft

- Catamaran No Heel Sailing

- Catamarans and Seasickness

- Catamaran Space

- Catamaran Boat Handling

- Catamaran Advantages over Monohulls

- Wave-Piercing Bows

- MULTIHULLS & CATAMARANS App for Iphone

- Catamaran Surveys

- Multihull Services

- Catamaran Build Consultation

- Financing Services

- Catamaran Repair & Service Facilities

- Catamaran Demo Rides & Shows

- Catamarans for China

- Yacht Design

- Interior Styling & Yacht Art

- Photography

McConaghy MC63 Power Tourer – showing her pace

Nautitech 48 Open catamaran – Video

Nautitech 48 catamaran – Interior Design

How the Nautitech 48 catamaran was conceived – Designer Comments.

Launched ! – McConaghy MC82P Power

McConaghy 75 catamaran – Stunning NY Loft-Style Interior

VIDEO: Nautitech 48 catamaran walkthrough. Part 1. EXTERIOR

VIDEO: Nautitech 48 catamaran walkthrough. Part 2. INTERIOR

McConaghy 75 Launched.

NEEL 52 trimaran nominated European Yacht of the Year 2023

Helpful tips from aeroyacht.

AEROYACHT PUBLICATIONS

Catamaran books by gregor tarjan.

JOIN AEROYACHT’S NEWSLETTER

About Chubb: About Chubb

About Chubb: About Chubb in the U.S.

About Chubb: Careers

About Chubb: Citizenship

About Chubb: Investors

About Chubb: News

Claims: Claims

Claims: Claims Difference

Claims: Claims Resources

Claims: Report a Claim

Login / Pay My Bill: Login for Business

Login / Pay My Bill: Login for Individuals

Login / Pay My Bill: QuickPay for Businesses

Login / Pay My Bill: QuickPay for Individuals

Login / Pay My Bill: Login to CRS

Contact Us: Contact Us

Contact Us: Global Offices

- File a claim

- Get a quote

Yacht Insurance

Protect your superior watercraft with superior protection from Chubb.

Chubb has been a leading provider of yacht insurance for over 100 years, offering some of the most comprehensive policies available for private, pleasure watercrafts. Being on the water is an experience of peace, calm, and new adventures on the horizon. It’s an experience you want to protect. Our Masterpiece® Yacht insurance policy offers superior coverage for pleasure yachts 36 feet or greater in length. And for captained vessels 70 feet or greater in length and valued at $3 million or more, our Masterpiece Yacht Preference policy has the specialty coverages you and your crew need.

Masterpiece® Yacht Policy Highlights

Agreed Value Coverage

We pay the entire agreed amount, with no deductible, for a total loss. With our Masterpiece Yacht Select policy, eligible vessels can receive Replacement Cost coverage up to 120%.

Liability Protection

Limits of coverage to suit your personal needs, including: legal defense costs, liability as required by the Oil Pollution Act of 1990, wreck removal, and Jones Act coverage for paid crew.

Replacement Cost Loss Settlement

Repair or replacement of covered property is paid for without deduction for depreciation for most partial losses.

Uninsured/Underinsured Boater Coverage

Pays for bodily injury to persons aboard the insured watercraft who are injured by an uninsured owner or operator of another vessel.

Medical Payments

Reasonable medical and related expenses are included for all those onboard, boarding or leaving the covered vessel. These benefits are provided on a per person basis, rather than per occurrence. Optional and customized limits are available.

Search & Rescue

Up to $10,000 for the expenses incurred by an insured in relation to a governmental unit such as the United States Coast Guard (USCG) who provide emergency aid and assistance are included for no additional charge. With our Masterpiece Yacht Select option, coverage is available up to $25,000.

Longshore and Harbor Workers’ Compensation Act (LHWCA)

When Liability coverage is purchased, coverage is automatically provided for those employed aboard the vessel who are within the jurisdiction of the LHWCA.

Personal Property & Fishing Equipment Coverage

Protection is automatically included for the clothing, personal effects and fishing gear of the boat owner and their guests. Optional higher limits are available.

Coverage for Marinas as Additional Insured

Marinas, yacht clubs and similar facilities where clients keep their vessels are included as Additional Insureds.

