Bored Ape Yacht Club

- facebook-rs

How Four NFT Novices Created a Billion-Dollar Ecosystem of Cartoon Apes

By Samantha Hissong

Samantha Hissong

J ust last year, the four thirtysomethings behind Bored Ape Yacht Club — a collection of 10,000 NFTs, which house cartoon primates and unlock the virtual world they live in — were living modest lifestyles and working day jobs as they fiddled with creative projects on the side. Now, they’re multimillionaires who made it big off edgy, haphazardly constructed art pieces that also act as membership cards to a decentralized community of madcaps. What’s more punk rock than that?

The phenomenal nature of it all has to do with the recent appearance, all over the internet, of images of grungy apes with unimpressed expressions on their faces and human clothes on their sometimes-multicolored, sometimes-metal bodies. Most of the apes look like characters one might see in a comic about hipsters in Williamsburg — some are smoking and some have pizza hanging from their lips, while others don leather jackets, beanies, and grills. The core-team Apes describe the graffiti-covered bathroom of the club itself — which looks like a sticky Tiki bar — in a way that echoes that project’s broader mission: “Think of it as a collaborative art experiment for the cryptosphere.” As for the pixel-ish walls around the virtual toilet, that’s really just “a members-only canvas for the discerning minds of crypto Twitter,” according to a blurb on the website, which recognizes that it’s probably “going to be full of dicks.”

(Full-disclosure: Rolling Stone just announced a partnership with the Apes and is creating a collectible zine — similar to what the magazine did with Billie Eilish — and NFTs.)

“I always go balls to the wall,” founding Ape Gordon Goner tells Rolling Stone over Zoom. Everything about Goner, who could pass for a weathered 30 or a young 40, screams “frontman,” from his neck tattoo to his sturdy physique to the dark circles under his eyes and his brazen attitude. He’s a risk taker: Back during his gambling-problem days, he admits he’d “kill it at the tables” and then lose it all at the slot machines on the way to the car. He’s also the only one in the group that wasn’t working a normal nine-to-five before the sudden tsunami of their current successes — and that’s because he’s never had a “real job. Not bad for a high school dropout,” he says through a smirk. Although Goner and his comrades’ aesthetic and rapport mirror that of a musical act freshly thrust into stardom, they’re actually the creators of Yuga Labs, a Web3 company.

Editor’s picks

The 250 greatest guitarists of all time, the 500 greatest albums of all time, the 50 worst decisions in movie history, every awful thing trump has promised to do in a second term.

Goner and his partners in creative crime — Gargamel, No Sass, and Emperor Tomato Ketchup — were inspired by the communities of crypto lovers that have blossomed on platforms like Twitter in recent years. Clearly, people with this once-niche interest craved a destination to gather, discuss blockchain-related developments, and hurl the most inside of inside jokes. Why not, they thought, give NFT collectors their own official home? And Bored Ape Yacht Club was born.

This summer, 101 of Yuga Labs’ Bored Ape Yacht Club tokens, which were first minted in early May, resold for $24.4 million in an auction hosted by the fine-art house Sotheby’s. Competitor Christie’s followed shortly thereafter, auctioning off an art collectors’ haul of modern-day artifacts — which included four apes — for $12 million. Around the same time, one collector bought a single token directly from OpenSea — kind of like eBay for NFTs — for $2.65 million. A few weeks later, another Sotheby’s sale set a new auction record for the most-valuable single Bored Ape ever sold: Ape number 8,817 went for $3.4 million. At press time, tokens related to the Bored Ape Yacht Club ecosystem — this includes the traditional apes, but also things called “mutant” apes and the apes’ pets — had generated around $1 billion. “My name’s not even Gordon,” says Goner, who, like the rest of Yuga Labs’ inner circle, chooses to hide his true identity behind a quirky pseudonym. “Gordon Goner just sounded like Joey Ramone. And that made it sound like I was in a band called the Goners. I thought that was fucking cool. But when we first started, I kept asking, ‘Are we the Beastie Boys of NFTs?’ Because, right after our initial success it felt like the Beastie Boys going on tour with Madonna: Everyone was like, ‘Who the fuck are these kids?’ ” (Funnily enough, Madonna’s longtime manager, Guy Oseary, signed on to rep the foursome about a month after Goner made this comment to Rolling Stone .) He’s referring to the commotion that immediately followed the first few days of Bored Ape Yacht Club’s existence, when sales were dismal. “Things were moving so slowly in that weeklong presale,” recalls Goner’s more soft-spoken colleague, Emperor Tomato Ketchup. “I think we made something between $30,000 and $60,000 total in sales. And then, overnight, it exploded. All of us were like, ‘Oh fuck, this is real now.’ ” The 10,000 tokens — each originally priced at 0.08 Ethereum (ETH), around $300 — had sold out. While the crypto community may have been asking who they were, the general public started wondering what all the fuss was about. Even Golden State Warriors player Stephen Curry started using his ape as his Twitter profile picture, for all of his 15.5 million followers to behold.

Bored Ape art isn’t as valuable as it is because it’s visually pleasing, even though it is. It’s valuable because it also serves as a digital identity — for which its owner receives commercial usage rights, meaning they can sell any sort of spinoff product based on the art. The tokens, meanwhile, act like ID cards that give the owners access to an online Soho House of sorts — just a nerdier, more buck-wild one. Noah Davis, who heads up Christie’s online sales department for digital art, says that it’s the “perennial freebies and perks” that solidify the Bored Ape Yacht Club as “one of the most rewarding and coveted memberships.” “In the eyes of most — if not almost all of the art community — BAYC is completely misunderstood,” he says. However, within other tribes of pop culture, he continues, hugely prominent figures cherish the idea of having a global hub for some of the most “like-minded, tech-savvy, and forward-thinking individuals on the planet.” Gargamel is “a name I ridiculously gave myself based off the fact that my fiancée had never seen The Smurfs when we were launching this,” says Goner’s right-hand man, who looks kind of like a cross between the character he named himself after and an indie-music-listening liberal-arts school alum. He’s flabbergasted at the unexpected permanence of it all. “Now, I meet with CEOs of billion-dollar companies, and I’m like, ‘Hi, I’m Gargamel. What is it that you would like to speak to me about?’ ”

The gang bursts out in laughter.

In conversing, Gargamel and Goner, whose relationship is the connective tissue that brought the others in, are mostly playful — but they do bicker, similar to how a frontman and lead guitarist might butt heads in learning to share the spotlight. They first met in their early twenties at a dive bar, in Miami, where they were both born and raised, and immediately started arguing about books. “He doesn’t like David Foster Wallace because he’s wrong about things,” Goner interjects, cheekily, as Gargamel attempts to tell their story. “He hasn’t even read Infinite Jest . He criticizes him, and yet he’s never read the book! He’s like, ‘Oh, it’s pretentious MFA garbage.’ No, it’s not.” Gargamel then points out that he has read other books by Wallace, while No Sass, who still hasn’t chimed in, flashes a half-smile that suggests they’ve been down this road more than once before. “I think, on the whole, he was the worst thing to happen to fucking MFA programs, given all the things people were churning out,” says Gargamel. They eventually decide to agree that Wallace, like J.D. Salinger, isn’t always interpreted correctly or taught well, and we move on — only after Goner points out the tattoos he got for Kurt Vonnegut and Charles Bukowski “at like 17,” but before diving too deep into postmodernist concepts. Goner and Gargamel’s relationship speaks to how the group operates as a whole, according to No Sass, whose name is self-explanatory. “There’s always a yin and yang going on,” he says. Throughout the call, No Sass continues to make sense of things and keep the others in check in an unwavering manner, positioning him as the backbone of the group — or our metaphorical drummer. “It’s like, I’ll come up with the idea that wins us the game,” Goner says, referencing his casino-traversing past. “And his job is to make sure we make it to the car park.” No Sass’ rhythm-section counterpart is clearly Tomato, the pseudo-band’s secret weapon who’s loaded with talent and harder to read. (He picked his name while staring at an album of the same name by English-French band Stereolab.) The project’s name, Bored Ape Yacht Club, represents a club for people who got rich quick by “aping in” — crypto slang for investing big in something unsure — and, thusly, are too bored to do anything but create memes and debate about analytics. The “yacht” part is coated in satire, given that the digital clubhouse the apes congregate in was designed to look like a dive bar in the swampy Everglades.

