FRACTIONAL YACHT / SHARED CATAMARAN OWNERSHIP

Please notify me of the next available boat for the Fractional Yacht Ownership Program

Ownership Redefined For The Sharing Community: Sharing Is The New Owning!

Our current ideal of owning as much “stuff” as we can and of over consumption is being replaced with a new ideal of shared use and ownership. It gives people access to a lifestyle that they otherwise might not be able to afford, and it reduces waste. Imagine owning and sailing your own luxury catamaran for less than 20% of what conventional yacht ownership or bareboat charter would usually cost you! Not only does it save you money but it eliminates the waste of an asset sitting idle for months, collecting dust AND problems.

That is exactly what this program is designed to do! Fractional or Shared Yacht Ownership gives you the opportunity to enjoy the benefits of yacht ownership for a fraction of the cost of conventional ownership or even charter! Shared yacht ownership is exactly what it sounds like—you buy a share or fraction of a yacht. It is not a timeshare where you only purchase the rights of usage for a certain amount of time and end up with nothing when the term expires. With shared ownership you legally own the fraction of the asset and hold the title to the yacht.

It holds the answer to hassle-free and financially smart boat ownership. It’s a simple concept— up to five co-owners can enjoy the benefits of owning a yacht while splitting the cost of the vessel and its management. It is the simplest way to realize your sailing dreams sooner than you otherwise could and with the least hassle. You can use the yacht as you like and your preferred holidays are always available for you.

Shared Catamaran Ownership is Appealing But…

People have been forming partnerships to co-own expensive assets for a long time, but until now they have had to figure out the logistics themselves. The benefits of shared ownership are very appealing, but it’s been too cumbersome for most to set up. Finding the right partners, setting up partnerships, and managing the logistics of owning a shared asset can be time consuming and difficult. We have created a program that makes the entire process easier and makes shared ownership available to everyone.

Fractional / Shared Yacht Ownership Structure

Number of owners.

Up to five owners each buys a share in a luxury yacht at a fraction of the cost. Unlike timeshare programs where you do not own the yacht and end up with nothing at the end, this program ensures that you have an equity stake in the yacht and hold title of the vessel. We limit the shares to only five owners per boat or less. That way all owners are guaranteed to get equal time. Because owners of fractional shares involve direct ownership, each user has greater control over how the boat is used and maintained and where it is located.

Duration Of The Program

Duration of the program is 7 years. The boat will be sold at the end of the program. Upon the sale of the asset, the owners recover a percentage of their initial cost and will be proportionally refunded from the net proceeds. The owner is free to sell their ownership interest at any time. Since fractional yachts are well maintained and serviced, the value of each owner’s share may not devalue as rapidly as an average yacht’s value.

Owner Weeks & Cost Per Share

Partners own 20% of the boat in an LLC, boat is financed, and chartered through a charter company based in the British Virgin Islands or Bahamas. Partners get to use it two weeks a year plus anytime it’s not booked within 30 days out for a total of 10-15 weeks for the duration of the program. Each week retails for $12K which is waived. Partners only pay cleaning and insurance and variable weekly costs.

Fractional Yacht Owner Use

Owner use is shared equally between the owners according to the number of members. Owner access is allocated fairly to ensure that all owners can optimize the use of the yacht and that all the owners get quality time on the yacht to meet their needs or desires.

- Owner Use Reservations: Owners will reserve time on a reservation system on first come basis (Member A, Member B etc.) with limitations. Dates are decided upon via an equal reservation system well in advance. The first co-owner who signs up becomes “A” in the rotation, the second person “B,” and so on during the first year. The next year, the co-owner who was “A” and had first choice becomes “E”

- Owner Use Limitations: It is envisaged that the maximum continuous owner use will be two weeks per year per owner

- Owner Competency: A competency check will be done with each owner after which owners will operate the vessel as their private yacht. No captain or further supervision will be required once competency is established (training is available should the owner wish to improve skills). If owners wish to hire captains for their use, they may do so at their own cost.

- Reciprocal Use: The plan is to develop co-ownership bases in other locations that will create a reciprocal owner use option. Potential locations currently being investigated –Bahamas (Marsh Harbor), Puerto Rico, Annapolis, USVI (St Thomas). To start, the only location will be Fort Lauderdale, which has easy access to the Bahamas and the Florida Keys cruising grounds.

Operating Costs Are Covered By Charter Revenue

The annual operating costs such as insurance, dockage, annual haul out and scheduled maintenance will be offset by income from chartering the yacht. With traditional yacht ownership, the owner spends around 10 percent of the total value of the yacht annually but with our model based on seven years, one can save up to 90 percent of the cost of traditional yacht ownership. That is a huge advantage for the owners of a fractional yacht.

Fractional Yacht Models

The latest catamaran models from the world’s top manufacturers like Lagoon, Fountaine Pajot, Nautitech and Bali are available for these programs, fully equipped with air-conditioning, generator, full electronics, dingy, outboard and sun awnings.

Fractional Yacht Management & Maintenance

The vessel will be professionally managed and maintained by a management company to ensure that you enjoy your use of the boat with minimum hassle – boats are maintained in turn key condition and ready for you to step aboard.

Fractional Yacht Shares Figures: Cost Of Yacht Share Ownership

We have made up a sample of cost per share using a 46ft catamaran plus full financials. Please contact us for more details.

Catamaran Guru Making Fractional Yacht Ownership Work!

Some of the early fractional yacht business models were guilty of taking advantage of the shareholders, and plenty have failed along the way. They would take a boat with a market price of say $2 million and divide it into 10 shares of $400,000, thereby doubling their investment by selling it for a total of $4 million. The Management / brokerage companies were trying to make a killing on one boat. It did not sit well with many potential buyers. Savvy boat owners might be willing to pay a small premium, but they’re not willing to get taken to the cleaners.

Catamaran Guru’s innovative fractional shared yacht ownership programs provide you with a financially savvy solution to yacht ownership that is ideal for your active lifestyle. You can experience all the benefits of yacht ownership without the hassles of staffing, maintaining, or servicing your yacht.

Contact us for full details today! OR Call: 804.815.5054

We're Ready, Let's Talk.

Estelle cockcroft, join our community.

Get the latest on catamaran news, sailing events, buying and selling tips, community happenings, webinars & seminars, and much more!

9 thoughts on “FRACTIONAL YACHT / SHARED CATAMARAN OWNERSHIP”

Hi could you add my name for the next available round of fractional ownership.

Many thanks in advance

Matt we have you on the list!

Will do! It looks like we will have another Bali 4.6 available in the coming weeks.

We lost our Leopard catamaran in Hurricane Irma and have been looking to buy again.

We are interested in fractional ownership. Can you let me know if this is currently available?

Hi there My wife and I are in Australia We are just about to buy our second vessel We are trying to decide on buying into a syndicate of private owners for private use or whether to buy into a charter program in the Whitsundays and attach a business loan to it including our deposit Wondering if you guys may have something that would suit our needs Ideally We would be looking at a cat around 45 foot in length with preferably four cabins

Craig, my apologies for the late reply! Your comment got buried in the hundreds of comments we’ve received lately. We would be happy to have a chat with you and see what might work for you. We can chat online or by phone or alternately email us your questions and I will reply asap. [email protected]

You have been added and someone will contact you shortly

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Recent Posts

First-annual virgin islands boating exhibition (vibe).

VIBE – It’s a Destination Boat Show! Join us May 10 – 12 at

BALI Catamarans Unveils The New Bali 5.8 Flagship

CATANA GROUP launches its 14th BALI CATAMARAN model, the BALI 5.8, for the brand’s

Love Stories At Sea…because it’s valentine’s day

Because it’s Valentine’s day, we wanted to celebrate all the couples that we helped

Your Go-To Resource for all your Catamaran Needs!

Check out our brochure to learn about all we have to offer and why

For more than 30 years, we have been a part of the catamaran community and created Catamaran Guru™ to encourage and educate all the aspiring sailing out there. We understand the dream of traveling the world by catamaran and created a one-stop-shop to make that dream a reality for you.

- Stephen & Estelle

- Testimonials

Get Started

- Yacht Sales

- Used Yachts

- Charter Management

- Boat as Business Programs

- Seminars & Events

- Report Store

- AMR in News

- Press Releases

- Request for Consulting

- Our Clients

Catamaran Market Size, Share, Competitive Landscape and Trend Analysis Report by Product Type, by Size, by Application : Global Opportunity Analysis and Industry Forecast, 2021-2031

AT : Automotive systems and accessories

Report Code: A11384

Tables: 124

Get Sample to Email

Thank You For Your Response !