Trailer Coverage

We automatically include coverage up to $5,000 for your trailer used with your insured vessel. Higher limits are available.

Emergency Towing & Assistance

Our policy includes this coverage with optional higher limits available.

Boat Show & Demonstration Coverage

We automatically provide this coverage, at no additional charge.

Precautionary Measures

We will pay up to the policy limit the reasonable costs incurred to haul, fuel or dock the insured watercraft endangered by a covered peril.

Bottom Inspection

We will cover the reasonable costs to inspect the bottom of an insured vessel after grounding, stranding, or striking a submerged object. There is no deductible for this coverage.

Oil Pollution Act of 1990 (OPA) Coverage

If Liability coverage is purchased, our policy provides coverage in addition to the Liability limit, up to the required OPA statutory limits, regardless of the Liability limit chosen. Additionally, if the OPA statutory limit is increased in the future, our policy will automatically increase the applicable OPA limit to match the new higher statutory limits.

Temporary Substitute Watercraft

Up to $5,000 to charter a temporary substitute watercraft if the insured vessel is out of commission due to a covered loss and cannot be repaired within 72 hours. With our Masterpiece Yacht Select policy offering, the limit of Temporary Substitute Watercraft is increased to $10,000.

Marine Environmental Damage Coverage

This feature provides protection up to $10,000 for fines and penalties as a result of marine environmental damage, as defined by the policy terms. Coverage is provided in addition to the insured's applicable Liability and OPA limits. With our Masterpiece Yacht Select policy offering, the limit of Marine Environmental Damage Coverage is increased to $25,000.

57% of boating accidents happen on calm days with waves less than 6 inches.

Chubb offers some of the most comprehensive protection and services available rain or shine.

*Source: 2016 Recreational Boating Statistics, United States Coast Guard

Masterpiece Yacht Preference

Masterpiece Yacht Preference fulfills the specialty insurance needs of luxury yacht owners with captained vessels 70 feet in length and greater, valued at $3 million or more.

No depreciation applies on the following items

Machinery inside the hull, Personal Property, dingy/tender, and Personal Watercraft.

Emergency Towing Service

We include coverage up to the amount of Property Damage with no deductible.

The medical payments limit offered is on a per occurrence basis, and we will pay costs incurred up to three years from the date of occurrence.

Marina as Additional Insured

The marina, yacht club, or similar facility where the insured yacht is docked, moored, or stored is included as an Additional Insured.

Captain and Crew Coverage

Liability coverage is extended to the captain and crew members serving aboard the insured yacht.

Defense Costs

Defense costs are included in addition to the limit of liability and includes up to $50,000 loss of earnings.

Mooring or Slip Rental Agreement Waiver

When waiver of subrogation is required through a written contract by a yacht club, marina, or similar facility used for the purpose of storage or slip rental, our Masterpiece Yacht Preference policy will permit an insured to waive their rights of subrogation.

Masterpiece® Recreational Marine Insurance Brochure

Your client’s guide to watercraft protection. Make sure they’re protected, with the right coverage, so they can relax on and off the water.

Related Coverage

We provide exceptional boat insurance with tailored protection.

We help you stay ahead and informed with these helpful tips and tricks

12 safety tips for recreational boaters

As the weather warms up, many of us head to lakes, rivers, or the ocean to fish, waterski, cruise, and relax onboard a boat, yacht or other personal watercraft.

Understanding boat insurance

A comprehensive guide to finding the right boat insurance coverage.

This information is descriptive only. All products may not be available in all jurisdictions. Coverage is subject to the language of the policies as issued.

Find an Agent

Speak to an independent agent about your insurance needs.

HANHAM INSURANCE AGENCY

Catamaran insurance program.

When it comes to insuring catamarans worldwide, Hanham Insurance Agency is renowned for securing the strongest coverage and lowest premiums for our clients while offering exceptional, personal client service.

