Marine Underwriters of America

Get peace of mind!

Whether by land or sea we’ve got you covered…

Marine Underwriters of America (MUA) is a one-stop-shop for all of your marine insurance needs.

We are the premier underwriter of ocean marine, inland marine, and related property for the commercial and recreational marine customer. With over 200 years of combined marine experience, you will be impressed with our product knowledge, creativity, response, and innovative service.

We distribute through an exclusive network of marine specialized producers strategically located throughout the country to meet the needs of our customers.

To request a list of producers located in your geographical area please contact us through the Contact Us form of our website.

If you have a specialized marine operation and would like to join our elite group of producers, please feel free to contact us through the Contact Us page of our website.

Our Service

We know there are many choices in the marine market and we expect that we will earn your business through the “old-fashioned” service that many of our competitors no longer provide.

We promise:

- out of the box thinking

- prompt responses

- returned telephone calls

- personal service

Marine Insurance Protection Above and Beyond Since 1989.

Since 1989, Anchor Marine Underwriters has been providing exceptional service to our clients throughout the United States. Our clients include boat and yacht owners, charter operators, commercial vessels, floating property owners, personal lines clients and owners of marine-related businesses. Our knowledgeable staff has over 75 years’ worth of combined experience in marine insurance and related fields.

Log in to Markel

- US Broker Agent

US customer login

Log in to make a payment, view policy documents, download proof of insurance, change your communication and billing preferences, and more.

Log in to access admitted lines for workers compensation, business owners, miscellaneous errors and omissions, accident medical, general liability, commercial property, farm property, and equine mortality.

Markel Online

Log in to access non-admitted lines for contract binding property & casualty, excess, and commercial pollution liability.

MAGIC Personal Lines portal

Log in to access personal lines products including marine, specialty personal property, powersports, bicycle, and event insurance.

Markel Surety

Log in to access Markel's surety products.

- News and press

Yacht insurance

The marine insurance leader for over 45 years.

Find a Markel marine agent and get a free, no-obligation quote today.

If you love your yacht, you’ll love our insurance.

We’ve been the yacht insurance leader for over 45 years because we provide coverages that fit your yacht and your lifestyle. Markel yacht insurance can offer distinct advantages in coverage features, options, knowledge and experience.

Why do you need yacht insurance?

Whether you own a yacht or a houseboat, we understand it’s not a typical boat and shouldn’t be covered by a typical boat insurance policy. That’s where we come in—each Markel yacht insurance policy can be customized to fit your yacht, your needs, your budget and your style.

Still not sure?

Here’s a few of the potential advantages to insuring your yacht with us:.

More complete coverage than any other carrier at no additional cost.

Experienced yacht underwriters and marine claims specialists who provide prompt, responsive service.

Discounts and cost-effective coverage options to save you money.

Flexible payment options.

Save money by customizing your yacht insurance

Actual cash value coverage (ACV) Reduce your coverage to ACV, which factors in depreciation of your yacht should you have to file a claim.

Lay-up option We’ll discount your yacht insurance premium during the winter months when your yacht is not in use.

Higher deductibles If you can manage minor repairs to your boat on your own, selecting a higher deductible will reduce your premium.

Windstorm exclusion Live in an area that isn’t at risk for a hurricane? You may consider removing windstorm coverage from your policy.

Liability only Coverage in case you damage another yacht and/or person (doesn’t require a survey—even for older boats).

What we offer

We offer coverage for a variety of watercrafts over 26 feet in length, including:.

- Sport fishing boat

Our coverages can include:

- Coverage for your yacht

- Coverage for you

- Optional coverages

Hull and equipment insurance protection including:

- Protect and recover can cover reasonable costs incurred when trying to protect your yacht from further damage after an accident

- Consequential damage for non-wood yachts–normal wear and tear and deterioration is not typically covered under a yacht insurance policy. However, if your yacht suffers damage from fire, explosion, sinking or collision because of one of these conditions, you may be protected

- Ice and freezing damage coverage if you contracted with a commercial marina or repair facility

- Agreed value for total loss

- Deductible waived on most total losses

- No depreciation on most partial losses

- Automatic tender coverage

Windstorm extra expense If there is a named storm, watch or warning, we will share the expense with you to help protect your yacht before the storm makes landfall.

Personal effects coverage For all the “extras” you physically bring onto your yacht. (i.e., smart phone, camera, etc.)

Emergency towing and assistance Coverage for towing expenses if your yacht happens to get stuck in or out of the water, including the delivery of gas, oil and parts.

Rental reimbursement coverage Coverage for when your yacht is being repaired from a covered loss.

Uninsured boater Unfortunately, not all boaters on the water have insurance. This coverage helps protect you and your family members if you are injured in an accident caused by an uninsured boater. Coverage is automatically included if watercraft liability is purchased.

Pollution liability Pollution coverage helps protects you if you are held legally liable due to an oil pollution leak or spill.

Medical payments Coverage for injuries suffered during an accident on your yacht.

Paid crew (Jones Act) Protection for you if you are legally responsible for injuries to a paid captain or crew member while on your yacht.