Gargamel, whose college roommate started mining Bitcoin back in 2010, got Goner into crypto in 2017, when the latter was bedridden with an undisclosed illness, bored, and on his phone. “I knew he had a risk-friendly profile,” Gargamel says. “I said, ‘I’m throwing some money into some stupid shit here. You wanna get in this with me?’ He immediately took to it so hard, and we rode that euphoric wave of 2017 crypto up — and then cried all the way down the other side of the roller coaster.” At the start of 2021, they looked at modern relics like CryptoPunks and Hashmasks, which have both become a sort of cultural currency, and they looked at “crypto Twitter,” and wondered what would happen if they combined the collectible-art component with community membership via gamification. The idea was golden but they weren’t technologically savvy enough to know how to build the back end. So, Gargamel called up No Sass and Tomato, who both studied computer science at the same university he had attended for grad school. “I had no idea what was involved in the code for this,” Gargamel admits. “I read something that said something about Javascript, so I called them and said, ‘Do you guys know anything about Javascript?’ And that couldn’t be further from what you’re supposed to know.” While they were tech-savvy, No Sass and Tomato were not crypto-savvy. They both wrote their first lines of solidity code — a language for smart contracts — in February of this year. “I was like, ‘Just learn it! It’s going to be great. Let’s go,’ ” recalls Gargamel. “From a technical perspective, some of the stuff that we’ve built out has had relatively janky workflows, which people then seize upon, asking us how we did it,” says Tomato. “It’s actually stake-and-wire or whatever, but nobody else has done it.” A lot of “stress and fear” went into the first drop, according to No Sass: “We were constantly on the phone going, ‘Oh, shit, is this OK? Is it going to explode?’ ” He shakes his head. “I wish we still had simple NFT drops. We can pump those out superfast now.” “Every single thing we do scares the shit out of me,” adds Tomato.

They started out with unsharpened goals of capitalizing on a very clear trend. But a fter one particularly enervating night of incessant spitballing, Goner realized that all he really wanted was something to do and for like-minded people to talk to in an immersive, fantastical world. Virtual art was enticing, but it needed to do something too. “We’d see these NFT collections that didn’t have any utility,” Goner says. “That didn’t make any sense to me at the time, because you can cryptographically verify who owns these things. Why wouldn’t you offer some sort of utility?”

Gargamel told him the next day he loved the clubhouse idea so much that he’d want to do it even if it was a failure. They realized they just craved “a hilarious story to tell 10 years later,” Gargamel says. “I figured we’d say, ‘Yeah, we spent 40 grand and six months making a club for apes, but it didn’t go anywhere.’ And that’s how we actually started having fun in the process.” Goner chimes in: “Because at least we could say, ‘This is how we spent our summer. How ridiculous is that? We made the Bored Ape Yacht Club, and it was a total disaster.’ ” Gargamel interjects to remind everyone that Tomato ended up reacting to their springtime victory by buying a Volvo, the memory of which incites another surge of laughter. They haven’t indulged in too many lavish purchases since then, but they all ordered Pelotons, Tomato bought a second Volvo, and they all paid their moms back for supporting them in becoming modern-day mad scientists. “I’ll never forget the night that we sold out,” says No Sass. “It was like two or three in the morning, and I hear my phone ring. I see that it’s Tomato and think something has gone terribly wrong. I pick up the phone and he’s like, ‘Dude, you need to wake up right now. We just made a million dollars.’ ” Nansen, a company that tracks blockchain analytics, reported that for one night Bored Ape Yacht Club had the most-used smart contract on Ethereum. “That’s absurd,” says Gargamel. “Uniswap [a popular network of decentralized finance apps] does billions and billions of transactions. But for that one night, we took over the world.” At press time, the foursome — let’s just go ahead and call them the Goners — had personally generated about $22 million from the secondary market alone. “Every time I talk to my parents about how this has blown up, they literally do not know what to say,” adds Tomato, whose mom started crying when he first explained what had happened.

Since its opening, the group has created pets for the apes via the Bored Ape Kennel Club, as well as the Mutant Ape Yacht Club. The latter was launched to expand the community to interested individuals who weren’t brave enough to “ape in” at the beginning: Yuga Labs unleashed 10,000 festering, bubbling, and/or oozing apes — complete with missing limbs and weird growths — via a surprise Dutch auction, which was used to deter bots from snatching up inventory by starting at a maximum price and working its way down. With a starting price of 3 ETH — or about $11,000 — this move opened up the playing field for about an hour, which is how long it took for the mutants to sell out. (The team also randomly airdropped 10,000 “serums,” which now pop up on OpenSea for tens of thousands of dollars, for pre-existing Apes to “drink” and thusly create zombified clones.) When they sold 500 tangible hats to ape-holders in June, the guys spent days packaging products in Gargamel’s mom’s backyard in Florida. “Immediately, some of them sold for thousands of dollars,” Gargamel exclaims. “It was a $25 hat. We were like, ‘Holy shit, we can be a Web3 streetwear brand. What does that even look like?’ ”

But the team is still searching for ways to create more value by building even more doors that the tokens can unlock. They recently surprised collectors with a treasure hunt; the winner received 5 ETH — worth more than $16,000 at press time — and another ape. And on Oct. 1, they announced the first annual Ape Fest, which runs from Oct. 31 through Nov. 6 and includse an in-person gallery party, yacht party, warehouse party, merch pop-up, and charity dinner in New York. Goner tells Rolling Stone that they’re currently discussing partnership ideas with multiple musical acts, but he refuses to reveal additional details in fear of jinxing things. Further down the line, the Goners see a future of interoperability, so that collectors can upload their apes into various corners of the metaverse: Hypothetically, an ape could appear inside a popular video game like Fortnite , and the user could dress it in digital versions of Bored Ape Yacht Club merch. “We want to encourage that as much as possible,” says Gargamel. “We’re making three-dimensional models of everybody’s ape now. But, y’know, making 10,000 perfect models takes a little bit of time.” At the start of the year, the guys had no idea their potentially disastrous idea would become a full-time job. They were working 14 hours a day to get the project up and running, and after the big drop, they decided to up that to 16 hours a day. “None of us have really slept in almost seven months now,” says Goner. “We’re teetering on burnout.” To avoid that, Yuga Labs has already put a slew of artists on staff and hired social media managers and Discord community managers, as well as a CFO. “We want to be a Web3 lifestyle company,” says Goner, who emphasizes that they’re still growing. “I’m a metaverse maximalist at this point. I think that Ready Player One experience is really on the cusp of happening in this world.” If Bored Ape Yacht Club is essentially this band of brothers’ debut album, there’s really no telling what their greatest hits will look like.

Most Popular

Over 1,000 jewish creatives and professionals have now denounced jonathan glazer’s 'zone of interest' oscars speech in open letter (exclusive), bill maher fires caa after oscar party snub (exclusive), rose hanbury just broke her silence on the prince william affair rumors, kobe bryant's parents face backlash after putting championship ring on the auction block, you might also like, thailand’s film investment drive attracts nation group newspaper publisher, exclusive: pacsun showcases young music artists for 2024 festival campaign, this folding treadmill is 20% off for amazon’s big spring sale, m. emmet walsh, instantly recognizable character actor from ‘blood simple’ and ‘blade runner,’ dead at 88, mlb’s highest-paid players 2024: ohtani on top despite $2m salary.

Rolling Stone is a part of Penske Media Corporation. © 2024 Rolling Stone, LLC. All rights reserved.

Verify it's you

Please log in.

Bored Ape Yacht Club

The Bored Ape Yacht Club is a project by Yuga Labs that consists of 10,000 ape-themed NFTs with various qualities and distinctive attributes. BAYC, like most PFP-based NFTs, was influenced by CryptoPunks, the first of sever

Stay on target!

Essential cookies are required for our systems to work, they do things like help you navigate our website without losing previous actions, improve performance and cannot be disabled.

Analytics and advertising cookies allow us to count the number of visitors, to recognize and observe visitors to our website and to analyze interactions with our website and services. They also allow us to see what pages and links you have visited so we can provide more relevant user experiences. We share this information with other organizations such as Google, for the same purpose.

- Google Analytics

- Beginner Guides

- NFT Blockchain

- Most Expensive NFTs

- Most Rarest NFTs

- Most Popular NFTs

- Collections

- Marketplaces

- Studio and Labs

- Influencers

Bored Ape Yacht Club: A complete and up-to-date overview of the revolutionary and leading NFT project

Table of contents

Bored Ape Yacht Club (BAYC) is arguably the most influential NFT project in the world. For almost a year, it remained second only to CryptoPunks in terms of turnover. This collection led to the creation of other equally popular and large-scale projects: BAKC, MAYC, Otherside metaverse, ApeCoin. The history of BAYC is a living testament to how a couple of successful deals can change an entire market. If not for one prominent NFT influencer, BAYC might not exist at all. But more on that later.

Today’s review is about an amazing global success story that has led to over $2 billion in sales, NFT market dominance, and elite status.

Bored Ape Yacht Club Official Links

- Official site: https://boredapeyachtclub.com

- Twitter @BoredApeYC: over 1M followers,

- Discord @BoredApeYachtClub : over 209K subscribers,

- Instagram @boredapeyachtclub : over 700K subscribers.

What is Bored Ape Yacht Club (BAYC)?

Bored Ape Yacht Club (BAYC) is a fusion of digital collectibles and an exclusive online community. Each Bored Ape is a unique digital character, created with over 170 distinct traits such as clothing, expressions, and headwear.

Moreover, owning a Bored Ape grants membership to the elite community, unlocking exclusive benefits. The value of these perks depends on an individual’s engagement with the concept. For instance, members can access The Bathroom, a collaborative art space within the cryptosphere, allowing them to contribute to a digital wall painting experience.