Our Executive will get back to you soon

The global catamaran market size was valued at $1.6 billion in 2021, and is projected to reach $2.7 billion by 2031, growing at a CAGR of 5.5% from 2022 to 2031.

A catamaran is a type of watercraft that features two parallel hulls of equal size, typically made of fiberglass, wood, or aluminum, which are joined together by a frame. It is designed for use in various water activities such as sailing, racing, cruising, and fishing. Catamarans can be propelled by sails or engines and they are known for their stability, speed, and comfort, making them popular among sailors and water enthusiasts. They come in various sizes, from small recreational boats to large commercial vessels.

Growth in demand for leisure and recreational activities

The catamaran market is driven by the increasing demand for leisure and recreational activities such as yacht chartering, island hopping, and cruising. The surge in popularity of boating as a leisure activity fuels the demand for catamarans, as they offer more space, comfort, and stability compared to traditional monohull boats. The demand for leisure and recreational activities has been steadily growing in recent years, driven by factors such as increase in disposable income, change in consumer preferences, and a growth in focus on health & wellness. One of the fastest-growing segments within the leisure industry is outdoor recreation, which includes activities such as camping, hiking, and water sports.

For instance, according to the Outdoor Industry Association, outdoor recreation in the U.S. generated $459.8 billion in consumer spending in 2019, supporting 5.2 million jobs and contributing $788 billion to the nation's gross output. Therefore, the growing demand for leisure and recreational activities are projected to drive the market growth during the forecast period.

Advantages of catamarans over monohull boats

Catamarans have several advantages over monohull boats that have contributed to their increase in popularity and market growth. Primarily, catamarans offer greater stability and safety compared to monohulls, thanks to their wider beam and twin-hull design. This makes them less prone to capsizing, even in rough waters. In addition, catamarans are faster and more efficient than monohulls due to their reduced drag and increased buoyancy. This means they can travel further and faster on less fuel, making them more cost-effective and environmentally friendly.

The comfort level of catamarans is also a key advantage. The two hulls provide a stable platform that minimizes rocking and rolling, making them ideal for those who suffer from seasickness. The spacious decks, cabins, and saloons also provide plenty of room for passengers to move around and relax, making them perfect for extended trips and liveaboard use.

Several companies have developed innovative catamaran designs and technologies to meet the growing demand for these vessels. For instance, Lagoon, Fountaine Pajot, and Leopard Catamarans are leading manufacturers of luxury catamarans, while Sunreef Yachts specialize in custom-built catamarans. Other companies, such as Gunboat and HH Catamarans, focus on high-performance catamarans for racing and offshore sailing. Overall, the advantages of catamarans over monohulls have helped to drive market growth and innovation in this sector.

High initial costs

One of the main challenges faced by the catamarans market is the high initial costs associated with these vessels. Catamarans are typically larger and more complex than monohull boats, which means they require more materials and labor to build. In addition, the specialized design and features of catamarans can also add to their costs. This can make catamarans a more expensive investment compared to traditional boats, which can be a barrier for some potential buyers.

For instance, a basic 40-foot catamaran can cost around $250,000 to $500,000, while larger models can cost well over $1 million. This cost can be even higher for custom-built or luxury catamarans. As a result, many people may opt for a more affordable monohull boat instead of a catamaran. Moreover, the high initial cost of catamarans is anticipated to hamper the market growth during the forecast period.

Technological advancements in Catamarans

One area of advancement is in propulsion systems. Some catamaran manufacturers have developed hybrid and electric propulsion systems that are more efficient and environmentally friendly than traditional diesel engines. For instance, Sunreef Yachts offers a range of electric and hybrid catamarans that can run solely on electric power or a combination of electric and diesel power, depending on the conditions.

Another area of advancement is in design and materials. Catamaran manufacturers are exploring new materials such as carbon fiber, which is lighter and stronger than traditional fiberglass. This allows for the construction of lighter and more fuel-efficient vessels. In addition, advances in computer-aided design (CAD) software and simulation tools are allowing designers to optimize the hull shape and improve the hydrodynamics of the vessel, resulting in improved speed and fuel efficiency.

Therefore, advancements in navigation and communication technology are making catamarans safer and easier to operate. This includes the integration of satellite navigation systems, radar, and sonar technology to improve situational awareness and collision avoidance, as well as advanced communication systems that allow remote monitoring and control of the vessel. These technological advancements are creating new opportunities for the catamarans market to develop more efficient, high-performance, and technologically advanced vessels.

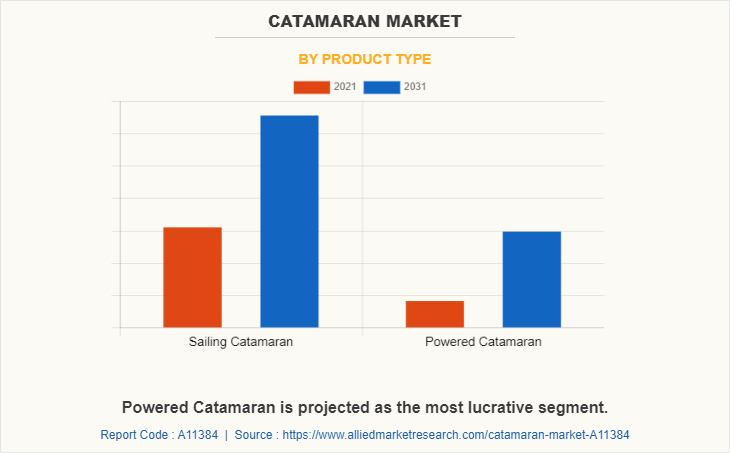

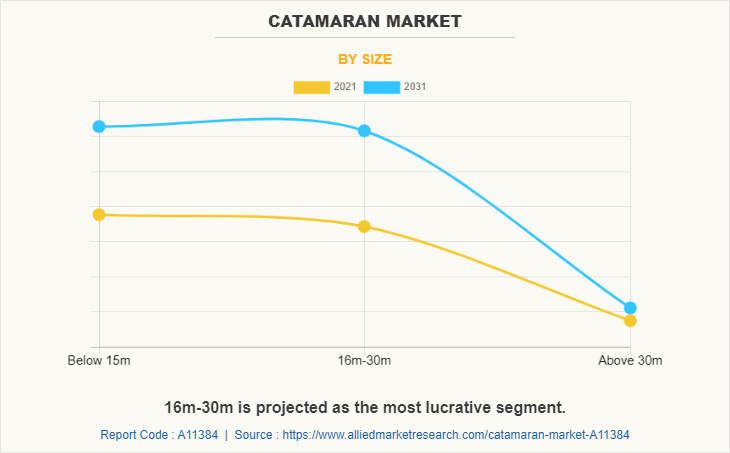

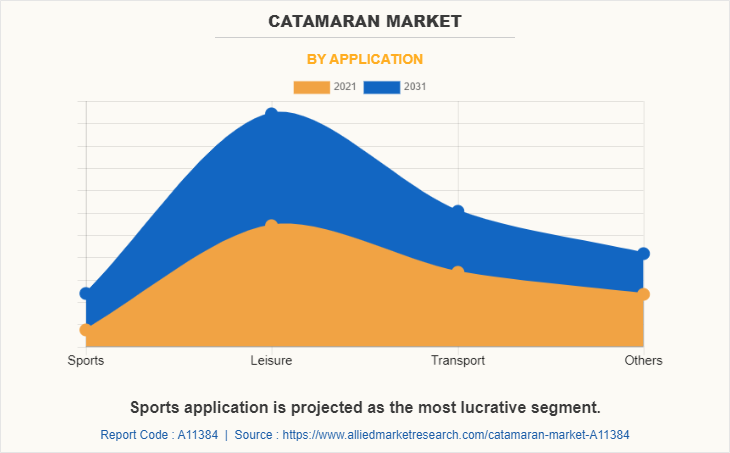

The catamaran market is segmented on the basis of size, application, product type, and region. By size, the market is divided into below 15m, 16m-30m, and above 31m. By application, it is fragmented into sports, leisure, transport, and others. By product type, it is bifurcated into sailing catamaran and power catamaran. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the catamaran market are Leopard Catamarans, Outremer catamarans, Beneteau/Lagoon, Fountaine Pajot, Catana Catamarans, Nautitech Catamaran, Privilege Catamarans, Antares Catamarans, Gemini Catamarans, and Seawind Cats.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the catamaran market share analysis from 2021 to 2031 to identify the prevailing catamaran market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the catamaran market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global catamaran market trends, key players, market segments, application areas, and market growth strategies.