Protection and indemnity Coverage in the event that you are responsible for injuries to another person, or damage to their boat or property. Wreck removal is included with purchase of hull coverage.

- Boat trailer coverage

- Boat lift and boat house coverage

- Fishing tournament reimbursement for fishing boats

- Fishing equipment protection

- Transit and storage coverage

- Trip coverage

- Trip interruption reimbursement

- Personal liability coverage if you live aboard your yacht

Frequently asked questions about yacht insurance

General questions.

How much coverage do I need? Each boat, person, location and situation is different. There isn't a good way to give a "ballpark" figure for how much coverage you need. It’s best to evaluate your comfortable level of risk when protecting your boat, assets and passengers. Your best option is to call our boat specialists at +1.800.236.2453 to discuss the best coverage for you.

Can I insure my yacht for liability only? Yes, we offer protection and indemnity (liability only) coverage to help protect you in case you are responsible for injuries to another person or damage to another boat or property. Many carriers do not offer liability-only policies for yachts, or if they do, require a survey. However, Markel’s protection and indemnity coverage does not require a survey, so you’re able to do what you love without worries out on the water.

Will my policy cover normal wear and tear of my yacht? Most insurance policies will not cover normal wear and tear of your yacht and the deterioration or the resulting damage. However, if your yacht is damaged from fire, explosion, sinking, collision or stranding, you may be protected under our consequential damage coverage.

Can I use my yacht for chartering? We know that sometimes yacht owners charter their yacht for sightseeing tours or even sport fishing to help offset some of the costs of owning a yacht. Markel offers an optional limited charter coverage for these situations provided the captain of the watercraft has a minimum of 2 years loss-free experience of yachting. Additional restrictions may apply.

I live on my yacht. Am I covered? Markel provides live aboard coverage. Be sure to disclose that you live aboard to your agent.

My yacht is in a corporation's name. Can I still insure it with Markel? Our yacht insurance policy can cover corporately titled boats for both personal use and client entertainment. We do require all corporately titled boats designate a designee of the watercraft. Contact your agent to learn more.

Do I need to insure my yacht in the winter? It may seem that since you don't use your yacht in the winter you don't need to insure it. This is a risky way of looking at insurance and one that we have seen cost far too many people far too much money. Your yacht is at risk for damages at all times of the year, not only when it's on the water. For example, if your yacht is placed in storage for the winter and is damaged, you will not have any assistance in paying for those repairs without an active insurance policy.

Do you cover unique boats? We offer coverage for various kinds of boats that other insurers may shy away from, including: high performance boats, airboats, hovercraft, etc. Not sure if your watercraft will be covered? Give us a call at +1.800.236.2453 to speak with one of our marine insurance specialists.

What kind of fishing equipment is covered? Your rods, reels and tackle are automatically covered under your personal effects coverage up to the limit purchased. If that coverage isn't sufficient, our fishing equipment coverage provides insurance protection at replacement cost. Please contact one of our marine insurance specialists at +1.800.236.2453 to find out more.

Claims questions

How do I file a claim? We understand that no one wants to file a claim. That's why we do everything we can to make the process as painless as possible. You can report your yacht insurance claim by calling our office at +1.800.236.2453 or submit your claim online and we'll take it from there.

How long will it take for my claim to be processed? We are committed to investigating, evaluating and resolving marine insurance claims in a timely manner.

Is there anything I can do to help speed up the claim process? Yes, you can help streamline the claims and settlement process and avoid delays by providing the following information when you file your claim:

- Policy number

- Date, time and location of loss or damage

- Description of loss or damage

- Digital photos (if possible)

- Phone number to reach you

Additional resources

Related articles.

From boat safety tips to breaking down yacht insurance, find the information, advice, and resources you’ll need all in one place.

Warrior Sailing

Markel is a proud supporter of Warrior Sailing, an organization dedicated to healing and strengthening the lives of veterans through sailing. Visit warriorsailing.org to learn about Warrior Sailing and how you can donate to the program so they can continue to help the lives of wounded veterans.

Related products

Specialized coverage designed specifically for boats 26 feet or less, such as pontoons, runabouts, fishing boats and more.

Personal watercraft

Insurance for personal watercrafts (PWCs) such as a Jet Ski, Sea-Doo or WaveRunner.

High performance boat

Coverage for speedboats greater than 26 feet in length and capable of speeds 66 to 120 m.p.h.

the atlass insurance group PORTFOLIO OF INSURANCE SERVICES insurance risk managers & brokers

+1 800.330.3370, 954.525.0582, insurance agents login.

A RISK STRATEGIES COMPANY

Yacht and Boat Insurance | Mega-Yacht Specialists

We represent the finest insurers. offering “a” rated company coverage from the united states and europe..

The Atlass Insurance Group has direct access to most of the leading U.S. and London recreational marine boat insurance and yacht insurance underwriters. Because of our constant communication with the marketplace and ability to access those underwriters, we are able to provide the broadest coverage at the best terms to our clients.