A more substantial advantage is that Bored Ape NFT holders possess complete commercialization rights for their apes. This means if you own a Bored Ape, you have the freedom to use it for various commercial purposes. In addition, each community member has exclusive access to the annual IRL ApeFest and participates in the project’s airdrops. And this, believe us, turns this valuable investment asset into 2-3-4 additional digital assets.

In general, we won’t tell you everything at once. Therefore, this comprehensive, up-to-date guide to the most prestigious ecosystem is for you.

Bored Ape Yacht Club in numbers

- The Bored Ape Yacht Club (BAYC) comprises a limited collection of 10,000 unique NFTs, launched on April 29, 2021, at a mint price of 0.08 ETH (equivalent to $190).

- Presently, the collection is under the ownership of 5,546 distinct wallets, with 55% being unique owners.

- Notably, the floor price for these exclusive NFTs currently stands at around 26 ETH, translating to approximately $40,000.

- The sales volume of BAYC has surpassed a remarkable 1.3 million ETH, equivalent to a staggering $2.17 billion.

- The peak of its popularity was evident when the most expensive BAYC, numbered #8817, was sold at Sotheby’s for an astounding $3.4 million in late October 2021. In another remarkable auction, the Yuga Labs team successfully sold a lot of 101 NFTs for an impressive $24.4 million at Sotheby’s in September 2021.

- During the peak of the NFT craze in April 2021, the entry price for BAYC was as high as $400,000.

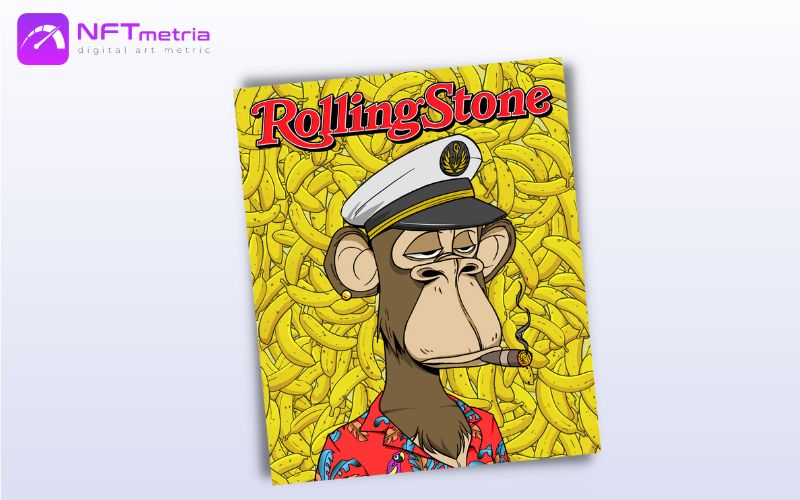

- Demonstrating its widespread appeal, a special edition of Rolling Stone magazine featuring a Bored Ape on the cover, limited to 2,500 copies, sold out within a mere four minutes at the beginning of November 2021.

- Interestingly, only a small fraction of the collection, approximately 2% (244 pieces out of 10,000), is currently available for sale. These listings range from 26 ETH to 5,000 ETH, indicating that the majority of holders view their BAYC assets as valuable long-term investments, showing no haste in parting with their prized possessions at lower prices. This steadfast confidence underlines the collective belief in the project’s enduring potential.

Thanks to all these records, the project is included in the TOP of the best NFT collections .

Data (including exchange rates) are given at the time of publication (October 18, 2023)

Bored Ape Yacht Club attributes

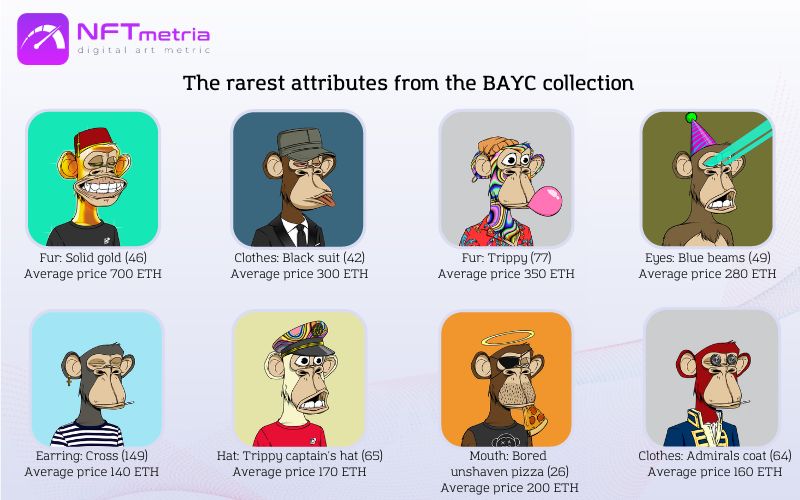

Every BAYC possesses distinct features (168), categorized into 7 main attributes, each having various versions:

- The background

Some attributes are rarer than others, which makes these monkeys more collectible. Therefore, they are more expensive than others. For example, apes with Solid gold fur are rarer and more expensive than others. The floor price for these NFTs has consistently remained above 330 ETH throughout their sales history, having been offered for sale only twice. This rarity is attributed to their substantial investment potential, promising far greater returns in the future compared to a quick but less rewarding sale.

What sets this collection apart? It stands as one of the initial projects meticulously hand-drawn by artists, deviating from the algorithm-generated images prevalent in other collections like the renowned CryptoPunks. This distinction marks their first and most significant departure from the CryptoPunks phenomenon.

Who created the Bored Ape Yacht Club?

Let’s delve into the origins of this journey. In a twist of fate, a group of friends came together to establish their startup venture. They named their team Yuga Labs , driven by the ambition to construct a media empire exclusively dedicated to NFTs. Crafting Bored Ape Yacht Club (BAYC) marked their inaugural stride toward achieving this ambitious vision.

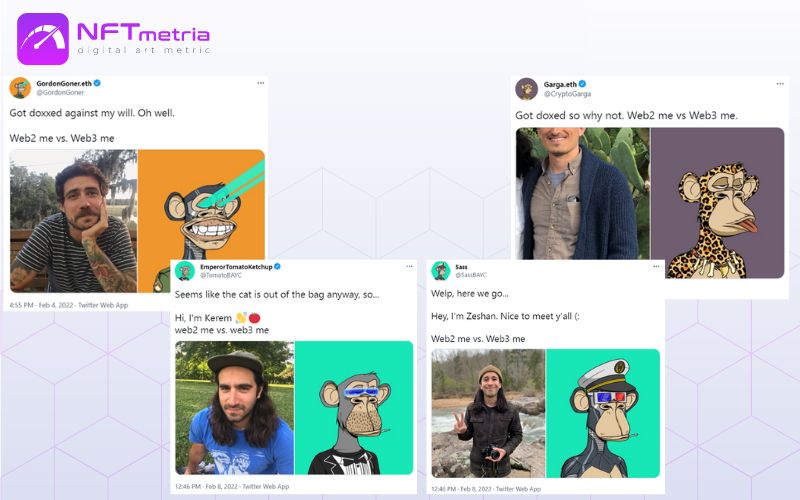

Initially, all developers at Yuga Labs operated under pseudonyms, a practice they maintained until BuzzFeed unmasked two of them in a February 2022 article.

And the aliases are:

- Gordon Goner @GordonGoner ,

- Gargamel @CryptoGarga ,

- Sass @SassBAYC ,

- Emperor Tomato Ketchup @TomatoBAYC .

It was revealed that Gargamel is, in fact, Greg Solano, an author and literary critic, while Gordon Goner goes by Wiley Aronov. Sass and Emperor Tomato Ketchup, whose real names are Zeshan and Kerem respectively, both work as software engineers.

Prior to their involvement with BAYC, Gargamel and Gordon Goner had minimal presence in the crypto community, lacking any prior development experience in the field. Despite their lack of experience, both individuals had been active traders since 2017. Tomato and Sass were newcomers to the world of NFTs and cryptocurrencies. Nevertheless, the four of them collaborated, forming Yuga Labs, and subsequently launched BAYC under this banner.

Regarding the creation of actual art, none of the founders were responsible. The primary artist for the original BAYC collection is a woman known by the pseudonym Seneca, or the All-Seeing Seneca. Additional contributors included artists such as Thomas Dugley, Migwasher, and a couple who preferred to remain anonymous.

Bored Ape Yacht Club success story

Before the inception of BAYC concept, the team at Yuga Labs was already immersed in project development. Yuga Labs realized that traditional art market concepts did not translate well into the digital realm. While paintings adorn living room walls, NFTs serve as social media profile pictures. Recognizing this shift, the team sought an “exclusive” feature for club members, giving rise to the idea of a yacht club.

Yuga Labs envisioned the club as a haven for early crypto and NFT pioneers, individuals who had ventured into the world of cryptography during its nascent stages. These early “apes,” having reaped the benefits of their earlier investments, found themselves in a leisurely state, spending their days on yachts or socializing in bars.