Catamaran Market Report Highlights

Analyst Review

The catamaran market is growing rapidly as a result of a number of factors such as the advantages of catamarans over monohull boats and the rise in demand for leisure & recreational activities. However, other considerations, such as high initial costs and environmental concerns, limit the market expansion. On the other hand, factors such as rise in consumer demand for eco-friendly boats and technical improvements offer significant opportunities for the market to propel during the forecast period.

According to the US Coast Guard, there were 4,291 recreational boating accidents in 2020, resulting in 767 deaths and 3,191 injuries. Of those accidents, 56 involved catamarans. While catamarans are generally considered safer than monohull boats, it is important for catamaran drivers to follow safe boating practices, such as wearing life jackets and avoiding alcohol while driving. Catamarans are used in various industries, including commercial fishing, transportation, and search & rescue. For example, the US Navy uses catamarans for mine countermeasures and coastal patrol. Advances in technology have led to the development of innovative catamaran designs, such as hydro foiling catamarans that use underwater wings to lift the boat out of the water and reduce drag. Catamaran tour is a popular activity in many coastal destinations, providing visitors with the opportunity to explore the ocean, spot marine life, and enjoy the scenery.

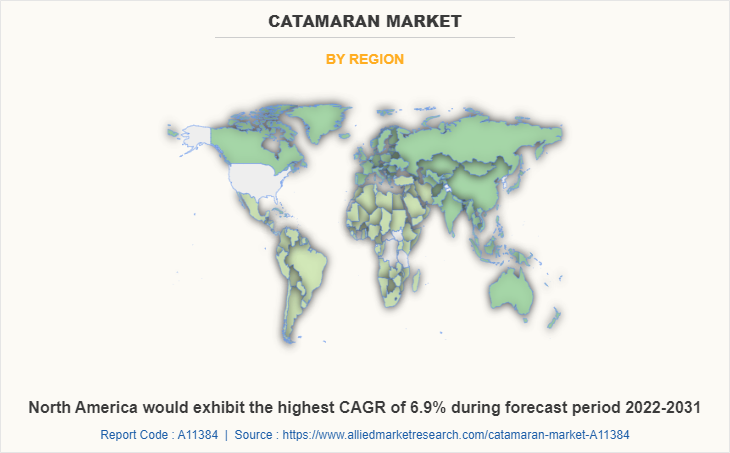

Among the analyzed regions, Europe is the highest revenue contributor, followed by Asia-Pacific, North America, and LAMEA. While North America is expected to lead during the forecast period due to growth in technological advancements and the rise in adoption of catamarans in countries such as U.S., Canada, and Mexico.

- Navigation Systems

- Audio Systems

- Auto Parts And Components

- Auto Repair Manuals

- Automotive Diagnostic Tools

- Automotive Lighting Upgrades

- Backup Cameras And Sensors

- Electrical Systems

- Exterior Accessories

- Filters And Fluids

The Catamaran Market was valued for $1,583.80 million in 2021 and is estimated to reach $2,704.05 million by 2031.

Leisure is the leading application of the catamaran market.

Europe is the largest regional market for catamaran.

Rising water sports activities and increasing spending on leisure vacation activities are the upcoming trends of catamarans market.

Loading Table Of Content...

- Related Report

- Global Report

- Regional Report

- Country Report

Enter Valid Email ID

Verification code has been sent to your email ID

By continuing, you agree to Allied Market Research Terms of Use and Privacy Policy

Advantages Of Our Secure Login

Easily Track Orders, Hassel free Access, Downloads

Get Relevent Alerts and Recommendation

Wishlist, Coupons & Manage your Subscription

Have a Referral Code?

Enter Valid Referral Code

An Email Verification Code has been sent to your email address!

Please check your inbox and, if you don't find it there, also look in your junk folder.

Catamaran Market

Global Opportunity Analysis and Industry Forecast, 2021-2031

West Coast Multihulls

West Coast Multihulls 955 Harbor Island Drive Suite 180 San Diego, CA 92101 619.571.3513

- Name: * E-mail: * Message: *

- Boat Search

- Vessel Type : Any New Sail Used-Brokerage Sail New Power Used-Brokerage Power

- Length Overall : -

- Hull Form : Any Catamaran Trimaran Monohull

- ALL Catamarans

- New Catamarans

- Used Catamarans

Catamaran Shared Ownership

- Full Event Listings

- Multihull vs Monohull

- San Diego Catamaran Charters

- Sea of Cortez Catamaran Charters

- Multihull Sailing Lessons

- San Diego Sailing Events

- The WCM Approach

VELA is the Shared Ownership, Sail Exchange, and Yacht Management division of West Coat Multihulls. We have opportunities for you to share ownership of a beautiful catamaran in San Diego or the Sea of Cortez.

If you love sailing, but struggle with the idea of the boat sitting at the dock week after week , this program is for you. If you find yourself coming to the boat to finally get away, and being stuck working on the boat instead of sailing it and playing with friends and family, this program is for you. Reservation flexibility and a top notch maintenance program reduce your stress and maximize your fun!

Shared Ownership

As a fractional owner, you can sail a newer, larger and better equipped catamaran at a much lower overall cost than individually purchasing a boat yourself.

Sail Exchange

Participating in the Sail Exchange Program allows you to trade days on your boat with other catamaran owners in any location where we have participating boats.

Charter Partnership

If you own more time on your catamaran than you need, you can offset more of your ownership costs by partnering with the charter operations of West Coast Multihulls.

Sailing Locations

Docking your catamaran in San Diego gives you access to the Southern California Coastline, Catalina and the other Channel Islands. Visit some exceptional dock-and-dine restaurants on a trip up the scenic coastline, or head out to the islands for some hiking & diving in locations that are truly unique.

Sea of Cortez

Sailing in the Sea of Cortez is spectacular. The scenery, sea life, remoteness, and tacos make this cruising ground one of the best in the world. With our two Sea of Cortez locations you have the entire area from Cabo San Lucas to Bahia Concepcion within reach of a fun seven day trip.

If you want to sail your own catamaran for 4-8 weeks per year, while minimizing expenses and ownership costs, there is no better way to make this happen. Inquire Today! »

Start your boat search, wcm events calendar.

Inside Scoop: WCM News

Email address:

- Your Source for EVERYTHING Multihull!

- Catamarans for Sale

- Contact West Coast Multihulls

- Multihull vs Monohull: Advantages

- Other Catamarans for Sale

- Sailing in San Diego: Charters & Lessons

- Submit a Testimonial

- Boat Sales: 619.571.3513 Lessons/Charters: 619.365.4326

- Your Source for Catamarans and Trimarans

- Copyright © 2008-2016, West Coast Multihulls

- The Denali theme by Usability Dynamics, Inc.

The increase in leisure tourism and racing events and the increasing disposable income of people across the globe are some of the key factors driving the growth of the catamaran industry. A catamaran has a single deck that holds together two parallel hulls. It has more significant internal space than a monohull because of its two-hull structure, which means that the cockpit and living room between the two hulls have ample space. The catamaran is significant while traveling from one distant location to another. Because of increased maritime tourism and people's preference for opulent vacations, the business is expanding at a rapid pace. A catamaran is mainly famous among High-Net-Worth Individuals (HNWI) who prefer leisure travel and have enough money to spend on those travels. One of the main reasons why catamarans are so popular these days is because of their size and stability.