Most importantly, in time of loss, the Atlass Insurance Group is ready to advise and assist in the settlement of claims. We are constantly in touch with surveyors and claims adjusters worldwide, and are fully committed to fair and equitable claims settlements for our insured.

Customized Coverage & Exclusive Yacht & Boat Insurance Product Solutions

Atlass specialists can arrange insurance coverage for all categories of yachts and pleasure craft worldwide. We provide the finest and most affordable marine boat and yacht insurance products available. Our insurers represent the yachting spectrum from coastal cruising small boats to mega yachts worldwide.

Motor Boats & Sailing Boats Covered, Including High Performance Boats

Headquartered in fort lauderdale florida, atlass insurance group is engaged continuously, in the marine insurance markets of the united states and abroad., get-a-quote | yachts & boats.

* Required Fields

------- Select Your State ------- Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District Of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming --------------- American Samoa Guam Northern Mariana Islands Puerto Rico United States Minor Outlying Islands Virgin Islands

------- Select Your Country ------- United States Afghanistan Åland Islands Albania Algeria American Samoa Andorra Angola Anguilla Antarctica Antigua and Barbuda Argentina Armenia Aruba Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia, Plurinational State of Bonaire, Sint Eustatius and Saba Bosnia and Herzegovina Botswana Bouvet Island Brazil British Indian Ocean Territory Brunei Darussalam Bulgaria Burkina Faso Burundi Cambodia Cameroon Canada Cape Verde Cayman Islands Central African Republic Chad Chile China Christmas Island Cocos (Keeling) Islands Colombia Comoros Congo Congo, the Democratic Republic of the Cook Islands Costa Rica Côte d'Ivoire Croatia Cuba Curaçao Cyprus Czech Republic Denmark Djibouti Dominica Dominican Republic Ecuador Egypt El Salvador Equatorial Guinea Eritrea Estonia Ethiopia Falkland Islands (Malvinas) Faroe Islands Fiji Finland France French Guiana French Polynesia French Southern Territories Gabon Gambia Georgia Germany Ghana Gibraltar Greece Greenland Grenada Guadeloupe Guam Guatemala Guernsey Guinea Guinea-Bissau Guyana Haiti Heard Island and McDonald Islands Holy See (Vatican City State) Honduras Hong Kong Hungary Iceland India Indonesia Iran, Islamic Republic of Iraq Ireland Isle of Man Israel Italy Jamaica Japan Jersey Jordan Kazakhstan Kenya Kiribati Korea, Democratic People's Republic of Korea, Republic of Kuwait Kyrgyzstan Lao People's Democratic Republic Latvia Lebanon Lesotho Liberia Libya Liechtenstein Lithuania Luxembourg Macao Macedonia, the former Yugoslav Republic of Madagascar Malawi Malaysia Maldives Mali Malta Marshall Islands Martinique Mauritania Mauritius Mayotte Mexico Micronesia, Federated States of Moldova, Republic of Monaco Mongolia Montenegro Montserrat Morocco Mozambique Myanmar Namibia Nauru Nepal Netherlands New Caledonia New Zealand Nicaragua Niger Nigeria Niue Norfolk Island Northern Mariana Islands Norway Oman Pakistan Palau Palestinian Territory, Occupied Panama Papua New Guinea Paraguay Peru Philippines Pitcairn Poland Portugal Puerto Rico Qatar Réunion Romania Russian Federation Rwanda Saint Barthélemy Saint Helena, Ascension and Tristan da Cunha Saint Kitts and Nevis Saint Lucia Saint Martin (French part) Saint Pierre and Miquelon Saint Vincent and the Grenadines Samoa San Marino Sao Tome and Principe Saudi Arabia Senegal Serbia Seychelles Sierra Leone Singapore Sint Maarten (Dutch part) Slovakia Slovenia Solomon Islands Somalia South Africa South Georgia and the South Sandwich Islands South Sudan Spain Sri Lanka Sudan Suriname Svalbard and Jan Mayen Swaziland Sweden Switzerland Syrian Arab Republic Taiwan, Province of China Tajikistan Tanzania, United Republic of Thailand Timor-Leste Togo Tokelau Tonga Trinidad and Tobago Tunisia Turkey Turkmenistan Turks and Caicos Islands Tuvalu Uganda Ukraine United Arab Emirates United Kingdom United States United States Minor Outlying Islands Uruguay Uzbekistan Vanuatu Venezuela, Bolivarian Republic of Viet Nam Virgin Islands, British Virgin Islands, U.S. Wallis and Futuna Western Sahara Yemen Zambia Zimbabwe

Knowledgeable and Experienced Insurance Specialists - L

Boat & Yacht Insurance

There’s nothing quite as pleasurable and exhilarating as cruising around the world in a super- luxurious yacht equipped with world-class amenities. But yacht ownership is not just about sailing the ocean. Instead, there are a number of risks and responsibilities involved as well.

At Atlas Underwriters, we want you to have a worry-free experience of exploring the waters. Therefore, we help you find a comprehensive marine insurance policy that can provide you financial support in case of damage to your boat, as well as for injury to you or one of your passengers.