Reportedly, Yuga Labs swiftly attracted prominent crypto investors who backed this vision with their savings. With investments secured, the team commenced collection development, determining attributes, crafting illustrations, and securing a minting contract. The official release occurred on April 29, 2021, with NFTs initially priced at 0.08 ETH per ape (approximately $190 at that time). Initial sales were gradual, and by May 1, the momentum was still low.

However, the narrative took a dramatic turn when influential NFT personality, Pranksy , acquired nearly all the monkeys, announcing the purchase to his extensive Twitter following. This event catalyzed a rapid transformation; BAYC’s collection completely sold out within 12 hours.

Remarkably, the BAYC team emphasized in interviews that they had no prior contact with Pranksy before the sale. In the subsequent month, BAYC experienced a surge in secondary sales, marking the beginning of its rapid ascent.

Why is Bored Ape Yacht Club popular?

The widespread appeal of the Bored Ape Yacht Club (BAYC) can be attributed to several key factors:

Celebrity and Mass Appeal

When influential figures or celebrities own NFTs, it creates a desire for others to own them too. Notable personalities such as Jimmy Fallon and Justin Bieber owning Bored Ape NFTs triggered a surge in sales and excitement. This celebrity endorsement generates hype, a driving force in the NFT market. People purchasing BAYC at high prices today anticipate its potential expansion beyond celebrity social media profiles, envisioning its presence in popular media like Netflix shows, renowned games, and Hollywood movies.

Community Engagement

The community surrounding the collection serves as a vital driving force. Members are drawn not only to the project’s existence but also to the exclusive privileges it offers, providing them a sense of belonging to an elite society alongside stars and celebrities. NFTs function as membership cards, granting access to exclusive groups. The more valuable people perceive their membership, the less inclined they are to sell their assets. Additionally, higher floor prices attract wealthy crypto traders, enhancing the community’s financial dynamics.

Long-term Project Viability

Unlike many projects in the market consisting solely of visual images and minimal backstory, BAYC stands out. After the initial collection release, the team expanded their initiatives, introducing two more collections, a governance token, and eventually, a metaverse. These interconnected projects are meticulously designed around the concept of monkeys, amplifying their value, significance, and impact. Notably, BAYC boasts a detailed project whitepaper outlining the team’s plans, providing transparency and assurance to investors about the project’s future trajectory.

BAYC’s value extends beyond mere collectibility, encompassing a robust social component.

Upon purchasing a BAYC token, buyers gain membership not just in the form of a token, but in an exclusive community of like-minded crypto enthusiasts. Membership privileges within this closed club continue to expand and currently include:

- Access to Exclusive Discord Server. Members join a private Discord server comprising over 30,000 individuals, including token holders and celebrities. This platform allows interaction and communication among the BAYC community members.

- Ownership and Commercial Use Rights. Owners of BAYC NFTs possess not only the rights to their virtual apes but also the commercial freedom to monetize these assets. Owners can generate income by licensing the images or creating products based on their NFTs. For instance, a BAYC member created a Twitter account for their monkey, inventing a backstory. This narrative led to the creation of a biography by New York Times author Neil Strauss, detailing the virtual valet Jenkins, an employee of the yacht club.

- Participation in Online and Offline Activities. BAYC members enjoy opportunities for both virtual and real-world engagement. They can attend exclusive events, including private parties. A notable offline event, Ape Fest, took place from October 31 to November 6, 2021, in New York. The festival featured diverse activities for monkey owners across the city, including a yacht party, charity dinners, and a concert featuring renowned personalities like Chris Rock, Aziz Ansari, and the Strokes. Over 700 attendees participated in these events. In June 2022, Ape Fest featured performances by artists like Eminem, Snoop Dogg, LCD Soundsystem, and Amy Schumer, further enhancing the unique experiences available to BAYC members. In 2023, ApeFest will be held in Hong Kong from November 3 to 5.

- The Bathroom serves as a digital canvas for Bored Ape Yacht Club (BAYC) graffiti holders. Each NFT owner has the opportunity to contribute by drawing one pixel every fifteen minutes on a designated virtual wall.

- Access to derivative NFT collections. BAYC members gain exclusive entry to other NFT collections curated by Yuga Labs. Furthermore, they are eligible for free airdrops (we will talk about them below).

Remarkably, the creators managed to transform their monkeys into a cultural phenomenon. BAYC has transcended being merely an image; it now functions as a key to an exclusive community and serves as a status symbol. This transformation has led many individuals to invest substantial sums, ranging from tens to hundreds of thousands of dollars, in these digital images.

Which celebrities own BAYC NFT?

Notably, BAYC has garnered significant attention from celebrities. A-listers prominently feature NFTs as their avatars on social media platforms, incorporate them into videos, and even participate in events dedicated to these digital creations. This widespread celebrity endorsement has introduced BAYC to hundreds of millions of people, further enhancing its popularity and reach.

Bored Ape owners include:

- American singer and show woman Paris Hilton,

- Pop legend Madonna,

- Singer Justin Bieber,

- Actor Kevin Hart,

- Broadcaster Jimmy Fallon,

- Musician Lil Baby,

- Rappers Snoop Dogg and Eminem, Post Malone and Jermaine Dupri,

- Billionaire Mark Cuban ,

- Basketball players Shaquille O’Neal, Stephen Curry, Josh Hart, LaMelo Ball and Tyrese Haliburton,

- American football stars Dez Bryant, Tom Brady and Von Miller,

- Musical groups The Chainsmokers and Waka Flocka Flame.

- Post Malone even managed to show the process of buying Bored Ape through the MoonPay app in a recent clip from The Weeknd – One Right Now. At the time of writing the video has received more than 106 million views on YouTube.

Imagine, we have listed only a small part of the celebrities who have invested large sums in these bizarre works.

Bored Ape Yacht Club ecosystem

The Bored Ape Yacht Club (BAYC) ecosystem is a thriving digital universe that combines exclusive NFT collectibles, vibrant community engagement, and innovative utility. With celebrities endorsing these NFTs and an expanding range of interactive experiences, the BAYC ecosystem stands as a pinnacle of creativity and community within the NFT space.

Mutant Ape Yacht Club (MAYC)

Mutant Ape Yacht Club (MAYC) introduces a collection of 20,000 uniquely mutated apes, each boasting an array of distinctive physical flaws. These mutations range from eerie rotting features to curious growths and even blurry snouts, making each mutant ape a truly one-of-a-kind creation. Upon the launch of the Mutant Ape Yacht Club, owners of Bored Apes were gifted a unique “serum.” This serum could be fused with their existing Bored Ape, resulting in the creation of an entirely new Mutant Ape character.

The purpose behind their creation was to acknowledge the enthusiasm of BAYC owners for the community, while also enticing more collectors to join the ecosystem. The initial price of MAYC stood at 3 ETH, and astonishingly, the entire collection was sold out within just one hour in August 2021, generating a staggering $96 million for the project team.

What sets MAYC apart is the introduction of innovative “serums,” randomly distributed among users. These serums hold the power to transform ordinary Bored Ape Yacht Club (BAYC) monkeys into unique MAYC mutants. The serums come in three distinct levels:

- M1 and M2 Serums: These serums allow users to create a mutant monkey with some resemblances to the original BAYC character. The mutations are noticeable yet maintain a connection to the ape’s origins.

- M3 Serum: The coveted M3 serum takes the concept further by enabling the creation of an entirely new mutant monkey. This serum enhances the ape’s uniqueness, resulting in a mutant creation that stands apart from the rest, making it a highly prized asset in the NFT realm.

- You can buy a token for a minimum of 4.8 ETH,

- Total sales exceeded 988K ETH (Over $1.5 billion),

- The most expensive MAYC #30002 was sold for 500 ETH,

- Over 11K unique owners (58%).

You can also check out our ranking of the rarest MAYC tokens.

Bored Ape Kennel Club (BAKC)

Bored Ape Kennel Club (BAKC) comprises 10,000 unique NFT dogs, each possessing distinctive traits. The collection is designed around a particular theme: a bored ape’s melancholy can be comforted by the presence of a faithful companion dog, bringing warmth and joy. Unlike the MAYC, the BAKC was exclusively offered to existing BAYC members. In June 2021, digital dogs were randomly distributed to BAYC owners for free as part of their perk – one dog for each BAYC. Within a limited timeframe, these members had the opportunity to “adopt” one of these 10,000 charming dogs. Notably, during the initial six weeks, a 2.5% royalty fee from secondary market sales was directed towards supporting no-kill animal shelters, adding a philanthropic aspect to the endeavor.

- You can buy a token for a minimum of 1.5 ETH,

- Total sales exceeded 273K ETH (Over $430k),

- The most expensive BAKC #5908 was sold for 50 ETH,

- Over 5K unique owners (53%).

ApeCoin Governance Token

ApeCoin ( $APE ) serves as the economic management token within the BAYC ecosystem, fostering community development. It operates as an ERC-20 token specifically designed to empower the community of bored monkeys. Yuga Labs, the brains behind the BAYC collection, has integrated ApeCoin across all its products and services.