Our Catamaran Insurance Program includes the following enhanced coverage options at the lowest premiums available:

- Agreed Value Hull Coverage

- 3rd Party Liability Coverage

- Uninsured and Underinsured Boater Coverage

- Fuel Spill and Environmental Damage Coverage

- Medical Expense Coverage

- Personal Effects Coverage

- Towing and Emergency Expenses Coverage

- Emergency Veterinary Expenses

- Charter Coverage

- Worldwide Cruising Limits

- Liveaboard Coverage

CLICK HERE FOR QUOTES

Here is a list of some of the catamarans we have insured worldwide:

Antares Catamarans

Leopard Catamarans

Lagoon Catamarans

Gunboat Catamarans

Outremer Catamarans

Gemini Catamarans

Catana Catamarans

Stiletto Catamarans

Neel Catamarans

Seawind Catamarans

Atlantic Catamarans

Privilege Catamarans

Mooring Catamarans

Sunsail Catamarans

St. Francis Catamarans

Fontaine - Pajot Catamarans

Nautitech Catamarans

Manta Catamarans

Maine Cat Catamarans

Kronos Catamarans

#LloydsInsurance #boatbuildersinsurance #SailboatInsuranceCharleston #BoatingInsurance #YachtingBoating #Doineedboatinsurance #BoatInsurance #Boat #BoatInsuranceCharleston #YachtInsuranceCharleston #Charleston #Yachting #YachtInsurance #cruising #marineinsurance #boater #liabilityOnlyInsurance #sailboatliabilityinsurance #boatus #yachtinsurance #marineinsurance #boatinsurance #SailboatInsurance #sailing #Sailboat #bostonwhaler #LloydsyachtInsurance #damage #sailboatinsurance #yacht #bostonwhalerinsurance #yachting #uninsured #boating #CharlestonInsurance #Insurance #boat #CatamaranInsurance #LagoonInsurance #LeopardInsurance #AntaresInsurance #BahiaInsurance #AgreedValueInsurance #WorldwideCruisingInsurance #LiveaboardInsurance #GeminiInsurance #CatanaCatamaranInsurance #NeelYachtInsurance #FountainePajotInsurance #MantaCatamaranInsurance #BestCatamaranInsurance #FloridaBoatInsurance

- Find A School

- Certifications

- North U Sail Trim

- Inside Sailing with Peter Isler

- Docking Made Easy

- Study Quizzes

- Bite-sized Lessons

- Fun Quizzes

- Sailing Challenge

Why is Boat Insurance important?

A comprehensive boat insurance policy should cover:.

American Sailing members must claim their discount via the Sailors Portal . Not a member? Join or renew today or visit Ahoy Insurance to get a quote.

It is also important to remember that boat insurance is often required by your state, your marina, and/or your boat finance company (if applicable). Experts recommend not relying solely on your home insurance policy.

In many cases, your homeowner policy may not even cover liability protection, and damage is typically covered only under $2,000. However, your umbrella policy is a great addition to your marine policy, as it extends liability protection at an affordable rate.

We partnered with the best

The Ahoy! Insurance offering

Get a great insurance quote, fast, a worry-free boating experience, supporting you if something goes wrong, how does the ahoy offering work, get a quote & pay, just in case.

- Learn To Sail

- Mobile Apps

- Online Courses

- Upcoming Courses

- Sailor Resources

- ASA Log Book

- Bite Sized Lessons

- Knots Made Easy

- Catamaran Challenge

- Sailing Vacations

- Sailing Cruises

- Charter Resources

- International Proficiency Certificate

- Find A Charter

- All Articles

- Sailing Tips

- Sailing Terms

- Destinations

- Environmental

- Initiatives

- Instructor Resources

- Become An Instructor

- Become An ASA School

- Member / Instructor Login

- Affiliate Login

Catamaran Insurance: Protecting Your Yacht Investment

Comprehensive Coverage for Discerning Yacht Owners

Discover Top-notch Boat Insurance with Nammert – Your Trusted Partner for Safe Seafaring!

When it comes to premium boat insurance, trust Nammert – our top choice and recommendation! We direct you straight to Nammert’s pages to ensure you have access to the latest and best boat insurance offerings.

Customizing Catamaran Insurance: Sail with Confidence

The Freedom to Customize

Catamaran insurance is your canvas, ready to be painted with your unique preferences. It offers you the freedom to tailor your coverage to suit your specific needs and sailing aspirations.