The space between the two hulls of a catamaran tends to have more room for the catamaran, both below and above decks. Some of the benefits of using a catamaran:

Boat manufacturers supersize: Shipyards are constantly growing in size, and boatbuilders are venturing out and creating bolder designs that push the limits of scale and speed. As a result, catamarans are growing more extensive and lighter. Sunreef Yachts, for example, has progressively increased its fleet size, and in 2022, they delivered the Sunreef 49 Power Cat model, which is currently the biggest yacht in the fleet, measuring 160 feet

Increased stability, i.e., reduces seasickness: The two-hull construction and broad beam of a catamaran give a calm sailing experience with little rolling, which is perfect for seasick guests. A multi-hull catamaran has higher stability because of its more significant surface area

A catamaran of the same size as a monohull is more expensive. Once a boat is purchased, there are extra running and maintenance fees (i.e., cost of ownership). For example, after the purchase, the individual will have to pay more for a more significant and comprehensive marina slip, and fuel expenses quickly build up because a catamaran has two engines. Another frequently claimed disadvantage of catamaran cruising is that these sorts of boats cannot "self-right" themselves in the improbable event of capsizing. Monohull sailboats are built to "right" themselves if they go flipped in high-volume waves during a storm. Catamarans, by definition, cannot accomplish this. Boat makers are manufacturing catamarans that are faster and more fuel-efficient as design and technology advance. As a result, many loyal monohull owners have converted to catamaran ownership. In November 2021, Servo Yachts LLC debuted The Martini 7.0, a 165-foot catamaran boat with revolutionary technology that treats seasickness in guests. Catamaran Market Report Highlights

A catamaran is like any other type of expensive leisure tourism. Wealthy families, affluent individuals, and anyone with enough money who wants to try different experiences are willing to pay for a catamaran on the condition that it is safe

In January 2022, the Martini 7.0, a 165-foot catamaran yacht, featuring unique technology that gives passengers seasickness treatment, was presented by Servo Yachts. The Martini 7.0, created in partnership with the U.K.-based company Shuttleworth Design, has novel marine stabilization techniques that allow the yacht to glide more softly across the water, eliminating the kind of motion that often causes guests to get seasick

The power catamaran segment is estimated to hold the major market share and expand at a CAGR of 6.2% from 2022 to 2030

The small-sized catamarans segment is projected to advance at the highest CAGR during the forecast period

The catamaran market for sports applications is expected to expand at the highest CAGR during the assessment period

Key industry players include African Cats., Bavaria Catamarans, Beneteau Group, and CATATHAI

Key Topics Covered: Chapter 1. Methodology and Scope Chapter 2. Executive Summary

Chapter 3. Market Variables, Trends, & Scope Outlook 3.1. Market Segmentation 3.2. Catamaran Market Size & Growth Prospects 3.3. Catamaran Market - Value Chain Analysis 3.4. Catamaran Market Dynamics 3.4.1. Market Driver Analysis 3.4.2. Market Restraint Analysis 3.4.3. Market Opportunity Analysis 3.5. Catamaran Penetration & Growth Prospects Mapping 3.6. Catamaran Market - Porter's Five Forces Analysis 3.6.1. Supplier power 3.6.2. Buyer power 3.6.3. Substitution threat 3.6.4. Threat from new entrant 3.6.5. Competitive rivalry 3.7. Catamaran Market - PEST Analysis 3.7.1. Political landscape 3.7.2. Economic landscape 3.7.3. Social landscape 3.7.4. Technology landscape 3.8. COVID-19 Impact Analysis Chapter 4. Catamaran Market Product Outlook 4.1. Catamaran Market, By Product Analysis & Market Share, 2021 & 2030 4.2. Sailing Catamarans 4.2.1. Market estimates and forecasts, 2017 - 2030 (USD Million) 4.2.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million) 4.2.3. Sport 4.2.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million) 4.2.3.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million) 4.2.4. Leisure 4.2.4.1. Market estimates and forecasts, 2017 - 2030 (USD Million) 4.2.4.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million) 4.2.5. Transport 4.2.5.1. Market estimates and forecasts, 2017 - 2030 (USD Million) 4.2.5.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million) 4.2.6. Others 4.2.6.1. Market estimates and forecasts, 2017 - 2030 (USD Million) 4.2.6.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million) 4.3. Power Catamarans 4.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million) 4.3.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million) 4.3.3. Sport 4.3.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million) 4.3.3.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million) 4.3.4. Leisure 4.3.4.1. Market estimates and forecasts, 2017 - 2030 (USD Million) 4.3.4.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million) 4.3.5. Transport 4.3.5.1. Market estimates and forecasts, 2017 - 2030 (USD Million) 4.3.5.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million) 4.3.6. Others 4.3.6.1. Market estimates and forecasts, 2017 - 2030 (USD Million) 4.3.6.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million) Chapter 5. Catamaran Market Size Outlook 5.1. Catamaran Market, By Size Analysis & Market Share, 2021 & 2030 5.2. Small 5.2.1. Market estimates and forecasts, 2017 - 2030 (USD Million) 5.2.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million) 5.3. Medium 5.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million) 5.3.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million) 5.4. Large 5.4.1. Market estimates and forecasts, 2017 - 2030 (USD Million) 5.4.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million) Chapter 6. Catamaran Market Application Outlook 6.1. Catamaran Market, By Application Analysis & Market Share, 2021 & 2030 6.2. Sport 6.2.1. Market estimates and forecasts, 2017 - 2030 (USD Million) 6.2.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million) 6.3. Leisure 6.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million) 6.3.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million) 6.4. Transport 6.4.1. Market estimates and forecasts, 2017 - 2030 (USD Million) 6.4.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million) 6.5. Others 6.5.1. Market estimates and forecasts, 2017 - 2030 (USD Million) 6.5.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million) Chapter 7. Catamaran Market: Regional Estimates & Trend Analysis

Chapter 8. Competitive Analysis 8.1. Recent Developments and Impact Analysis, by Key Market Participants 8.2. Company/Competition Categorization (Key Innovators, Market Leaders, Emerging, Niche Players) 8.3. Vendor Landscape 8.3.1. Key company market share analysis, 2021 8.4. Company Analysis Tools 8.4.1. Market Position Analysis 8.4.2. Competitive Dashboard Analysis Chapter 9. Competitive Landscape 9.1. Company Profiles 9.2. African Cats. 9.2.1. Company overview 9.2.2. Financial performance 9.2.3. Product benchmarking 9.2.4. Strategic initiatives 9.3. Bavaria Catamarans 9.3.1. Company overview 9.3.2. Financial performance 9.3.3. Product benchmarking 9.3.4. Strategic initiatives 9.4. Beneteau Group 9.4.1. Company overview 9.4.2. Financial performance 9.4.3. Product benchmarking 9.4.4. Strategic initiatives 9.5. CATATHAI 9.5.1. Company overview 9.5.2. Financial performance 9.5.3. Product benchmarking 9.5.4. Strategic initiatives 9.6. Fountaine Pajot Catamarans 9.6.1. Company overview 9.6.2. Financial performance 9.6.3. Product benchmarking 9.6.4. Strategic initiatives 9.7. Leopard Catamarans 9.7.1. Company overview 9.7.2. Financial performance 9.7.3. Product benchmarking 9.7.4. Strategic initiatives 9.8. NAUTITECH 9.8.1. Company overview 9.8.2. Financial performance 9.8.3. Product benchmarking 9.8.4. Strategic initiatives 9.9. Outremer Yachting 9.9.1. Company overview 9.9.2. Financial performance 9.9.3. Product benchmarking 9.9.4. Strategic initiatives 9.10. Seawind 9.10.1. Company overview 9.10.2. Financial performance 9.10.3. Product benchmarking 9.10.4. Strategic initiatives 9.11. Voyage 9.11.1. Company overview 9.11.2. Financial performance 9.11.3. Product benchmarking 9.11.4. Strategic initiatives

For more information about this report visit https://www.researchandmarkets.com/r/9nmerg-market?w=12

About ResearchAndMarkets.com ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