Why is this relevant in our article? Well, 15% of the total coin supply was distributed to BAYC holders, enabling them to engage in lucrative trading activities on various prominent cryptocurrency exchanges.

- The total supply of $APE stands at 1 billion coins;

- The cryptocurrency’s market capitalization has surpassed $420 million;

- The value of a single Apecoin recently ranged from $1.1 to $2;

- The token reached its peak value on April 29, 2022, hitting $23.

Otherside Metaverse

On March 19, 2022, Yuga Labs took the virtual world by storm, unveiling a captivating trailer for the highly anticipated Otherside metaverse via their official Twitter account. Unlike anything seen before, this metaverse is a masterpiece of gamification, combining elements of role-playing games with iconic characters from popular NFT collections including BAYC, MAYC, CryptoPunks, Meebits , World of Women , Cool Cats and others blue chips.

What sets Otherside apart is its unique collaboration with industry giants Animoca Brands and Improbable, promising a groundbreaking virtual experience. In this immersive metaverse, NFT enthusiasts can interact with digital assets from well-known collections, creating an interconnected universe of creativity and innovation.

However, what truly sets Otherside apart from the rest is its ambitious endeavor to create a massively multiplayer online role-playing game (MMORPG) metaverse. This bold step aims to seamlessly integrate diverse NFT universes, providing players with an unparalleled gaming experience that transcends traditional boundaries.

Today, Otherside is a strategic priority for the entire ecosystem, as recently confirmed by the company’s CEO, pointing out strategic focuses .

How much do BAYC cost?

In April, 2021 the mint price was 0.08 ETH ($190). To visualize the price growth, we made a cut at the average price for 1 NFT:

- In August 2021: 24 ETH;

- In October 2021: 62 ETH;

- In January 2022: 116 ETH;

- In May 2022: 159 ETH;

- In August 2022: 120 ETH;

- In January 2023: 75 ETH;

- In August 2023: 28 ETH.

Now (October 2023) the floor price is 26 ETH. On average, the latest sales are in the range of 24-40 ETH. To date, the sales volume has surpassed a remarkable 1.3 million ETH, equivalent to a staggering $2.17 billion.

The most expensive BAYC sales

- In September 2021, Yuga Labs achieved a significant milestone by selling a collection of 101 NFTs for an impressive $24.4 million at Sotheby’s.

- #8817 fetched an astonishing $3.4 million at Sotheby’s by the close of October 2021, further solidifying the club’s status as a coveted and valuable collection in the NFT market.

- #7537 sold on June 15, 2022 for 1024 ETH ($1.2M at time of purchase).

- #6388 sold on July 9, 2022 for 869.69 ETH ($1M at time of purchase).

- #232 sold on November 23, 2022 for 800 ETH ($947k at time of purchase).

You can also see our ranking of the most expensive , rarest and most popular BAYC NFTs.

Where to buy Bored Ape Yacht Club?

In early April 2021, the NFTs were at their peak and quickly sold out. Now they can only be bought in secondary markets. You can see all NFTs available for sale on their page only on the marketplaces:

- LooksRare ,

How to buy Bored Ape Yacht Club?

Wondering how to become a part of the Bored Ape Yacht Club community? Here’s a simple guide:

- Connect Your Crypto Wallet: Start by linking your crypto wallet, ensuring secure storage for your digital assets.

- Visit the Official Collection: Locate the official Bored Ape Yacht Club collection. You can find links to official accounts in the previous paragraph.

- Choose Your NFT: Explore the collection to find the specific NFT you wish to purchase. Click on the NFT and then hit the “Buy” button.

- Place a Bid (Optional): Alternatively, you can place a bid on the token you like. Ensure you have enough ETH to cover gas or transaction fees. If the seller accepts your bid, the transaction will proceed.

- Congratulations!: Once the deal is confirmed, you officially become a valued member of the Yuga Labs community. Enjoy your newfound privileges!

Collaborations and news about BAYC

This extensive review would be incomplete if we did not touch on important news about the project itself. So, below are the largest of them.

- In October 2021, Yuga Labs inked a deal with renowned music manager Guy Osiri, known for his collaborations with Madonna and U2. Osiri’s agency, Maverick Records, will serve as the representative for BAYC in the realms of film, television, and music.

- Following suit, in November 2021, music powerhouse Universal Music revealed its intentions to create a virtual metaverse centered around NFT apes. Additionally, they announced the promotion of a virtual group named Kingship, comprised of three rare Bored Ape members and one Mutant Ape.

- In November 2021, American rapper and producer Timbaland made a significant move by purchasing multiple BAYCs and establishing Ape-In Productions. This company and platform are dedicated to crafting content for various metaverse applications, specifically those incorporating BAYC visuals. Timbaland’s venture introduced TheZoo, a virtual group comprised of six Bored Ape members. The label debuted their inaugural track, “ApeSh!t,” accompanied by a music video in March 2021.

- In early November 2021, the renowned magazine Rolling Stone unveiled an exclusive NFT cover showcasing a Bored Ape. Limited to 2,500 copies, this special edition sold out within a mere four minutes, emphasizing its immense popularity.

- In December, 2021, Adidas launched its first NFT project, Into The Metaverse , in collaboration with several Bored Ape Yacht Club, Punk Comics, and NFT influencer Gmoney . Collaboration between Adidas and BAYC is coming soon on both virtual and physical wear.

- In June 2022, Snoop Dogg and Eminem launched a fresh track and music video featuring the Bored Apes collaboration. Both artists took on the persona of animated monkeys in the video. As of the latest update, the official channel has amassed over 88 million views for this captivating collaboration.

- In July, 2023, Yuga Labs launched network licensing for BAYC and MAYC brands called “ Made by Apes ”. Owners of these NFTs can officially register their goods, services or company under the NFT brand based on a unique online license.

- On August, 2023, Snoop Dogg and the world-famous shoe brand Skechers presented a collaboration in the form of a limited collection of street shoes called Dr. Bombay featuring a leopard BAYC. A total of 5 models in the collection with elements of leopard style and a large image of a leopard NFT ape. The cost is from 75 to 100 dollars.

- In September, 2023, the team has revealed its latest collaboration with the legendary Japanese streetwear brand BAPE . The collaboration will feature an extremely limited collection available exclusively to the community. The collaboration will feature an extremely limited collection available exclusively to the community. The premiere will take place at ApeFest 2023 in Hong Kong.

- In September, 2023, Yuga Labs announced The Yacht Club Open House IRL event. This inaugural event, designed to welcome non-members, promises a day filled with panel talks, immersive encounters, and the chance to connect with web3 creators, collectors, and the crypto-curious.

The Future of Bored Ape Yacht Club

Bored Ape Yacht Club (BAYC) has undeniably made its mark on the NFT and blockchain landscapes, but its journey is far from over. Looking ahead, we can expect BAYC to not just maintain its momentum but also soar to even greater heights.

BAYC has transcended into a cultural phenomenon, and its popularity is set to surge as more individuals get acquainted with its unique appeal. Several factors, such as the growing acceptance of NFTs, the metaverse’s rising popularity, and the steadfast support from its vibrant community, will act as the driving force behind its continued expansion.

In the realm of blockchain, BAYC is positioning itself as the most major player. The club’s potential lies in its ability to innovate, constantly introducing groundbreaking products and services. Through strategic partnerships and collaborations, BAYC could reshape how we engage with digital assets and virtual experiences, setting new standards in the industry.

BAYC’s future is remarkably promising. Its current success, combined with ongoing innovations, suggests a future where BAYC will wield significant influence over the NFT and blockchain sectors. Keep an eye on this space; exciting developments are undoubtedly on the horizon.

Should you invest in Bored Ape Yacht Club?

In the ever-evolving world of cryptocurrencies and NFTs, the Bored Ape Yacht Club has emerged as a significant player, capturing the attention of investors and enthusiasts alike. The question on many minds is: Should you invest in Bored Ape Yacht Club?

At its core, BAYC is not just a collection of unique and artistic NFTs; it represents a thriving community and a cultural phenomenon. The exclusivity and creativity embedded in each Bored Ape make them highly coveted digital assets. With celebrities, influencers, and notable personalities endorsing BAYC, its popularity has skyrocketed, leading to substantial market demand.

Investing in these NFTs offers the allure of potential profits, especially given its historical price trends and the ever-expanding NFT market. The limited supply of 10,000 Bored Apes ensures their rarity, a key factor driving their value. Additionally, BAYC’s foray into the metaverse and collaborations with renowned artists and musicians hint at its potential for long-term growth and innovation.

However, like any NFT investment , BAYC comes with risks. The volatile nature of the cryptocurrency market means prices can fluctuate rapidly. Potential investors must conduct thorough research, understanding the market trends, community dynamics, and the overall utility of BAYC within the NFT ecosystem.

In conclusion, investing in Bored Ape Yacht Club can be a lucrative venture for those willing to navigate the complexities of the crypto world. With its strong community, unique value proposition, and continuous developments, BAYC stands as a compelling investment opportunity. As always, diversification and a well-informed approach are key when considering any investment in the digital realm.