Real-Life Inspiration: Meet Sarah, an experienced catamaran owner who enjoys both leisurely cruises and competitive racing. Her insurance policy reflects her diverse interests, with specialized coverage for racing events, ensuring she can navigate every facet of catamaran life with confidence.

Valuing Your Catamaran Right

Your catamaran is more than just a boat; it’s an investment in your dreams and adventures. Understanding how to accurately determine its value is crucial to securing the right coverage.

Insider’s Tip: Consider Alex, who was caught off guard when a storm damaged his catamaran, revealing that his insurance policy’s „agreed value“ didn’t align with the market worth. This chapter will unveil the steps to ensure your catamaran is accurately valued, sparing you potential financial setbacks.

Safeguarding Your Onboard Treasures

Your catamaran isn’t just a vessel; it’s a treasure chest of memories and prized possessions. In this section, we’ll explore the comprehensive protection of the valuables onboard.

Expert Advice: Imagine your navigational equipment being damaged during a storm. Hull insurance is crucial, but you also need equipment coverage to secure your vital assets. This chapter will guide you on how to ensure everything you hold dear on your catamaran is included in your policy.

Specialized Pursuits Require Specialized Coverage

Do you have a penchant for catamaran racing or occasionally charter your vessel? Specialized pursuits necessitate tailored insurance coverage. We’ll show you how to embark on these endeavors without compromising your peace of mind.

Real-Life Scenario: Meet Emily, an avid catamaran racer who grappled with elevated premiums due to her passion. This chapter will unveil options to make specialized activities more budget-friendly and less worrisome.

Preparing for the Storm

While we can’t control the weather, we can certainly prepare for its unpredictability. Emergency services coverage and strategies for navigating hurricane seasons are on the agenda.

Actionable Insight: Let’s delve into how comprehensive emergency services coverage can be your lifeline during unexpected incidents. We’ll also discuss the importance of preparing for hurricane seasons as part of your insurance strategy.

Navigating the Waters of Fine Print and Deductibles

Insurance policies can be intricate, filled with nuances and potential surprises. In this chapter, we’ll help you navigate these waters, ensuring no unexpected revelations disrupt your sailing experience.

Case Study: Consider Jake, who was taken aback by a high deductible that left him with unexpected expenses. We’ll educate you on understanding deductibles and steering clear of hidden surprises concealed within your policy.

The Power of Negotiation

Negotiation isn’t only reserved for marketplaces; it plays a pivotal role in securing the best insurance deal for your catamaran. We’ll provide you with the skills and knowledge to negotiate confidently.

Success Story: Meet Susan, who managed to trim her premiums through negotiation. This chapter will guide you in discussing terms with your insurer, ensuring you secure the most advantageous deal.

Charting the Future of Catamaran Insurance

The insurance landscape is evolving, adapting to new technologies, climate change, and market dynamics. In this final chapter, we’ll explore these trends, ensuring you’re well-prepared for the future of catamaran insurance.

Looking Ahead: As the insurance world evolves, we’ll discuss how technology, climate change, and market shifts are shaping the future of catamaran insurance. Staying informed and adaptable is key to securing your future adventures.

Sailing with Confidence

With the knowledge and insights we’ve shared, you’re well-equipped to customize your catamaran insurance. The true beauty of catamaran ownership is the freedom to explore the world’s waters on your terms. With the right insurance coverage tailored to your unique needs, you can sail with confidence, knowing that your vessel and adventures are secure.

Whether you’re planning serene coastal cruises, gearing up for exhilarating races, or embarking on captivating diving expeditions, the seas are your oyster. Customize your catamaran insurance, and may your journeys be filled with endless horizons, thrilling discoveries, and safe sailing. Bon voyage!

Why catamaran insurance matters

Are you a proud owner of a luxurious catamaran? Your yacht represents not just a significant financial investment but also a source of adventure and relaxation on the open water. To safeguard your prized possession and your peace of mind, it’s crucial to consider catamaran insurance. In this guide, we’ll explore the key aspects of catamaran insurance and why it’s a must-have for yacht owners like you.

protcet your investment

Owning a catamaran is a dream come true, offering endless opportunities for adventure and relaxation. However, it’s crucial for catamaran owners to understand the importance of insurance. Catamaran insurance provides essential protection for your valuable investment. Whether it’s safeguarding against accidents, weather-related damage, theft, or liability issues, yacht insurance ensures that you can enjoy your time on the water with peace of mind. Don’t set sail without the safety net of insurance—it’s your key to worry-free yachting.