What is Yacht Insurance?

Yacht insurance offers protection against accidental loss or damage to yacht or pleasure boat owners. It provides coverage for bodily injury, as well as damage to personal property on the boat. Some insurance policies also cover the cost of towing, gas delivery, and assistance in case a yacht gets stranded while at sea.

What Does Yacht Insurance Cover?

At Atlas Underwriters, we understand that every yacht has different coverage needs. Therefore, we draw on our extensive experience of providing the most comprehensive marine insurance policies to the yacht industry to devise a customized, cost-effective policy for your yacht and crew.

- Bodily injury to uninsured boaters

- Damage to personal property, including, but not limited to, clothing, cameras, stereo systems, and other personal items

- Fuel spills

- Mechanical breakdowns

- Physical damage due to collision with another boat or a submerged object

- Towing, gas delivery, and roadside assistance

- Protection for charters

- Environmental damage

- Bodily injury to paid crew

- Protection for extended navigation

- Hurricane escape reimbursement

- Defects in the design of a boat or yacht

- Loss caused by blistering or osmosis

- Loss caused by corrosion, except electrolytic corrosion

- Loss caused by denting or scratching

- Loss caused by marring

- Loss caused by mold, animals, insects, and marine life

- Loss caused by wear and tear

- Loss caused by weathering

In addition, most yacht insurance policies do not offer coverage for latent defects that may be present in a vessel. However, damage resulting from the defect is covered by most marine insurance policies. For example, if your water pump is defective, your yacht insurance policy will not offer coverage for replacing or repairing the water pump, but will pay for resulting damage to the engine.

To learn more about yacht insurance policies or to schedule an appointment with Atlas Underwriters, please call at (954) 318-7940.

Emergency Towing Coverage

Machinery Coverage

Accident Response

Consequential Protection

Our Products

- Accidental Death Insurance

- Kidnap, Ransom and Extortion Insurance

- Pilot Insurance-Loss License

- Disability Insurance

- Imparied Risk Insurance

- Fine Art Insurance

- Yacht Insurance

- Equine Insurance

- Cyber Insurance

- Professional Liability Insurance

- Medical Malpractice Insurance

- Overhead Expenses Insurance

- Travel Insurance

- Our Company

- Reinsurance Market Ratings

- Captive Market Insurance

- Make a Payment

- Partner Login

- OUR COMPANY

- PARTNER LOGIN

- PRIVACY POLICY

Subscribe to Weekly Bulletin

- Suggestion Box

- AIMUconnect

|

| American Institute of Marine Underwriters |

|

American Institute of Marine Underwriters |

- Board of Directors

- AIMU Event Calendar

- Event Photos

- Honorary Members

- Management Committee

- Past Chairpersons

- Past Presidents

- Members Only Content

- Member Services

- Types of Membership

Why Join AIMU

- AIMU Awards

- AIMU Education Schedule

- AIMU Intern Education Program

- AMIM Program - On Demand

- COMI Application

- COMI Certification Recipients

- COMI Certification Criteria

- E-Learning - On Demand

- IUMI Education

- Learning Opportunities by Topic

- Webinars on Demand

- Correspondent Application

- Global Correspondents

- Find a Surveyor

- Guideline for Ocean Cargo Loss or Damage Survey

- Submit Annual Port Activity Report

- Cuba Marine Insurance Issues

- Marine Insurance Restrictions

- OFAC Sanctions Programs and Country Information

- Table of States Statutory Ocean Marine and Pleasure Craft Exemptions

- States Which Require Licensing of In-House Ocean Marine Adjusters

- Commodities

- Issues Book

- Papers Available Online

- Maritime Industry Links

- Technical Resources

Industry Events

Review event schedule of the well-recognized industry organizations: CBMU, IUMI, COMA, MLA, BMUSF, AMIF-NY and MIAS

Learning on Demand

Take advantage of 35 pre-recorded webinars available for viewing 24/7. More details...

Statistical Reports

Underwriting year statistics for 2019-2022 is available under Members Only Content.

AIMU Events

Review all events under Education Schedule .

AIMU offers education, networking, statistics, recognition, and collaboration between members.

AIMU celebrated a milestone 125th Anniversary last year!

The American Institute of Marine Underwriters (AIMU) has 125 years of service as the trade association representing the United States ocean marine insurance industry as an advocate, educator and information resource.

AIMU provides an active program of support services to assist the U.S. marine insurance industry in providing its global customers with a level of performance unsurpassed in the world. Its worldwide network of surveyors (Correspondents) aids its members in handling claims with speed and efficiency. AIMU publishes a Weekly Bulletin, which provides its members with current information on maritime matters, media reports, legislation and court decisions. Through its educational programs, AIMU fosters the highest standards of professionalism, stimulates creativity and innovation and enhances the industry's traditional commitment to service.

AIMU ensures that U.S. marine insurers are heard by lawmakers, regulators and international bodies. It testifies before congressional committees and works closely with organizations and participates in coalitions focused on improving safety and preventing cargo-related crime. AIMU is the forum for action on the significant issues that affect U.S. marine insurers, reinsurers and the international trade community.