Opinion of NFTmetria

In the vast sea of NFT collections, Bored Ape Yacht Club (BAYC) has emerged as a beacon of exclusivity and innovation. While countless NFT projects come and go, only a select few truly capture the public’s imagination, and BAYC stands firmly among them. Its unprecedented popularity can be attributed to several key factors, making it a standout choice for both collectors and investors.

- Celebrity Allure and Social Status: One of the driving forces behind BAYC’s meteoric rise is the endorsement by celebrities and influencers. When influential figures, like Jimmy Fallon and Justin Bieber, proudly display their Bored Apes, it creates a hype that resonates far beyond the crypto community. BAYC serves not just as a digital art collection, but as a social symbol, a pass to an exclusive club where social status intertwines with digital ownership.

- Active Community and Social Component: BAYC has redefined the concept of NFT ownership. It’s no longer just about owning a piece of digital art; it’s about being part of a thriving community. The active engagement within the BAYC community fosters a sense of belonging, turning mere token holders into active participants in a digital society. This social component, where digital assets mirror real-world social interactions, is reshaping the way we perceive ownership in the digital realm.

- A Glimpse into the Future: While BAYC is undeniably a form of conspicuous consumption, it also serves as a trailblazer for the crypto sector. Its success raises an intriguing question: Could blockchain technology find its true calling in the realm of entertainment, paving the way for a future where digital experiences hold as much value as physical possessions? As mass adoption of blockchain technology inches closer, BAYC’s unique blend of art, social interaction, and celebrity endorsement might very well point the way forward.

In the ever-evolving landscape of cryptocurrencies and NFTs, Bored Ape Yacht Club stands as a testament to the potential of digital assets beyond financial investments. Its allure goes beyond monetary value; it represents a cultural shift where the digital and physical worlds intersect. As we witness the unfolding chapters of blockchain technology, BAYC offers a tantalizing glimpse into what the future might hold – a future where our digital lives are as rich and meaningful as our physical ones. Only time will reveal the full extent of this transformative journey.

We will teach you how to analyze trends and find NFT grails. You will figure out how to build an amazing collection of NFTs that will increase in value faster than the market over time.

Get the NFT Investor Introductory Course for Free!

You will learn in detail:.

- How to start investing in NFTs?

- How to choose and analyze an NFT project?

- How to choose an NFT for invest?

- Most successful investment strategies

- Tools for analyzing the NFT market

- Sports & Recreation ›

Art & Culture

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

- Market cap of Bored Ape Yacht Club NFTs worldwide 2022-2023

As of December 8, 2023, the market cap of Bored Ape Yacht Club NFT projects available on the Ethereum blockchain and listed on OpenSea was worth roughly 695 million U.S. dollars. As of December 2023, Bored Ape Yacht Club non-fungible tokens reported one of the highest market caps of profile picture (PFP) NFT collections worldwide . PFP NFTs refer to non-fungible tokens commonly used as profile pictures on social media accounts.

Market capitalization of Bored Ape Yacht Club non-fungible token (NFT) projects worldwide from December 2022 to December 2023 (in million U.S. dollars)

- Immediate access to 1m+ statistics

- Incl. source references

- Download as PNG, PDF, XLS, PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

December 2023

December 13, 2022 to December 8, 2023

figures only include the Ethereum blockchain and projects listed on OpenSea

Data refer to the sum of each NFT valued at the highest of its most recent traded price and the collection's floor price. Please find here more information on the market cap methodology and here more details about the listing criteria. Figures have been rounded.

Other statistics on the topic Crypto art

- NFT sales value in the art segment worldwide in the last 30 days February 2024

Financial Instruments & Investments

- Daily sales volume of NFT collection Bored Ape Yacht Club to December 10, 2023

- NFT sales in the art segment worldwide in the last 30 days February 2024, by type

- Biggest NFT marketplaces up until December 12, 2023, based on 30d sales volume

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

You only have access to basic statistics. This statistic is not included in your account.

- Instant access to 1m statistics

- Download in XLS, PDF & PNG format

- Detailed references

Business Solutions including all features.

Statistics on " NFT art market "

- Sales value of art and collectibles NFTs worldwide 2019-2023

- Market cap of leading NFT collections in the art segment worldwide 2023

- Market cap of Art Blocks NFT projects worldwide 2022-2023

- Key information on the NFT trading activity of Art Blocks worldwide 2023

- Market cap of leading PFP NFT collections worldwide 2023

- Daily sales and price of NFT collection CryptoPunks to January 10, 2022

- Daily sales of NFT collection CryptoKitties to November 29, 2022

- Key information on public auctions of art-related NFTs worldwide 2021-2022

- Contemporary art sales above one million U.S. dollars worldwide 2018-2022, by medium

- Leading NFT artists worldwide 2022, by auction revenue

- Total sales of selected leading auction houses worldwide 2022-2023, by category

- Sales of NFTs on Christie's 3.0 worldwide 2023, by auction

- Most expensive NFTs sold on Christie's 3.0 worldwide 2023, by price realized

- Total visits to digital art market website superrare.com worldwide 2021-2024

- Share of visits to digital art market superrare.com worldwide 2024, by country

- Share of works held in HNW art collections globally H1 2022, by medium and generation

- Leading channels used by HNW art collectors to purchase art worldwide H1 2023

- HNW art collectors planning to buy paintings vs. NFTs worldwide H1 2022, by market

- Median spending of HNW collectors on digital art H1 2023, by generation

- Main factors that would motivate art buyers to buy NFTs worldwide April 2023

Other statistics that may interest you NFT art market

NFT art market overview

- Premium Statistic Sales value of art and collectibles NFTs worldwide 2019-2023

- Premium Statistic NFT sales in the art segment worldwide in the last 30 days February 2024, by type

- Premium Statistic NFT sales value in the art segment worldwide in the last 30 days February 2024

- Premium Statistic Market cap of leading NFT collections in the art segment worldwide 2023

- Premium Statistic Market cap of Art Blocks NFT projects worldwide 2022-2023

- Premium Statistic Key information on the NFT trading activity of Art Blocks worldwide 2023

Collectibles

- Premium Statistic Market cap of leading PFP NFT collections worldwide 2023

- Premium Statistic Daily sales and price of NFT collection CryptoPunks to January 10, 2022

- Premium Statistic Market cap of Bored Ape Yacht Club NFTs worldwide 2022-2023

- Premium Statistic Daily sales volume of NFT collection Bored Ape Yacht Club to December 10, 2023

- Premium Statistic Daily sales of NFT collection CryptoKitties to November 29, 2022

- Premium Statistic Key information on public auctions of art-related NFTs worldwide 2021-2022

- Premium Statistic Contemporary art sales above one million U.S. dollars worldwide 2018-2022, by medium

- Premium Statistic Leading NFT artists worldwide 2022, by auction revenue

- Premium Statistic Total sales of selected leading auction houses worldwide 2022-2023, by category

- Premium Statistic Sales of NFTs on Christie's 3.0 worldwide 2023, by auction

- Premium Statistic Most expensive NFTs sold on Christie's 3.0 worldwide 2023, by price realized

Online art platforms and marketplaces

- Premium Statistic Biggest NFT marketplaces up until December 12, 2023, based on 30d sales volume

- Premium Statistic Total visits to digital art market website superrare.com worldwide 2021-2024

- Premium Statistic Share of visits to digital art market superrare.com worldwide 2024, by country

NFT collectors

- Premium Statistic Share of works held in HNW art collections globally H1 2022, by medium and generation

- Premium Statistic Leading channels used by HNW art collectors to purchase art worldwide H1 2023

- Premium Statistic HNW art collectors planning to buy paintings vs. NFTs worldwide H1 2022, by market

- Premium Statistic Median spending of HNW collectors on digital art H1 2023, by generation

- Premium Statistic Main factors that would motivate art buyers to buy NFTs worldwide April 2023

Further Content: You might find this interesting as well

NFT market experiences a significant rise in sales in a week

S ales of non-fungible tokens experienced a significant uptick over the past week, with transactions totaling $442.02 million, marking an 11.62% increase compared to the previous seven days. Leading the surge were Bitcoin-based NFTs, which claimed the top spot in sales volume across 22 different blockchains.

NFT market sales hit 11.62% in a week

The standout transaction of the week was the sale of the ‘Alien’ Cryptopunk #3,100, featuring a distinctive headband, fetching a staggering $16 million. Bitcoin-based collectibles transactions led the charge, amassing $166,090,817 in sales. This represents a notable 14.26% increase from the previous week, according to data from cryptoslam.io.