Types of catamaran insurance coverage

Insurance for your catamaran is crucial to protect your valuable asset when you’re out on the water. There are different types of catamaran insurance policies that cover various aspects of your boat and your activities. Here are the key types of catamaran insurance coverage:

Depending on your individual Needs and the usage of your catamaran, you can combine various types of insurance to ensure the best possible protection. It’s important to carefully review the terms and coverages of your catamaran insurance policy and make sure that you are adequately protected before setting sail.

Hull and Equipment Coverage

This coverage protects your catamaran itself, as well as its equipment and facilities. In case your catamaran is damaged or sinks due to collisions, grounding, or storm and weather events, this insurance covers the repair or replacement costs. This is a fundamental coverage that is essential for every catamaran owner.

Liability Insurance

Liability insurance is crucial to protect you from financial consequences if you are held responsible for damage to third parties or injuries. For example, if you accidentally damage another boat or someone on board your catamaran gets injured, this insurance covers the costs of liability claims and legal defense.

Personal Property Coverage

Your personal belongings on board your catamaran, such as electronics, furniture, and personal items, can also be insured. This coverage protects your possessions from theft or damage, whether it’s due to burglary or environmental factors.

Towing and Assistance

This insurance provides coverage for towing and assistance services in emergencies. If your catamaran encounters trouble and you need help, whether it’s due to running out of fuel or engine problems, this insurance covers the costs of rescue and assistance.

Pollution Liability Coverage

If your catamaran is involved in an oil spill or other environmental pollution incident, this insurance can cover the costs of pollution cleanup and potential liability claims.

Medical Payments Coverage

This coverage pays for the medical expenses of injuries sustained by you, your passengers, or your crew while on your catamaran. It provides safety and protection in case of an accident on board.

Why Catamaran Insurance is Essential

Owning a boat is a dream for many water sports enthusiasts, but it also comes with responsibilities and financial risks. A catamaran, a sailboat with two parallel hulls, is a popular choice for yacht owners. But why should you consider catamaran insurance, especially? In this text, we will explain the reasons and compare catamarans to other types of boats.

Stability and safety

Catamarans are known for their stability on the water. The dual hulls provide a wider base that reduces the risk of capsizing or rolling in rough seas. Compared to monohull boats, catamarans are less prone to keeling over, which is a safety advantage. However, it’s important to note that even catamarans can sustain damage in stormy conditions. Therefore, having catamaran insurance is crucial to protect your investment.

Catamarans typically offer more space on deck and in cabins compared to monohull boats of similar size. This makes them an attractive choice for those who value comfort and spaciousness. However, the additional space means you may have more valuables on board. Insuring your personal belongings and the equipment on the catamaran is, therefore, of paramount importance.

Speed and efficiency

Catamarans have a reputation for being faster and more efficient than many monohull boats. This makes them a preferred choice for adventurers and sailing enthusiasts. However, higher speeds can increase the risk of accidents. An accident can damage not only your boat but also other vessels or property. Liability insurance, included in catamaran insurance policies, safeguards you from financial consequences.

Versatility

Catamarans are versatile and suitable for both leisurely cruises and high-sea sailing. They can be used for family outings as well as racing. Each of these purposes may come with different risks. Your catamaran insurance can be customized to align with your specific activities.

Protect your boat with the perfect insurance! Explore tailored boat insurances and save in the process. Whether you own a sailboat, motorboat, or catamaran – Nammert and our recommended partners provide the most comprehensive insurance options for all types of watercraft. Don’t miss the chance to secure your sea adventures with top-notch boat insurance from Nammert! Browse Nammert’s pages to explore the current insurance offerings and ensure your boat is optimally protected. Your journey to safe and carefree seafaring starts here!

Make a Video Tour

Why boat insurance | insurance explained.

choosing the right catamaran insurance

When shopping for catamaran insurance, it’s essential to work with a reputable insurer who understands the unique needs of yacht owners. Here are some tips to help you make an informed decision:

- Evaluate Your Needs : Consider the size, value, and usage of your catamaran to determine the appropriate coverage.