AIMU Educational Calendar

AIMU offers many other educational opportunities View AIMU Education Programs here »

Only employees of AIMU Member Companies can be added to the email list. Subscribe »

Twitter Updates

Calendar of all Industry Events »

Read about the benefits of AIMU Membership here »

AIMU is committed to advancing the educational, governmental, regulatory and technical interests of the ocean marine insurance industry. One of the services AIMU provides for its members is the provision of education and publishing of information for use by underwriters, loss control and claims specialists, and other interested parties. Read more...

The topics covered by AIMU Reports, Bulletins, News Articles, Seminars and Webinars are intended to provide an overall awareness of the issues, hazards and exposures associated with a specific industry or ocean marine class of business. Volunteer members of a committee and/or staff of AIMU have produced this information. Committee members abide by antitrust restrictions and all other applicable laws and regulations while compiling information. It is generally not possible to treat any one subject in an exhaustive manner, nor is it AIMU's intent to do so. No representations or warranties are made regarding the thoroughness or accuracy of the information contained in Reports, Bulletins, News Articles and other information provided by third parties, Seminars and Webinars or any part of it. Nothing in this information should be interpreted as providing definitive guidance on any question relating to policy interpretation, underwriting practice, or any other issues in insurance coverage. AIMU does not prescribe to its members how to make underwriting or claims decisions, nor does it require that analysis follow any particular format. AIMU also makes no representation or warranty as to the work product or content of any information or report provided by any AIMU Correspondent or otherwise available on the AIMU website. Hide.

American Institute of Marine Underwriters 14 Wall Street Suite 820, New York, NY 10005 Registered in the U.S. Patent and Trademark Office www.aimu.org | AIMU Connect | YouTube | Linkedin

© Copyright 2013-2020 AIMU. All Rights Reserved. Disclaimer | Privacy Policy | Terms of Service | Site Map Join AIMU | Contact

- Critical Risks

- Risk Management

- The Insurance Industry

- Claims & The Law

- Workers’ Comp Forum

- Risk Insiders

- Sector Focus

Risk Central

- Power Broker

- Risk Matrix

- Risk Scenarios

- Risk All Stars

- Teddy Award

- Sponsored Content

- Branded Webinars

- Digital Issue

- Issue Archive

- National Comp

- National Ergo & Ergo Expo

- Award Applications

Newsletters

- &BrandStudio

- Privacy Policy

- About R&I

The best of R&I and around the web, handpicked by our editors.

White papers, service directory and conferences for the R&I community.

Go to Risk Central.

Digital edition.

Web replica of the print magazine.

View Digital Edition.

Industry perspective, a brief history of marine insurance.

The ubiquitous intermodal box container was developed by Malcolm McLean in 1956. Opposed by longshoremen, railroads, and ship lines, its simplicity and efficiency prevailed, reducing unit costs for retail consumer goods to essentially nothing. But there is a hitch: the efficiency of a pre-packed container means contents are rarely inspected. Flammable or hazardous materials are supposed to be declared, but often are not. As a result, containership fires are not uncommon. The newest massive vessels can carry close to 10,000 40-foot containers, raising new questions about concentration of risk.

Financial history has most often been taken to be the history of money, banking and lending, and stock markets. Fair enough, but insurance deserves equal billing.

It is a widely held belief by insurance professionals and several researchers that marine insurance — hull and cargo specifically — are the oldest forms of insurance. Some date early forms of those to Phoenician traders whose heyday of trading colonies around the Mediterranean began around 1200 BC. The French port of Marseilles was among the farthest west, founded around 600 BC.

Trade over those distances, with voyages lasting weeks and months, clearly involved risks greater than local trade, terrestrial or maritime. The history of business has been driven by the need to concentrate capital. That also means a concentration of risk. The history of insurance has been driven by the concurrent need to transfer and diffuse those concentrated risks.

The prize document in financial history is the oldest known share certificate, representing stock in the Dutch East India Company dated 1606. But marine insurance has that beat by two and a half centuries.

“The first formal marine insurance policy that we would recognize today as such was from 1350,” said Rod Johnson, director of marine risk management at RSA Global Risk, a major UK underwriter. He is also sits on the loss-prevention committee of the International Union of Marine Insurers.

“Marine insurance is based on agreed levels of uncertainty,” Johnson explained. “The owner of the vessel and the shippers of the cargo know where the vessel is supposed to go, but they don’t know exactly where it is or what it is doing at any moment. Neither do the insurers.”

Rod Johnson, director of marine risk management, RSA Global Risk

Those earliest formal policies built on the earliest attempt at international maritime law. According to Medieval Maritime Law from Oléron to Wisby: Jurisdictions in the Law of the Sea by Edda Frankot (University of Groningen/University of Aberdeen), “the most famous medieval sea laws are probably the Rôles d’Oléron (or Jugemens de la mer [Judgments of the Sea]), which are named after a small island off the coast of the medieval duchy of Aquitaine.” They are also known as The Rolls of Oleron.