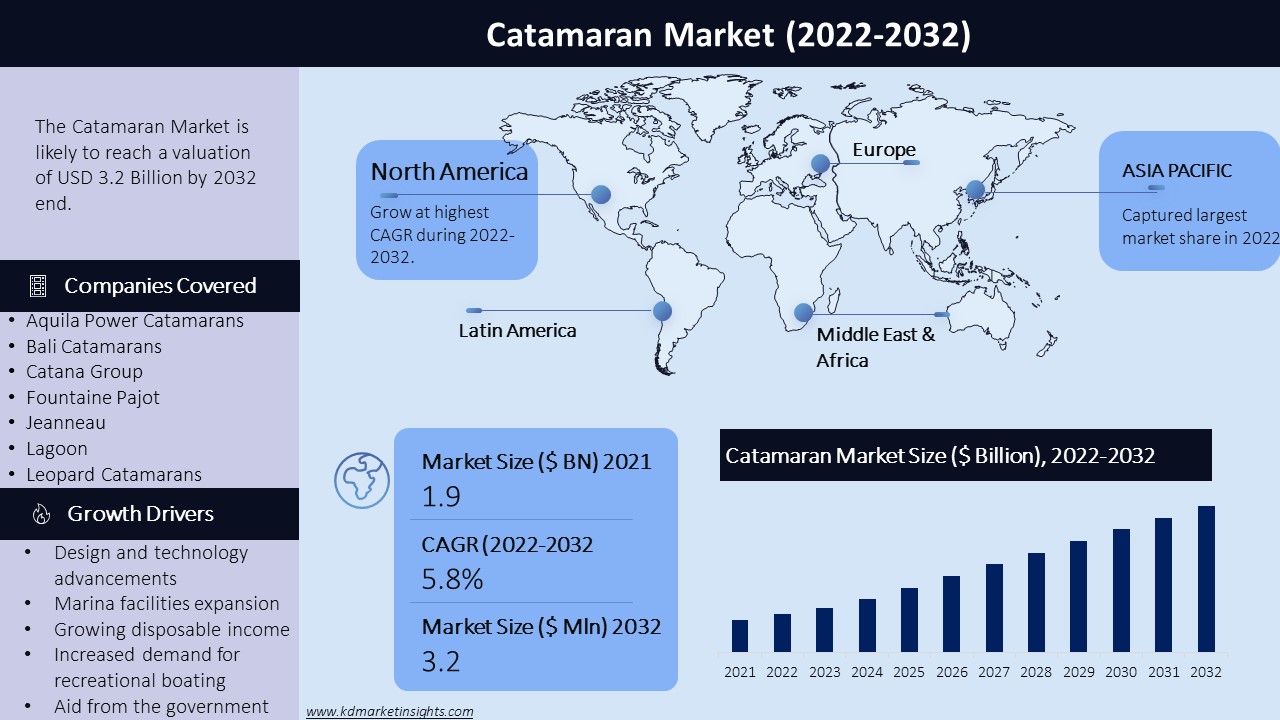

Catamaran Market: Global Share, Size, Growth, Trends & Outlook ( 2022 – 2032 )

Automotive And Transportation

- Status : Published

- Published on: July 2022

- Report ID: KDMI-3067

- Available Format: PDF/Excel/DOC

1 Preface 1.1 Research Methodology 1.2 Geographic Scope 1.3 Years Considered

2 Executive Summary

3 Market Overview 3.1 HDPE Pipes Overview 3.2 Market Definition & Key Market Segments 3.3 Industry Development 3.4 Global Market Maturity 3.4.1 North America 3.4.2 Europe 3.4.3 Asia Pacific 3.4.4 Latin America 3.4.5 Middle East & Africa 3.5 Porter’s Five Force Analysis 3.6 Industry Value Chain Analysis 3.7 Macro-Economic Trends

4 Competitive Landscape 4.1 Global HDPE Pipes Market 2017 4.2 Global HDPE Pipes Market Value Share, By Company 2017 4.3 Global HDPE Pipes Market Volume Share, By Company 2017

5 Growth Drivers & Barriers in Global HDPE Pipes Market 5.1 North America 5.2 Europe 5.3 Asia Pacific 5.4 Rest of World

6 Trends in Global HDPE Pipes Market 6.1 North America 6.2 Europe 6.3 Asia Pacific 6.4 Rest of World

7 Global HDPE Pipes Market 7.1 Introduction 7.1.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 7.1.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

8 Global HDPE Pipes Market Segmentation Analysis, By Product Type 8.1 Introduction 8.2 Strategic Insights 8.3 BPS Analysis, By Product Type 8.4 Market Attractiveness, By Product Type 8.5 PE 63 Market 8.5.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 8.5.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025 8.6 PE 80 Market 8.6.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 8.6.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025 8.7 PE 100 Market 8.7.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 8.7.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025 8.8 PE 100RC Market 8.8.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 8.8.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025 8.9 Others Market 8.9.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 8.9.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

9 Global HDPE Pipes Market Segmentation Analysis, By Application 9.1 8.1. Introduction 9.2 8.2. Strategic Insights 9.3 BPS Analysis, By Application 9.4 Market Attractiveness, By Application 9.5 Oil & Gas Pipe Market 9.5.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 9.5.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025 9.6 Agricultural Irrigation Pipe Market 9.6.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 9.6.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025 9.7 Water Supply Pipe Market 9.7.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 9.7.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025 9.8 Sewage System Pipe Market 9.8.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 9.8.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025 9.9 Others Market 9.9.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 9.9.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

10 Geographical Analysis 10.1 Introduction 10.2 North America HDPE Pipes Market 10.2.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 10.2.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025 10.3 By Product Type 10.3.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 10.3.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025 10.4 By Application 10.4.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 10.4.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

11 Europe HDPE Pipes Market 11.1.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 11.1.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025 11.2 By Product Type 11.2.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 11.2.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025 11.3 By Application 11.3.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 11.3.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

12 Asia Pacific HDPE Pipes Market 12.1.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 12.1.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025 12.2 By Product Type 12.2.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 12.2.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025 12.3 By Application 12.3.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 12.3.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

13 Latin America HDPE Pipes Market 13.1.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 13.1.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025 13.2 By Product Type 13.2.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 13.2.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025 13.3 By Application 13.3.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 13.3.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

14 Middle East & Africa HDPE Pipes Market 14.1.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 14.1.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025 14.2 By Product Type 14.2.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 14.2.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025 14.3 By Application 14.3.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025 14.3.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

15 Competitive Landscape 15.1 Market Share of Key Players in HDPE Pipes Market 15.2 HDPE Pipes Company Analysis 15.3 JM Eagle, Inc. 15.4 Company Overview 15.4.1 Product Offered 15.4.2 Business Strategy 15.4.3 Financials 15.4.4 SWOT Analysis 15.4.5 Market Share Analysis 15.4.6 Key Achievements & Developments 15.5 WL Plastics 15.6 POLYPLASTIC Group 15.7 Lane Enterprises, Inc. 15.8 Prinsco, Inc. 15.9 Uponor Oyj 15.10 Mexichem 15.11 United Poly Systems 15.12 Blue Diamond Industries, LLC 15.13 Radius Systems Ltd. 15.14 Other Prominent Players

16 Disclaimer

FREE Report Sample is Available

In-depth report coverage is now just a few seconds away

Pandemic disrupted the entire world and affected many industries.

Get detailed COVID-19 impact analysis on the Catamaran Market

Catamaran Market Insights

A catamaran is a type of boat or watercraft that has two hulls of equal size and shape, connected by a structure or platform. The word "catamaran" comes from the Tamil language of South India, where it originally referred to a type of fishing boat with two hulls. Popular for their stability, speed, and efficiency they need two hulls rather than one, offer less resistance within the water, and are ready to travel faster with less power. they're also less likely to tip over, making them a well-liked choice for sailing and other water sports.

Catamarans are available in a spread of sizes and designs, from small recreational boats to large commercial vessels. Some catamarans are designed for speed and racing, while others are built for comfort and luxury. they will be powered by sail or by motor, and a few are equipped with both.

The global catamaran market has seen growth in recent years, with an increasing demand for luxury and high-performance catamarans for recreational purposes, also as for commercial and military applications. The global catamaran market size was valued at around USD 1.9 billion in 2021 and is projected to grow at a compound annual rate of growth (CAGR) of around 5.8% from 2022 to 2032.The market size is projected to succeed in USD 3.2 billion by 2032.

Key drivers of the market include advancements in materials and design, increased disposable income, and growth in tourism and water-based recreational activities. The market is characterized by the presence of several established players and new entrants, offering a good range of catamaran models for various applications. North America and Europe are currently the most important markets for catamarans, followed by Asia-Pacific and therefore the remainder of the planet. The Asia Pacific region is predicted to witness the very best growth within the catamaran market thanks to the increasing number of water sports enthusiasts and rising disposable incomes.

Catamaran Market Key Drivers

The global catamaran market is driven by various key drivers contributing to its growth in recent years. Some of the key drivers of the are:

- Design and technology advancements: With the introduction of cutting-edge designs, materials, and technologies, the catamaran industry is constantly evolving. Demand for catamarans is being driven by these advancements, which are making them more comfortable, eco-friendly, and fuel-efficient.

- Marina facilities expansion: The growth of the most recent marinas and harbors all over the world has boosted the market by making it easier for people to own and operate catamarans.

- Growing disposable income: More people are willing to pay for the recreational use of luxury boats, such as catamarans, as disposable income rises.

- Increased demand for recreational boating: People are looking for recreational boats, such as catamarans, to enjoy water-based activities and discover new places as the tourism and leisure industries grow.

- Aid from the government: By investing in infrastructure development, encouraging water tourism, and offering incentives to eco-friendly vessels, governments are supporting the catamaran industry. This frequently fosters a favorable environment for the growth of the catamaran market.

- The popularity of environmentally friendly boats: There is a rising demand for eco-friendly boats, such as electric and hybrid catamarans, as environmental awareness and concern about sailing's environmental impact grow.

- Water sports are becoming more and more popular: The demand for catamarans is being driven by the rising popularity of water sports like sailing, cruising, and fishing. Due to their efficiency, speed, and stability, catamarans are ideal for these activities.