- Compare Quotes : Get quotes from multiple insurers to find the best coverage at a competitive price.

- Check Reviews : Look for customer reviews and ratings to gauge the insurer’s reputation for customer service and claims handling.

- Ask About Discounts : Inquire about available discounts for safety features, experience, or bundling policies.

- Review Policy Details : Carefully read and understand the terms, conditions, and exclusions of the policy before committing.

Why do I need catamaran insurance?

Catamaran insurance is essential to protect your boat and assets. It provides security and financial coverage when unexpected events such as accidents, theft, or damage occur.

What types of catamaran insurance are available?

There are various types of catamaran insurance, including:

- Hull Insurance: Covers damage to the catamaran itself.

- Liability Insurance: Protects against third-party claims in case of damage or injuries.

- Personal Property: Covers personal items on board.

- Emergency and Salvage Services: Offers assistance in case of breakdowns and rescue operations.

How is the value of my catamaran determined for insurance?

The value of your catamaran is usually determined as either an „agreed value“ or „market value.“ Agreed value is based on a prior agreement between you and the insurer, while market value considers the current market price for a similar boat.

What factors influence the insurance premium?

The premium for your catamaran insurance depends on various factors, including your boat’s value, intended use, location, captain’s experience, and the desired coverage level.

What specific terms or restrictions may be included in the policy?

Your policy may include specific terms and restrictions, depending on your insurance company and the selected plan. These could involve where you are allowed to sail, safety requirements on board, and more.

new blog posts

Pitfalls of catamaran insurance: What you need to know to avoid costly mistakes

Mrz 26, 2024

Catamarans are a symbol of freedom and adventure on the world's oceans. But before you set sail, there are some important aspects to consider, especially when it comes to insurance. In this blog post, we take a detailed look at the pitfalls of catamaran insurance and...

Catamaran Insurance for the Luxury Market: Requirements and Options

Mrz 19, 2024

The luxury catamaran market is growing in popularity among affluent boating enthusiasts seeking the ultimate in comfort, elegance and performance. As interest in luxury catamarans grows, so does the demand for tailored insurance solutions that meet the specific needs...

The impact of environmental factors on catamaran insurance costs

Feb 27, 2024

The allure of catamaran sailing is undeniable, offering enthusiasts an exhilarating experience on the open water. Yet, beyond the thrill of the waves lies a practical consideration: insurance. As catamaran owners, understanding the intricacies of insurance costs is...

What are you waiting for?

- [email protected]

- 01684 564 457

- Customer Login

- Renew Online

- Make a Claim

Catamaran Insurance

We are proud to provide our customers with bespoke catamaran insurance tailored specifically to your vessel and to your needs. While Catamarans come in a variety of designs, please note that this category is for Sailing Catamarans only. If you have a Powered Catamaran please use our Cruiser Insurance page. For smaller sailing catamarans please see our Dinghy Insurance page

- All policies underwritten by quality insurers

- Competitive boat insurance quotes

- Bespoke policies suitable for your requirements

- Specialist claims service

- Experienced, UK based team

- No automated calls or junk mail!

- Optional Legal protection Insurance available

Insuring your Catamaran is easy. Simply complete the form below and get your quote. Your quote can then be saved for later or you can proceed immediately and provide payment through our secure online system.

We at Mercia Marine aim to make it as easy as possible to obtain a quick indicative quote through a Quick Quote option, however if you’d prefer to spend a bit more time ensuring everything was correct we can also issue Formal Quotes online which you accept and pay for immediately.

Please Click GET QUOTE to receive either a Quick Indication or a Formal Quotation.

Tarvos Alford is committed to Ohio State 2025 recruiting class. Here's what it means

Another highly-touted defensive player has committed to Ohio State .

2025 four-star linebacker Tarvos Alford committed to the Buckeyes Saturday, choosing OSU over programs such as Miami and Florida State.

Here's what Alford's commitment means for Ohio State.

What does Tarvos Alford's commitment mean for the 2025 class?

The Ohio State defense adds another top-100 defensive player.