“They were drawn up in French in or shortly before 1286 and contain regulations for the wine trade from Brittany and Normandy to England, Scotland and Flanders,” Frankot wrote. “The two oldest extant manuscripts containing the Rôles, both from the early 14th century, are of English origin. A mention of the laws in a report written in the 12th year of Edward III’s reign (1329) confirms that the laws were in use in England in the first half of the 14th century. In France, the Rôles d’Oléron had been adopted as the official sea law by 1364.”

If any ship, or other vessel, by any casualty or misfortune happens to be wrecked and perish, in that case, the pieces of the hulk of the vessel, as well as the lading thereof, ought to be reserved and kept in safety for them to whom it belonged before such disaster happened, notwithstanding any custom to the contrary. — The Rules of Oleron (c. 1266) Article XLVI, according to the Admiralty and Maritime Law Guide

There is evidence of insurance-like risk-transfer agreements from Amsterdam in 1598, Antwerp in 1555, and Barcelona in 1484. And indeed, Marine Insurance: Origins and Institutions, 1300-1850 (Adrian Leonard ed. 2016) cites a 1601 quote from Sir Francis Bacon (1561-1626) that marine insurance had existed from “time out of mind.”

While there it is happenstance that centuries-old ephemera such as stock certificates or contracts have survived to provide original source material today, court records are meticulously kept. According to Robert Merkin et al., Marine Insurance Legislation (5th ed. 2014) “There are reports of marine insurance cases coming before the English courts in the 16 th and 17 th Centuries, and it is clear from the early cases that the courts were prepared to enforce marine policies according to their terms.”

The early concepts in marine insurance sorted first by practice, then contract, inevitably litigation, and finally legislation, included the difference between human causes and natural causes (“acts of man” or “acts of God”). Even that, which might seem to be a bright line difference, quickly got murky. A storm is obviously an act of nature, but failure to steer away from a storm, or to secure the vessel against wind and waves, are just as obviously human failings.

It should also be noted that merchants and mariners are among the least likely business persons to resolve matters by litigation and legislation. Intervention by civil and criminal authorities leads to regulation and taxation, both of which limit profitability. The distaste was mutual, that is courts and governments felt the limitations of their jurisdiction and of their expertise in nautical matters and early global trade.

At first, all that was at stake was the capital invested, or sunk, if that became literally true. Shipowners could also take out liens or mortgages on their vessels, called bottomry bonds. Like an equity loan on terrestrial property, the asset could be seized for non-payment. But if the asset were lost, both the owner and the lender were out.

Insurance represented a different approach: contingent capital. It was pledged by underwriters, but not at risk, and could theoretically be extended indefinitely. Underwriters were literally those who signed their names at the bottom of the policy. The synonym at the time was subscribers. They in turn could lay off part of their risk to others to the point where any one loss, or even a group of losses, could be borne by the wider pools of contingent capital.

Interestingly, marine insurance in Europe developed as a way to protect capital, but around the coast of what are today India and Pakistan at roughly the same time it developed as a way to replace capital. Lands bordering the Indian Ocean long had a maritime trading system every bit as extensive as that around the Mediterranean or northern Europe. There was, however, significantly less capital. The loss of a vessel could be ruinous to a fisherman or trader.

Marine insurance is based on agreed levels of uncertainty. The owner of the vessel and the shippers of the cargo know where the vessel is supposed to go, but they don’t know exactly where it is or what it is doing at any moment. Neither do the insurers. — Rod Johnson, director of marine risk management, RSA Global Risk

Early on, British merchants and mariners struck a balance between private and public interests: the club. Groups of traders, shipowners, brokers and investors would pool their resources.

The key factor is that all members of the club were known to each other and usually pledged to do business only within the club. In insurance, the similar form is the mutual in which pooled contingent capital is pledged.

“A succession of wars against France from the end of the 16 th Century had grave effects for both merchant and war vessels,” wrote Merkin.

That “also led to the wave of financial speculation ultimately stamped out by the Bubble Act of 1720, [which] resulted in a prohibition on the carrying of marine insurance by companies other than the two chartered [ones], The Royal Exchange, and London Assurance.”

In February 1688, Edward Lloyd’s Coffee House in Tower Street was referred to for the very first time in the London Gazette , according to the official company history, corroborated by historical references. The article declared a reward for five stolen watches and encouraged anyone with information to contact Lloyd at his shop “in the City.”

To this day “The City of London” is the one-square-mile business center, equivalent to the Financial District in Manhattan.

Lloyd’s coffee house specialized in information about shipping. At this time, there were more than 80 coffee houses within the City of London’s walls, each claimed its own specialization. By the 1730’s, Lloyd’s was emerging as the spot for marine underwriting by individuals.

The American Revolution, followed by the Napoleonic Wars, did not see the dire effects on shipping business as had been seen in earlier naval conflict. That helped to substantiate the viability of contingent risk. Just as important, marine insurance proved to be profitable, attracting more legitimate involvement, business expertise and capital.