- Increasing demand for luxury: Luxury and comfort are becoming increasingly popular uses for catamarans, particularly in the high-end market. The growing number of wealthy people looking for unique and cozy experiences is driving the demand for luxury catamarans.

Catamaran Market Key Trends and Developments

Some key trends and developments in the catamaran market include:

- Increased demand for electric and hybrid catamarans : With the growing specialization in eco-friendliness, there's a trend towards electric and hybrid catamarans that use alternative propulsion systems. These vessels are gaining popularity thanks to their low emissions and reduced fuel consumption.

- Customization and personalization : Consumers are trying to find more customization and personalization options for their catamarans. Manufacturers are responding to the present trend by offering more options for interior and exterior design, technology integration, and other features.

- Growth within the charter market : The charter marketplace for catamarans is growing rapidly, driven by the rising popularity of sailing vacations and water tourism. This trend is predicted to continue as more consumers seek unique and immersive travel experiences.

- Innovation in design and materials : Catamaran manufacturers are investing in research and development to make new designs and materials that improve performance, efficiency, and luxury. This includes the utilization of the latest materials like carbon fiber, also as innovative hull designs that reduce drag and improve stability.

- Advancements in materials and construction techniques : Manufacturers are using new materials and construction techniques to create lighter and more durable catamarans, offering improved performance and safety features.

- Integration of smart technology : Smart technology is being integrated into catamarans to reinforce safety, navigation, and entertainment. This includes features like GPS navigation, automated systems, and entertainment systems which will be controlled via smartphones and tablets.

Catamaran Market Segmentation

The Catamaran market can be segmented based on the following factors:

- Sailing Catamarans

- Power Catamarans

- Hybrid Catamaran

- Recreational Boating

- Commercial Operations

- Military Operations

- Small-Sized Catamarans (<30 feet)

- Medium-Sized Catamarans (30-60 feet)

- Large-Sized Catamarans (>60 Feet)

- Diesel Engines

- Electric Motors

- Individuals

- Charter Companies

- Governments

- North America

- Europe

- Asia-Pacific

- Rest of the World (RoW)

Catamaran Market Regional Synopsis

The North American catamaran market is predicted to grow at a CAGR of around 4% from 2021 to 2028. The market size is projected to succeed in $1.5 billion by 2028. The demand for catamarans is driven by the recognition of water sports and therefore the presence of several established boat manufacturers, especially within the coastal regions of the USA and Canada.

Europe is another key marketplace for catamarans, driven by the expansion of the tourism and leisure industries, also because of the increasing popularity of recreational boating in countries like France, Italy, and Spain. The Europe catamaran market is predicted to grow at a CAGR of around 3% from 2021 to 2028 and the market size is projected to succeed in $1.1 billion by 2028.

The Asia-Pacific region is a rapidly growing marketplace for catamarans, driven by the increasing income of consumers and therefore the growth of the tourism and leisure industries in countries like China, Australia, and New Zealand. The Asia Pacific catamaran market is predicted to grow at a CAGR of around 6% from 2021 to 2028 and is projected to succeed in $1.4 billion by 2028.

The rest of the world, including South America, Africa, and the Middle East, is a small but growing marketplace for catamarans, driven by the increasing popularity of recreational boating and therefore the growth of the tourism and leisure industries. The catamaran market within the rest of the world (RoW) is predicted to grow at a CAGR of around 5% from 2021 to 2028 and is projected to succeed in $1.2 billion by 2028.

Catamaran Market Key Challenges

The catamaran market faces several key challenges that could potentially impact market growth and profitability. Some of the key challenges include:

- Complex manufacturing process: Catamarans requires specialized equipment and skilled labor for manufacturing, which may increase production costs and cause internal control issues.

- Environmental concerns: The utilization of fossil fuels by boats, including catamarans, can contribute to air pollution, which may negatively impact the environment and harm wildlife.

- High cost: One of the most important challenges facing the catamaran market is the high cost of producing and buying a catamaran. Catamarans are typically costlier than traditional monohull boats, which may make them less accessible for a few consumers.

- Limited awareness and education: One of the most important challenges facing the catamaran market is restricted awareness and education among consumers about the advantages of the catamaran. Many consumers are unacquainted with catamarans and should not remember the benefits they provide over traditional monohull boats.

- Limited infrastructure: Another challenge facing the catamaran market is the limited infrastructure for catamaran operations, like marinas, boat ramps, and maintenance facilities making it difficult for catamaran owners to seek out suitable places to dock or launch their vessels.

- Regulatory issues: Stringent regulations and safety standards associated with the development and use of boats can limit the expansion of the catamaran market.

- Seasonal demand: The demand for catamarans is usually seasonal and hooked to weather, which may make it difficult for manufacturers and suppliers to manage inventory and maintain profitability.

- Weather and environmental concerns: Catamarans are more susceptible to weather and environmental conditions than monohull boats, which may limit their use in certain regions or during certain seasons. for instance, high winds and rough seas can make catamarans difficult to navigate, and hurricanes or other extreme weather events can cause significant damage to catamarans.

Catamaran Market Global Key Players

The global catamaran market is very competitive, with several key players operating within the market. These companies are leading manufacturers of catamarans, and offer a good range of products and services to customers around the world. A number of the main players within the mark include:

- Aquila Power Catamarans

- Bali Catamarans

- Catana Group

- Fountaine Pajot

- Leopard Catamarans

- Neel Trimarans

- Outremer Yachting

- Princess Yachts

- Privilège Marine

- Robertson and Caine

- Sunreef Yachts

Make This Report Your Own

Take Advantage of Intelligence Tailored to your Business Objective

- Publication date: 7th April 2023

- Base year: 2022

- Forecast year: 2023-2033

- Format: PDF, PPT,Word,Excel

- Quick Contact -

- +1(518) 300-1215

- [email protected]

- ISO Certified Logo -

Frequently Asked Questions(FAQ)

What is a catamaran, what are the advantages of owning a catamaran, what are the various sorts of catamarans, what is driving the expansion of the catamaran market, who are the key players within the catamaran market, what is the impact of covid-19 on the catamaran market, catamaran market, -: our clients :-.

Subscribe to Our Company Updates

The global catamaran market size is expected to reach USD 2.23 billion by 2030, according to this report. The market is anticipated to expand at a CAGR of 5.8% from 2022 to 2030. The increase in leisure tourism and racing events and the increasing disposable income of people across the globe are some of the key factors driving the growth of the catamaran industry.

A catamaran has a single deck that holds together two parallel hulls. It has more significant internal space than a monohull because of its two-hull structure, which means that the cockpit and living room between the two hulls have ample space. The catamaran is significant while traveling from one distant location to another. Because of increased maritime tourism and people's preference for opulent vacations, the business is expanding at a rapid pace.

A catamaran is mainly famous among High-Net-Worth Individuals (HNWI) who prefer leisure travel and have enough money to spend on those travels. One of the main reasons why catamarans are so popular these days is because of their size and stability. The space between the two hulls of a catamaran tends to have more room for the catamaran, both below and above decks. Some of the benefits of using a catamaran:

- Boat manufacturers supersize: Shipyards are constantly growing in size, and boatbuilders are venturing out and creating bolder designs that push the limits of scale and speed. As a result, catamarans are growing more extensive and lighter. Sunreef Yachts, for example, has progressively increased its fleet size, and in 2022, they delivered the Sunreef 49 Power Cat model, which is currently the biggest yacht in the fleet, measuring 160 feet

- Increased stability, i.e., reduces seasickness: The two-hull construction and broad beam of a catamaran give a calm sailing experience with little rolling, which is perfect for seasick guests. A multi-hull catamaran has higher stability because of its more significant surface area

A catamaran of the same size as a monohull is more expensive. Once a boat is purchased, there are extra running and maintenance fees (i.e., cost of ownership). For example, after the purchase, the individual will have to pay more for a more significant and comprehensive marina slip, and fuel expenses quickly build up because a catamaran has two engines.

Another frequently claimed disadvantage of catamaran cruising is that these sorts of boats cannot "self-right" themselves in the improbable event of capsizing. Monohull sailboats are built to "right" themselves if they go flipped in high-volume waves during a storm. Catamarans, by definition, cannot accomplish this.

Boat makers are manufacturing catamarans that are faster and more fuel-efficient as design and technology advance. As a result, many loyal monohull owners have converted to catamaran ownership. In November 2021, Servo Yachts LLC debuted The Martini 7.0, a 165-foot catamaran boat with revolutionary technology that treats seasickness in guests.