In a class that already includes two five-star cornerbacks in Devin Sanchez and Na'eem Offord , a top-60 defensive end in Zahir Mathis and another top-75 cornerback in Blake Woodby, Alford is another example of Ohio State going all-in on its defensive class in 2025.

Alford, a 6-foot-2, 210-pound linebacker out of Vero Beach, Florida, is ranked as the No. 63 player in the country.

Five of Ohio State's first nine commits in the class are top-100 defensive players. In the past two classes, Ohio State has had six top-100 defensive players combined. Ohio State also has a commitment from the No. 101 player in the country: defensive lineman London Merritt, who committed to the Buckeyes Friday.

In 2021, Ohio State landed six defensive players that were ranked as top-100 players in the class: J.T. Tuimoloau , Jack Sawyer , JK Johnson , Michael Hall Jr. Jordan Hancock and Reid Carrico .

And with Alford, momentum is seemingly on the Buckeyes' side for the 2025 class to not only match 2021, but exceed that total.

What does Tarvos Alford's commitment mean for James Laurinaitis?

James Laurinaitis helped Ohio State secure its best linebacker prospect since 2021.

In 2021, the Buckeyes secured a commitment from C.J. Hicks , the No. 7 prospect and No. 1 linebacker in the class, along with high four-star Gabe Powers . 2023 and 2024 brought signees such as Arvell Reese and Garrett Stover , but nothing at Hicks' level.

Alford, ranked as the No. 8 linebacker in the 2025 class, recorded 116 tackles, 12 tackles-for-loss, six pass break-ups, four sacks, three quarterback hits and an interception, doing a bit of everything in the middle of Vero Beach High School football's defense.

Ohio State has averaged two linebackers per class since 2020. And with Alford and three-star Eli Lee , the Buckeyes have two.

Laurinaitis has already made an impact on the Ohio State recruiting trail, helping secure four-star Payton Pierce in 2024, who he started his relationship on Notre Dame's coaching staff. But Alford brings Ohio State back to the national stage at linebacker.

Could Tarvos Alford start for Ohio State in 2025?

Heading into 2025, Ohio State is projected to have six scholarship linebackers returning in Hicks and Powers, who are draft eligible, Reese, Stover, Pierce and Nigel Glover. Sonny Styles is also draft eligible as he's expected to move to linebacker this fall.

While there is talent like Reese and Stover in front of him, Alford could be in line for a rotation piece immediately upon arrival. Expect the Florida native to get playing time right away.

Get more Ohio State football news by listening to our podcasts

- International edition

- Australia edition

- Europe edition

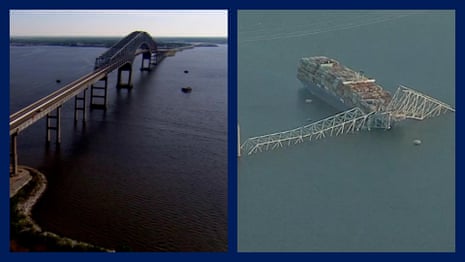

Baltimore bridge collapse: at least six missing as Biden laments ‘terrible accident’

Mayor says rescue efforts continuing after cargo vessel hit Francis Scott Key Bridge, sending vehicles into the water

A frantic search-and-rescue effort continued on Tuesday hours after a major bridge in Baltimore , Maryland, snapped and collapsed when a container ship collided with it in the early morning, sending a number of vehicles into the water.

Baltimore fire department officials said at least six construction workers were still missing, after reports that a 948ft Singapore-flagged container ship leaving port on its way to Sri Lanka had crashed into the Francis Scott Key Bridge.

Jeffrey Pritzker, a senior executive at Brawner Builders, the employer of the construction workers, said Tuesday afternoon that they were presumed dead, given the water’s depth and the length of time since the crash. Pritzker said the crew had been working in the middle of the bridge when it came apart. No bodies have been recovered. “This was so completely unforeseen,” Pritzker said. “We don’t know what else to say. We take such great pride in safety, and we have cones and signs and lights and barriers and flaggers. But we never foresaw that the bridge would collapse.”

A report from the Baltimore Banner earlier said the were construction workers from El Salvador, Guatemala, Honduras and Mexico who are in their 30s and 40s, with spouses and children.