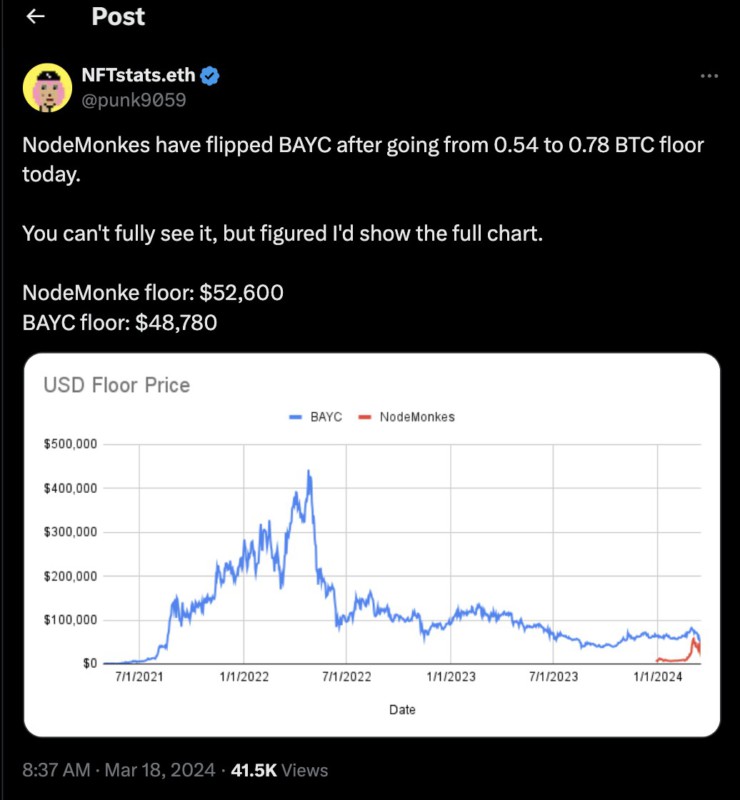

Collections such as Uncategorized Ordinals and Nodemonkes on the Bitcoin blockchain made significant contributions, with sales reaching $41.46 million and $37.02 million, respectively. The Natcats Tap collection also made an impact, generating $11,227,067 in sales. Ethereum-based collectibles transactions closely followed, registering the second-highest sales at $165,264,274.

Cryptopunks emerged as the top collection on the Ethereum blockchain, with weekly sales totaling $27,041,685. Additionally, Bored Ape Yacht Club (BAYC) and Pudgy Penguins made substantial contributions to Ethereum’s success, with sales ranging between $11,210,023 and $10,978,077. Overall, Ethereum sales saw an 11.72% increase from the preceding week.

Ethereum’s strong presence in the Non-fungible token sector

Other blockchains, including Solana, BNB Chain, and Mythos Chain, also witnessed notable activity in NFT sales. The Blast blockchain experienced the most substantial weekly growth, surging by 196.64% to reach $5,306,912 in sales. The ‘Alien’ Cryptopunk #3,100 sale for $16 million marked the apex of the week’s transactions.

Notable sales on Solana included Boogle #071, which sold for $355,368, and an Uncategorized Ordinal NFT, which fetched $353,833. Furthermore, a significant auction took place on Friday, with the largest Ordinal inscription, the Runestone, fetching 8 BTC ($544,713). Leonidas, the creator of Runestop, announced that all proceeds from the auction would support the network fees for the Runestone airdrop initiative.

The past week witnessed a surge in NFT transactions, with Bitcoin-based NFTs leading in sales volume. Ethereum-based NFTs are closely followed, with collections like Cryptopunks and Bored Ape Yacht Club driving sales on the Ethereum blockchain.

As interest in NFTs continues to grow, various blockchains are seeing increased activity, underscoring the expanding landscape of digital collectibles and unique assets in the cryptocurrency space. The sale of the ‘Alien’ Cryptopunk #3,100 for $16 million serves as a testament to the growing value and popularity of NFT s in the digital marketplace.

NFTGo: NFT Annual Report 2024

This annual report from NFTGo aims to evaluate the NFT ecosystem holistically - analyzing key metrics, spotlighting trends, and forecasting what's next.

Table of Contents

Chapter 1 nft ecosystem, nft landscape, the evolution of nfts: key history and milestones, chapter 2 market overview, marketcap & volume - signs of a rebound, blue chip index - continued blue chip dominance, category - pfp is still the key to nfts, holder & traders - from volatile market to calm market, marketplace - blur vs opensea, who wins, solana & btc - the rising market in 2024, nft/eth ratio - nft market exhibits unique resilience, nftfi trends - degods and mayc were the most consistently deposited collections, socialfi trends - continued growth in volumes, chapter 3 micro trends, floor distribution, collection issuances, market cap & volume distribution, liquidity distribution, royalty distribution, chapter 4 global influence, the search interest for nft, ordinals are becoming the hottest topic, the number of potential sellers and buyers is balancing, brand landscape, trends for nft adoption, chapter 5 nft fundraising trends, crypto fundraising trends, gamefi & social, regional funds by category, chapter 6 top sales, top sale in 2023, top #10 sale in summary, top #10 most profitable address, top #10 whales, top #10 marketplace, chapter 7 top projects to watch out, nft projects poised to release tokens in 2024, top projects to watch out, chapter 8 whale movement analysis, whale trends and analysis, whale behavioral traits, top nft whales to watch out, chapter 9 predictions for 2024, web3 gaming will see significant expansion in 2024, most existing token economic models remain conceptual rather than fully functional, bitcoin eco will explode in popularity in early 2024, nfts can interact with brands targeting generation z, chapter 10 a must read for beginners 2024, what are nfts and why do they matter, overview of key nft protocols, nft top analysts, how to participate in nfts in 2024, how to mint nfts, how to purchase tokens for nft projects, how to purchase an nft.

The NFT Revolution: 2024 and Beyond

In just a few short years, NFTs have catalyzed a digital revolution - rising meteorically before market forces intervened. Even in the downturn, resilience and innovation prevail. Builders forge ahead, transforming the possibilities for ownership, community, and beyond through emergent use cases.

As we enter 2024, questions loom about the future of NFTs. Some wonder if the hype has fizzled for good. Yet upticks in trading activity signal enduring enthusiast demand.

To comprehend the road ahead, we must review the past. This report chronicles the NFT landscape's evolution from its advent to today. We examine key events, investments, innovations, and data that shaped its developmental arc.

The power of engaged communities and social dynamics to drive adoption, regardless of market cycles. Novel integrations with mainstream brands that expand possibilities. The emergence of decentralized financial products unlocking further functionality.

While speculation has defined several boom-bust phases, a maturing ecosystem is taking form - one centered on utility and meaning rather than bets on price appreciation alone.

As our analysis shows, when surface-level hype evaporates, the true core of NFTs comes into focus – new models for culture, ownership, and community coordinated by code rather than institutions.

The coming year heralds uncertainty but also immense possibility. With more builders joining each day, NFTs remain fertile ground for visionaries charting the future through a decentralized lens.

This report aims to illuminate that future by understanding the past. We invite you to explore this knowledge resource as you navigate the ever-evolving frontier of NFTs. The revolution continues.

—— Elsa, Head of Research

What You Can Expect From the Report

The NFT annual report 2024 builds upon our learnings from previous years to deliver an in-depth perspective on the NFT market.

- Evaluates capital flows and upcoming plans for top-performing NFT projects - serving as a benchmark for grasping future trends

- Covers key metrics across categories: market capitalization, volume, sales, holders, capital inflows

- Analyzes gaming, collectibles, avatars, art, metaverse, DeFi, IP, social, music, utility

- Explains NFT data patterns and trading strategies, like identifying buyer demand

- Examines distribution and characteristics of projects: wealth gaps among users, liquidity differences

- Reveals whale behaviors - investments, reactions to events, entry and exit timing

- Consulted influencers and academics for 2024 NFT predictions

Special Thanks To Our Partners!

As we enter 2024, the NFT landscape will continue evolving as new utility concepts displace obsolete trends. By examining emerging use cases and infrastructure improvements, we can forecast some likely hype cycles:

Metaverse Interoperability - 2023 saw many brands and creators launch proprietary virtual worlds and NFTs, but these remain fragmented. In 2024, cross-platform ecosystems could enable unified digital identity and assets across metaverses. This will spur fresh hype and speculation on virtual experiences with transferable utility across worlds.

Gaming NFT Evolution - While play-to-earn models received backlash in 2023, gaming NFTs will evolve into tools for creation, customization and governance. User-generated gaming metaverse worlds will take off, leveraging NFTs for provable digital asset ownership, creative contributions, and community coordination.

Social Tokens - Social NFTs allowing exclusive access or influence with creators blew up in 2023. However, in 2024 we may see a shift from NFT speculation to direct revenue sharing via tokens. This social patronage could displace NFT hype with more sustainable monetization for creators building engaged communities.

Overall, 2024's hype cycles will center on NFTs enabling connectivity, creativity, and collective governance - moving beyond an isolated asset speculation mania toward meaningful utility fostering participation and ownership. Use cases that empower, rather than restrict, may finally shift discussion toward constructive applications over profit-seeking hype.

NFTs have gone through several key phases of evolution since their inception. Here is an overview of the major milestones in NFT history so far.

Phase 1: Early Origins (2012-2016)

- 2012 - Colored Coins introduced the concept of tokens representing real-world assets on Bitcoin's blockchain. This laid the groundwork for NFTs.

- 2014 - Counterparty launched, enabling creation of tokens for any asset on Bitcoin's blockchain. Early NFT experiments happened, like trading Rare Pepe illustrations.