Catamaran Market Report Highlights

- A catamaran is like any other type of expensive leisure tourism. Wealthy families, affluent individuals, and anyone with enough money who wants to try different experiences are willing to pay for a catamaran on the condition that it is safe

- In January 2022, the Martini 7.0, a 165-foot catamaran yacht, featuring unique technology that gives passengers seasickness treatment, was presented by Servo Yachts. The Martini 7.0, created in partnership with the U.K.-based company Shuttleworth Design, has novel marine stabilization techniques that allow the yacht to glide more softly across the water, eliminating the kind of motion that often causes guests to get seasick

- The power catamaran segment is estimated to hold the major market share and expand at a CAGR of 6.2% from 2022 to 2030

- The small-sized catamarans segment is projected to advance at the highest CAGR during the forecast period

- The catamaran market for sports applications is expected to expand at the highest CAGR during the assessment period

- Key industry players include African Cats., Bavaria Catamarans, Beneteau Group, and CATATHAI

Key Topics Covered:

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

Chapter 3. Market Variables, Trends, & Scope Outlook

Chapter 4. Catamaran Market Product Outlook

Chapter 5. Catamaran Market Size Outlook

Chapter 6. Catamaran Market Application Outlook

Chapter 7. Catamaran Market: Regional Estimates & Trend Analysis

Chapter 8. Competitive Analysis

Chapter 9. Competitive Landscape

Companies Mentioned

- African Cats.

- Bavaria Catamarans

- Beneteau Group

- Fountaine Pajot Catamarans

- Leopard Catamarans

- Outremer Yachting

For more information about this report visit https://www.researchandmarkets.com/r/vacv1a

ResearchAndMarkets.com Laura Wood, Senior Press Manager [email protected] For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

- Automotive and Transport /

Catamaran Market Size, Share & Trends Analysis Report by Product (Sailing Catamarans, Power Catamarans), by Size (Small, Medium, Large), by Application (Sport, Leisure, Transport), by Region, and Segment Forecasts, 2022-2030

- August 2022

- Region: Global

- Grand View Research

- ID: 5649374

- Description

Table of Contents

Companies mentioned, methodology, related topics, related reports.

- Purchase Options

- Ask a Question

- Recently Viewed Products

- Boat manufacturers supersize: Shipyards are constantly growing in size, and boatbuilders are venturing out and creating bolder designs that push the limits of scale and speed. As a result, catamarans are growing more extensive and lighter. Sunreef Yachts, for example, has progressively increased its fleet size, and in 2022, they delivered the Sunreef 49 Power Cat model, which is currently the biggest yacht in the fleet, measuring 160 feet

- Increased stability, i.e., reduces seasickness: The two-hull construction and broad beam of a catamaran give a calm sailing experience with little rolling, which is perfect for seasick guests. A multi-hull catamaran has higher stability because of its more significant surface area

Catamaran Market Report Highlights

- A catamaran is like any other type of expensive leisure tourism. Wealthy families, affluent individuals, and anyone with enough money who wants to try different experiences are willing to pay for a catamaran on the condition that it is safe

- In January 2022, the Martini 7.0, a 165-foot catamaran yacht, featuring unique technology that gives passengers seasickness treatment, was presented by Servo Yachts. The Martini 7.0, created in partnership with the U.K.-based company Shuttleworth Design, has novel marine stabilization techniques that allow the yacht to glide more softly across the water, eliminating the kind of motion that often causes guests to get seasick

- The power catamaran segment is estimated to hold the major market share and expand at a CAGR of 6.2% from 2022 to 2030

- The small-sized catamarans segment is projected to advance at the highest CAGR during the forecast period

- The catamaran market for sports applications is expected to expand at the highest CAGR during the assessment period

- Key industry players include African Cats., Bavaria Catamarans, Beneteau Group, and CATATHAI

What is the estimated value of the Global Catamaran Market?

What is the growth rate of the global catamaran market, what is the forecasted size of the global catamaran market, who are the key companies in the global catamaran market.

- African Cats.

- Bavaria Catamarans

- Beneteau Group

- Fountaine Pajot Catamarans

- Leopard Catamarans

- Outremer Yachting

Global Catamaran Market by Product (Power Catamarans, Sailing Catamarans), Size Outlook (Large (Above 50m), Medium (30m-50m), Small (Upto 30m)), Application - Forecast 2024-2030

- Report

Catamarans Global Market Report 2024

- January 2024

Global Catamaran Market 2024-2028

- October 2023

Catamaran Global Market Insights 2023, Analysis and Forecast to 2028, by Manufacturers, Regions, Technology, Product Type

- November 2023

Catamaran Motor Yacht Global Market Insights 2023, Analysis and Forecast to 2028, by Manufacturers, Regions, Technology, Application, Product Type

ASK A QUESTION

We request your telephone number so we can contact you in the event we have difficulty reaching you via email. We aim to respond to all questions on the same business day.

Request a Quote

YOUR ADDRESS

YOUR DETAILS

PRODUCT FORMAT

Fractional Yacht Shares Ltd T/A Yachtfractions. Reg. Office: 110 Corve Street, Ludlow, Shropshire, SY8 1DJ Postal Address: Burleigh House. Bromyard Road. Tenbury Wells. Worc’s. WR15 8BZ

Co. Number; 10682217. Registered in England & Wales.

Chrisyachtfractions@outlook.com

- About yacht sharing

- Buy a boat share

- Sell your boat

- Buyer Enquiry Form

How to buy a share

The purchase of a share in a yacht is almost as much about the people as it is the boat. Our experience shows us that shared ownership is nearly always successful. Like any good relationship it relies on give and take, sympathy for the other person’s desires and a general respect for each other and the shared asset.

It is important therefore that both the buyer, the seller, and the other owners are all comfortable that the change of ownership will not alter the harmony of the group.

Share Agreement

Almost all share groups will have a clause in their share agreement which states that the existing owners have a reasonable right of veto. This is rarely exercised and is normally only due to a lack of experience of a prospective buyer or a need the buyer has, which is crucial to them, but which would alter the way in which the group is run and the boat enjoyed. Eg… A new owner may wish to change sailing grounds each season whereas the existing owners are quite happy where they are. It is not important to regard the other owners as good friends moreover a healthy group operates on a business-like basis where owners interact as good work colleagues should. All groups which Yacht Fractions deals with must have a share agreement. We can provide a template for a new share agreement, but it must be written by the syndicate for the syndicate, and fully endorsed by the syndicate.

We will not deal with a syndicate which does not have a boat share agreement, and which will not accept one, and we strongly advise any buyer to avoid any share group which is not formally defined.

Whilst share groups will have an agreement they will rarely refer to it, preferring to run the group in a friendly way through discussion and agreement. The agreement is in the back-ground for reference if the owners fail to agree.

The Sale Process

- Ownership is transferred normally on a Bill of Sale . On occasion a boat is owned by a limited company in which case the ownership is in the form of a transfer of shares. The buyer contacts Yacht fractions via email or ideally by registering on the website. This will give us all the information we need to progress interest in a boat. We need full contact details and brief summary of sailing experience and qualifications.

- Yacht Fractions will contact the seller of the share and make them aware of the potential buyer, their sailing background, and any specific requirements they may have such as school summer holidays.

- Yacht Fractions will supply contact phone numbers for the seller to the buyer and ask them to make contact for an initial chat. Usually, if the boat is in the UK this will result in an agreement to meet on the boat for an inspection. The majority of shares in overseas-based boats are sold unseen. We do recommend viewing [3 rd party] and / or surveys before buying, as we are unable to validate the accuracy of the adverts placed by sellers. However, most buyers speak with the other remaining owners who should be very open and honest about the boat and its’ condition and make a decision on this basis. When an inspection is to be done at some time involving a delay in the sale process we recommend that the buyer and seller enter into a Sale Agreement , and for the buyer to pay a deposit to secure the share until after the inspection.

- Once the buyer wishes to proceed there will be one or more of the following conditions to be met:- the buyer must be accepted by the other owners, and the buyer to satisfy himself he wishes to join the syndicate.

- The buyer must be accepted as a skipper by the insurance company

- The buyer must accept the terms of the share agreement

- The buyer may wish to inspect or survey the boat

- The buyer may have specific requirements that need to be accepted by the other owners.

- Before any of the steps above are covered we need to agree the basis of the deal: *This is the price to be paid and the timing of the transfer. Without this fundamental agreement there is no point in processing the purchase, and spending lots of time talking to other owners. For most UK based boats this takes place after the initial viewing, for overseas boats it will normally happen following the initial chat.