Costa Concordia, owned by the world’s largest cruise line Carnival, hit rocks close to the island of Giglio off Tuscany in January 2012, killing 32 people. The captain, who fled as the ship sank, was convicted of manslaughter. The salvage — righting, removing, and scrapping of the ship; as well as payment of damages and environmental restoration — cost $2 billion and took more than two years.

At least one reference dates the first publication of Lloyd’s Ships arrived in 1692 as a news sheet that became Lloyd’s List . The company itself cites 1734 as the initial publication of Lloyd’s List.

“The first edition of Lloyd’s List, one of the world’s oldest continuously running journals, was first published by Thomas Jemson,” according to the official company history.

“He used Lloyd’s name and not his own because by this time, the establishment had instant recognition in the shipping community and a dedicated audience who would pay for subscriptions. More than 300 years on, the paper still provides weekly shipping news to London and beyond.”

Returning to the question of natural versus human causes for loss, an important trial took place in 1764. It was over a ship built in France and insured by Lloyd’s. At the trial after its loss, the vessel was described as being in a “weak, leaky and distressed condition.”

The long case determined that a ship must be seaworthy before leaving shore, and that a loss would not have to be paid on an insured vessel “which suffered from a latent defect unknown to both parties to the contract.”

Favorable rulings and profitability led to a lowering of standards. “Underwriters at Lloyd’s coffee house had enjoyed higher profits in the early 1760s, in part due to the Seven Years’ War, but as it came to an end, marine premiums returned to a lower level,” according to the company history.

This drove certain underwriters to more speculative lines — putting their names to other kinds of risks, including highway robbery and death by gin drinking — and Lloyd’s coffee house soon became notorious as a gambling den.

An extract from the London Chronicle of the time stated: ‘The amazing progress of illicit gambling at Lloyd’s coffee house is a powerful and very melancholy proof of the degeneracy of the times.’” A “new Lloyd’s” was formed by reform-minded members, supported by legislation and regulation.

In 1799 the economy in the German city of Hamburg was in dire straights, and City of London merchants raised a large amount of capital, mostly in specie, to keep its sister port city solvent. The consignment was loaded onto the Royal Navy frigate HMS Lutine, and insured by Lloyd‘s underwriters.

The Lutine was driven ashore in the Netherlands by a storm with the loss of all crew and cargo. In 1858 The Lutine bell was salvaged and hung from the rostrum of Lloyd’s Underwriting Room. Eventually, the bell would be struck when news of an overdue ship arrived — once for its loss, and twice for its safe return.

Just two years earlier the North of England Steam Ship Insurance Association (NESSIA) was founded in Newcastle upon Tyne in January 1856, according to the sesquicentennial history of the successor organization, the North of England Protecting & Indemnity Club.

NESSIA appears to have been among the earliest clubs founded to insure steamships. Although they had been in use for almost half a century, steamships were still a minority of the British merchant fleet, which then accounted for half of all the world’s tonnage.

Some shipowners, especially those in the north of England, bridled at the limited market for insurance, one of the two recognized commercial underwriters, The Royal Exchange and London Assurance, as well as the individuals and clubs in Lloyd’s. By 1824 the legal sanction for that triumvirate was ended, and mutual clubs began to grow.

The North of England Iron Steam Ship Protecting Association, its name reflecting the growing development of the steamship, emerged out of NESSIA in 1860.

“Today the P&I clubs, including 13 international groups, represent about 90 percent of the world’s P&I business,” said Nick Tonge, deputy director (correspondents) at North of England P&I. “There are a few commercial underwriters that get into P&I, and the business is still growing. Vessels are growing in size.”

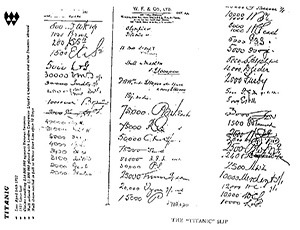

The insurance ticket signing off on the loss of the Titanic. Courtesy: Willis Towers Watson

The most recent set of broad maritime laws pertaining to responsibilities of owners, masters, and shippers is the International Convention for the Unification of Certain Rules of Law relating to Bills of Lading, universally known as the Hague-Visby Rules.

The original Hague Rules were adopted in 1924, then updated in 1968 and 1979.

Interestingly, several major maritime nations “denounced” the original 1924 treaty; notably the U.K., the Netherlands, Finland, Sweden, Denmark, Japan, Australia and Hong Kong. All subsequently accepted the conventions.

Today only four nations refuse to acknowledge Hague-Visby: Paraguay and St. Vincent & the Grenadines stand by their ’24 refusal; Lebanon declined in ’24 and again in ’68. Egypt accepted in ’24 then denounced in ’68.

To be clear, Hague-Visby does not set insurance policy or practice. They are international conventions upon which individual insurance companies or clubs base their policy terms and conditions.

Marine insurance has now developed into about half a dozen distinct lines, some reflecting the original and timeless need to transfer risk for vessel and cargo, and some reflecting very modern perils. Tonge explained that P&I insurance covers primarily liability: crew claims, passenger claims, pollution, cargo damage and some collision.