Phase 2: Growth of Infrastructure (2017-2020)

- 2017 - CryptoKitties, one of the first major NFT projects, allowed trading unique digital collectibles on Ethereum. Its popularity drove ERC-721 standard for NFTs.

- 2018 - NFT marketplaces like OpenSea and SuperRare emerged, making it easier to create, buy and sell NFTs.

- 2019 - NBA Top Shot introduced officially licensed NFTs of NBA video highlights, attracting mainstream attention.

Phase 3: Explosive Growth (2021-Early 2022)

- 2021 - Beeple's NFT artwork sold for record $69 million at Christie's auction house, sparking NFT mania.

- 2021 - Bored Ape Yacht Club (BAYC) became a hugely popular NFT collection and status symbol. Its success spurred more PFP projects.

- 2021 - NFT gaming gained steam through Axie Infinity and metaverse projects like The Sandbox and Decentraland.

- 2021 - Nouns pioneered community-centric approach with NFTs tied to DAO governance.

- 2022 - Leading NFT projects like Doodles, Azuki and Moonbirds saw multi-million sales. Yuga Labs emerged as key player.

Phase 4: Market Contraction (Late 2022-2023)

- 2022 - NFT bubble burst as speculation cooled off. Market shifted from short-term flips to long-term utility.

- 2023 - Focus on building sustainable communities and real-world utility around NFT projects going forward.

- 2024 - New NFT projects with accessibility and new narratives, such as Gonesis.

In summary, NFTs have progressed through the expected phases of a new disruptive technology - early innovation, infrastructure development, explosive growth, and market maturation. The long-term utility of NFTs continues to evolve.

2023 NFT volumes appear volatile but ultimately demonstrate momentum late in the year surpassing January/February levels. Q1 and Q4 prove to be the strongest quarters while a lull happens in Q3.

Annual trading volume of the NFT market in 2023. Source: NFTGo

Upon reviewing the aggregate data, it's evident that both market capitalization and trading volume have seen a downturn when compared to the previous year. The market capitalization suffered a significant decline of 41.79%, plummeting to its lowest at 3.3 million ETH. The peak of trading activity was on February 20th, where the daily trading volume soared to its yearly high of 240,000 ETH. However, this momentum was not sustained throughout the year. Disappointing updates and releases, such as the much-anticipated game Legends of the Mara, the new collection Azuki Elementals, and the Degods update, failed to meet community expectations, contributing to a dampening of market enthusiasm. As a result, trading volumes remained subdued for the middle portion of the year. Despite this lull, there were signs of a rebound beginning in November.

2023 Blue chip index, Source: NFTGo

Entering 2023 off a brutal ~70% correction, expectations for blue chip NFTs have been broadly tempered. However, some glimmers of resilience emerged late in 2023, with the index rallying off a bottom of 4,488 in October 2023 to regain the 5,000 handle by year's end. This may suggest enduring demand for quality collections amidst wide-scale capitulation in more speculative corners of digital assets.

Looking ahead to 2024, there is a credible bull case underpinned by expectations that new blue chip collection will arise such as pudgy penguins. Most likely is an extended period of uneven maturation marked by interim volatility spikes as the market balances precariously between speculation and functionality. Thus while glimpses of stability are plausible, the road ahead remains rocky towards establishing NFTs as a unique digital asset category deserving of rich standalone valuations.

The trading volume of different collections. Data Source: NFTGo

A deep dive into 2023 NFT trading volume reveals that blue chip collections still dominate the market. Bored Ape Yacht Club alone accounted for 10.45% of total volume, with Mutant Ape Yacht Club and Azuki ranking second and third. The top 9 collections combined made up nearly 50% of overall volume. While newer collections arise frequently, the data indicates that the most trusted and recognizable blue chip NFTs are still capturing the majority of trading activity and value.

A comparison of the market caps of different NFT categories. Source: NFTGo

The chart indicates that PFPs continue to be the cornerstone of NFT applications, having achieved a total market capitalization of approximately 4 million ETH. In contrast, the art category—surpassing games, collectibles, and utility—has emerged as the second-highest in the NFT space with a market cap close to 500 million ETH. This surge is likely due to the advancements in AI, as evidenced by the evolution of OpenAI's ChatGPT, which seems to have bolstered the market significantly.

Since last year, the domain name category has become more prominent, reflecting a heightened interest in digital assets and their potential applications within the burgeoning digital landscape.

PFPs are expected to remain the bedrock of the NFT industry, providing a foundation for various NFT collections to broaden their reach. These collections are exploring new ventures, such as partnerships with the traditional Web2 industry and migration to more populous blockchains, in an effort to expand their audience.

Since 2022, the NFT sector has entered a phase of consolidation, with each category cultivating its distinct audience. The current strategy for growth involves broadening business models to attract additional investors and enthusiasts. Notable developments include the launch of a new game by Yuga Labs, innovative collections and elements by Azuki and DeGods, and Pudgy Penguins' collaboration with Walmart. The integration of AI has infused the industry with fresh momentum, leading to an increase in video and generative art NFTs. Looking forward to 2024, we anticipate more innovative endeavors that will likely invigorate the market further.

A comparison of the liquidity of different NFT categories. Source: NFTGo

Contrary to expectations, it was the gaming category that emerged with the highest liquidity, surging by approximately 380%. This impressive liquidity can be attributed to the popularity of collections such as Otherside Koda, as well as the introduction of new gaming collections like OVERWORLD INCARNA. Additionally, renewed interest in classics such as Pixelmon has further invigorated the market. The art and land categories have also demonstrated substantial liquidity, both exceeding 200% when compared to other categories.

2023 NFT holder & trader statistics. Source: NFTGo

As 2023 came to a close, the NFT market shifted into a less volatile trading phase compared to the previous year. The initial four months were characterized by heightened activity, with traders rapidly offloading their NFTs, contributing to instability and daily fluctuations in trader numbers. However, the latter half of the year saw a transition to a more tranquil trading environment, leading to a more stable market.

Data from NFTGo indicates that the market as a whole experienced a decline throughout 2023. There was a significant reduction in active traders, with a 47.51% decrease compared to 2022. Despite this downturn in trading activity, the number of NFT holders saw considerable growth, increasing by 132.44% over the course of the year, reaching a total of 6.42 million holders.

Daily number of sellers / number of buyers ratio in 2023. Source: NFTGo

The time series data shows the daily buyer to seller ratio over 2023 ranged from 0.52 to 1.02, with an overall average of 0.85, indicating a reasonably balanced market between buyers and sellers. However, there was moderate variability day-to-day and some cyclicality observed, with the lowest monthly averages occurring in April (0.66) and May (0.80).

The highest monthly average in September (0.92), indicating the upcoming “Uptober” conditions.Daily spikes above 0.95 occurred 11 times throughout the year, highlighting particular days with surging buyer demand compared to sellers. The maximum daily ratio of 1.02 on June 29 was preceded by an incline over the prior two weeks pointing to building buyer strength.

NFT marketplaces in 2022. Source: NFTGo

In 2022, OpenSea dominated trading volumes with 7.74 million ETH, 6x higher than its next competitor. However, new entrant Blur saw meteoric growth after launching in October 2022, surpassing OpenSea's daily volumes by December.

NFT marketplaces in 2023. Source: NFTGo

This growth continued into 2023, with Blur accumulating 4.33 million ETH in total volume - over 2.5x OpenSea's 1.7 million ETH. However, OpenSea maintained a lead in number of sales at 7.9 million vs. Blur's 4.1 million. This implies higher average order values on Blur.

Examining active traders further reinforces Blur's traction with higher-value clients. Blur saw 292K active traders in the past month including 187K buyers and 210K sellers. OpenSea had more traders overall at 642K buyers and 719K sellers, but Blur appears to be capturing more high-value whale traders.

Key drivers of Blur's growth include its zero platform fees, token incentives, and features catering to professional traders like bulk buys. However, subsidies are likely unsustainable long-term.

The market will consolidate further around platforms offering the best core user experience, discovery and community-building features. Traders will prefer marketplaces with the multi chain trading, highest liquidity, security, etc.

Overall trading volume and number of traders grew significantly over the course of the year, indicating growing interest in Solana NFTs. Total weekly volume across both marketplaces rose from around $1.5 million in early January to over $1.1 million in late December. The number of active traders per week increased from around 80,000 to over 110,000 over the same period.

Collections comparison between Solana marketplaces. Source: Dune Analytics

The number of unique collections traded per week increased 4x from around 5000 in January to over 15k in December, pointing to growing diversity in the NFTs being traded on Solana.

Traders comparison between Solana marketplaces. Source: Dune Analytics

The number of active NFT traders on Solana surged in 2023, with the combined weekly traders on Magic Eden and TensorSwap rising 3x from January to over 100K by December.

Average weekly trade size declined over the year, from around $850 in January to $550 in December, possibly indicating more speculative trading of lower-priced NFTs. Magic Eden's average trade size was consistently larger than TensorSwap's.

Solana Volumes Traded. Source: Dune Analytics