- Once we have agreed the basis of the deal we then proceed as follows;- The buyer needs be accepted by the other owners. This may simply be by an email from the seller informing the other owners of the buyer, their experience and qualifications. Sometimes it is a phone chat with one or more of the other owners. Very occasionally it involves a meeting.

- The seller or the group manager will contact the insurance company to check that the buyer will be accepted as a skipper.

- If there is to be a delay between the agreement to buy and completion of the purchase we will raise a Sale Agreement .

- Completion- at the point of completion, Yacht Fractions will raise a Bill of Sale . This is signed by both the buyer and the seller. Once Yacht Fractions is in possession of Bills of sale from both buyer and seller , and the purchase funds are in our client account the completion will take place. The seller will be paid and the bills of sale exchange with both parties.

This website uses cookies to improve your experience.

- Member Login

- About Membership

- Membership Levels

- Global Access

- Embark Mobile App

- About Ownership

- Ownership Benefits

- Ownership Opportunities

- SailTime Marine Financing

- Base Locations

- Target Bases

- About SailTime

- Start Your Own Business

- SailTime Brochures

- Articles & Media

- Request Info

start sailing

Redefining fractional sailboat membership and ownership, membership program, ownership program, world-class training, the sailtime fleet.

start your own sailtime business

With SailTime your dream to combine your passions of boating, being on the water and flexing your strong business background is now within reach.

SailTime is the most exciting Franchise business opportunity in the boating industry in the past 10-20 years. See how you can start your own franchise with SailTime!

News & Updates

Get in on the Boat Club Boom

SailTime & PowerTime Fractional Boat Club is Expanding to 50 Markets DID YOU KNOW that over the past five years, more

SailTime Southwest Florida

Ready About! Let’s Tack. If there is one word, one idea, one life-altering action, that we can chock up to

Boat Clubs Get You On The Water Faster

Ready to go Sailing this season? It is estimated that a whopping 100 million Americans go boating every year according

Sail It Like You Own It!

- 877-SAILTIME

- [email protected]

- Request a Brochure

- Partners & Vendors

- Articles & Media Coverage

- SailTime Fleet

- SailTime University

- Accessibility

37 Catamaran Lane, Bluffton, SC 29909

Single Family

Edward Greene

Coastal Oaks Development & Realty LLC

843-384-1483

Last updated:

March 19, 2024, 05:47 PM

About This Home

New construction home is underway, and the completion by September 2024 or earlier. The property will feature 4 bedrooms, 4 bathrooms, and 1 half bath. The first floor will have hardwood floors while the second floor will have carpet. The kitchen will have quartz countertops and Kitchen Aid stainless steel appliances. The home also boasts a big walk-in attic and coffer ceiling with lighting. Additionally, the kitchen cabinet will have upper and lower lighting, while the foyer and dining room walls will feature shiplap. Gas appliances and a fireplace are included, and the home offers a very private wooded view. There is also a 3-car garage.

Built in 2024

Price Summary

$408 per Sq. Ft.

Last Updated:

12 hour(s) ago

Rooms & Interior

Total Bedrooms:

Total Bathrooms:

Full Bathrooms:

Square Feet:

Living Area:

2,816 Sq. Ft.

Year Built:

Lot Size (Sq. Ft):

Finances & Disclosures

Price per Sq. Ft:

Contact an Agent

Yes, I would like more information from Coldwell Banker. Please use and/or share my information with a Coldwell Banker agent to contact me about my real estate needs.

By clicking Contact I agree a Coldwell Banker Agent may contact me by phone or text message including by automated means and prerecorded messages about real estate services, and that I can access real estate services without providing my phone number. I acknowledge that I have read and agree to the Terms of Use and Privacy Policy.

- Election 2024

- Entertainment

- Newsletters

- Photography

- AP Buyline Personal Finance

- Press Releases

- Israel-Hamas War

- Russia-Ukraine War

- Global elections

- Asia Pacific

- Latin America

- Middle East

- March Madness

- AP Top 25 Poll

- Movie reviews

- Book reviews

- Personal finance

- Financial Markets

- Business Highlights

- Financial wellness

- Artificial Intelligence

- Social Media

3 escaped inmates from Grenada charged with murder after US sailing couple vanishes

Police transport escaped prisoners Atiba Stanislaus, far left, and Trevon Robertson who are handcuffed together in Kingstown, St. Vincent and the Grenadines, Monday, March 4, 2024. The men had escaped from a police holding cell in Grenada on Feb. 18 and are suspected of hijacking a catamaran while Ralph Hendry and Kathy Brandel, who disappeared, were aboard. (AP Photo/Kenton Chance)

The yacht “Simplicity”, that officials say was hijacked by three escaped prisoners with two people aboard, is docked at the St. Vincent and the Grenadines Coastguard Service Calliaqua Base, in Calliaqua, St. Vincent, Friday, Feb. 23, 2024. Authorities in the eastern Caribbean said they were trying to locate two people believed to be U.S. citizens who were aboard the yacht that was hijacked by the three escaped prisoners from Grenada. (AP Photo/Kenton X. Chance)

- Copy Link copied

SAN JUAN, Puerto Rico (AP) — Three escaped inmates from the eastern Caribbean island of Grenada were charged in the killing of a U.S. couple whose catamaran they hijacked, police said Thursday.

Ron Mitchell, a 30-year-old sailor; Atiba Stanislaus, a 25-year-old farmer; and Trevon Robertson, a 23-year-old unemployed man, were charged with capital murder, escaping lawful custody, housebreaking, robbery and kidnapping. Stanislaus also was charged with one count of rape, according to a statement from the Royal Grenada Police Force.

The men appeared in court on Thursday and were ordered held in prison until their hearing in late March.

They were accused of escaping from a police holding cell on Feb. 18 and hijacking a catamaran owned by Ralph Henry and Kathy Brandel while they were aboard. Authorities said they believe the couple was thrown overboard as the suspects sailed to nearby St. Vincent, where they were arrested on Feb. 21.

The three men were ordered deported from St. Vincent on Monday.

The nonprofit Salty Dawg Sailing Association described Hendry and Brandel as “veteran cruisers” who participated in last year’s Caribbean Rally from Hampton, Virginia, to Antigua, and had planned to spend the winter cruising in the eastern Caribbean.

Their bodies have not been found.

Things to Do in Elektrostal, Russia - Elektrostal Attractions

Things to do in elektrostal.

- 5.0 of 5 bubbles

- 4.0 of 5 bubbles & up

- Good for a Rainy Day

- Good for Kids

- Good for Big Groups

- Adventurous

- Budget-friendly

- Hidden Gems

- Good for Couples

- Honeymoon spot

- Good for Adrenaline Seekers

- Things to do ranked using Tripadvisor data including reviews, ratings, photos, and popularity.

1. Electrostal History and Art Museum

2. Statue of Lenin

3. Park of Culture and Leisure

4. museum and exhibition center.

5. Museum of Labor Glory

7. Galereya Kino

8. viki cinema, 9. smokygrove.

10. Gandikap

11. papa lounge bar, 12. karaoke bar.

- Statue of Lenin

- Electrostal History and Art Museum

- Park of Culture and Leisure

- Museum and Exhibition Center

- Museum of Labor Glory

For the first time Rosatom Fuel Division supplied fresh nuclear fuel to the world’s only floating nuclear cogeneration plant in the Arctic

The fuel was supplied to the northernmost town of Russia along the Northern Sea Route.

The first in the history of the power plant refueling, that is, the replacement of spent nuclear fuel with fresh one, is planned to begin before 2024. The manufacturer of nuclear fuel for all Russian nuclear icebreakers, as well as the Akademik Lomonosov FNPP, is Machinery Manufacturing Plant, Joint-Stock Company (MSZ JSC), a company of Rosatom Fuel Company TVEL that is based in Elektrostal, Moscow Region.

The FNPP includes two KLT-40S reactors of the icebreaking type. Unlike convenient ground-based large reactors (that require partial replacement of fuel rods once every 12-18 months), in the case of these reactors, the refueling takes place once every few years and includes unloading of the entire reactor core and loading of fresh fuel into the reactor.

The cores of KLT-40 reactors of the Akademik Lomonosov floating power unit have a number of advantages compared to the reference ones: a cassette core was used for the first time in the history of the unit, which made it possible to increase the fuel energy resource to 3-3.5 years between refuelings, and also reduce the fuel component of the electricity cost by one and a half times. The FNPP operating experience formed the basis for the designs of reactors for nuclear icebreakers of the newest series 22220. Three such icebreakers have been launched by now.