Nick Tonge, deputy director (correspondents), North of England P&I

The other elemental form of marine insurance is hull and machinery (H&M), the vessel itself. That is handled largely by brokers in the commercial market.

The third line is freight, demurrage and defense (FD&D) that primarily protects charterers. Today, vessel owners tend to be investors that lease to operators on various types of time charters. “FD&D indicates what the owner is responsible for, and what the charterer is responsible for, but a lot of disputes still arise,” said Tonge.

The other three major forms of modern marine insurance are specialized. There is war-risk cover because acts of war are specifically excluded by both P&I and by H&M. There is also strike cover, to offset expenses arising out of labor disputes by stevedores, pilots and other trades essential to getting vessels loaded and unloaded. And, sadly, there is kidnap and ransom insurance.

For a business practice that dates back millennia, marine insurance continues to develop. The latest element is the newest in all of business: distributed-ledger systems, also known as blockchain technology. While these systems arose out of dodgy cryptocurrencies, it is just this year being put to legitimate commercial use by several consortia of steamship lines, underwriters and brokers.

For example, a vessel is supposed to have war-risk cover if it will be passing through a designated war zone. Often insureds choose not to take on that cost, which can be considerable.

With satellite navigation and “smart” contracts using a blockchain, a vessel can effectively go on-risk if it enters a danger zone and off-risk when it leaves, with the premium pro-rated for only the actual on-risk time rather than the whole voyage.

But even with such digital developments, marine insurance retains its history. P&I contracts are still renewed on February 20 because that was the earliest date on which Tyneside traders could leave port and cross the North Sea to the Baltic and find it free of ice.

The Lutine bell is still rung at Lloyd’s to herald news of an overdue vessel.

And even on the inland seas of North America, “The legend lives on from the Chippewa on down, of the big lake they called ‘Gitche Gumee.’ … And the iron boats go, as the mariners all know, with the gales of November remembered.”

The author thanks Taryn L. Rucinski, supervisory librarian at the U.S. Court of International Trade, for her insight, diligence and cheerful support of in finding and providing research materials.

Reprinted with permission from the Winter 2018 Edition of Financial History Magazine ( https://joom.ag/tYCY ), quarterly publication of the Museum of American Finance ( www.moaf.org ). All rights reserved .

Share this article!

Trending stories.

Planck’s Leandro DalleMule Discusses the Ethics of AI in Insurance

10 Questions for Andrew Wynn, Founder and Co-CEO of Ascend

Triaging Operational Risks: A Practitioner’s Guide to Business Continuity

The Insurance Communicators: 8 Questions for Mairi Mallon, Founder and CEO of Rein4ce

More from risk & insurance.

Chloe Gordge Promoted to Head of Terrorism for Markel in London

The latest people news in the industry today

ITC Vegas 2023

ITC Vegas is the world’s largest insurtech event – offering unparalleled access to the most comprehensive and global gathering of tech entrepreneurs, investors, and insurance industry leaders. Use discount code 200ITC131 to receive $200 off the registration.

Noel Pearman Appointed as Chief Underwriting Officer for Bermuda at AXA XL

The latest people news in the industry today.

Driving Toward Coverage Solutions on the Bumpy Road of Commercial Auto

In the wake of insurer exits, rising claims costs and increased risks, what’s ahead for the commercial auto insurance industry?

Sponsored: Pinnacle Actuarial Resources Inc.

Captives for hoas a new utah regulation allows the alternative risk transfer solution to extend into personal lines.

A homeowner might feel good knowing their property is insured against anything that could happen.

But that can change in an instant. Massive rate increases, non-renewal notices and a decline to offer new coverage in particular geographies are becoming the norm in many parts of the country as insurers try to remain financially viable amid shifting climate risks.

It’s a particular problem in the Western U.S., where states like California , Utah and Nevada have to contend with brutal wildfire seasons and the loss of high-value homes. Homeowners in the Southeast, particularly Florida, face similar concerns as hurricane risk creates problems with coverage availability and affordability.

“If a wildfire were to sweep through a neighborhood of multimillion-dollar homes, the damage could easily reach hundreds of millions of dollars,” said Greg Fears Jr., director and consulting actuary, Pinnacle Actuarial Resources.

As homeowners insurance carriers across the country pull out of regions with significant catastrophe risk, Utah is piloting an innovative solution: allowing homeowners associations (HOAs) to form their own captives to offer homeowners insurance policies to their members.

How Frustrated Homeowners Brought Personal Lines Captives to Utah

Greg Fears Jr., Director and Consulting Actuary, Pinnacle Actuarial Resources

The amendments to Utah’s captive legislation came after homeowners and HOAs expressed frustration at not being able to find insurance coverage. Historically, domiciles have only made captives available to commercial insureds.

“This represents a significant shift in the captive insurance space, as most domiciles have traditionally prohibited captives from operating in the personal lines market,” Fears said.

Under the amended regulations, HOAs can establish an association captive to provide homeowners insurance policies to their members.

Each HOA will be able to determine if all of its members are required to participate or if some can opt out of the program. HOAs should have no issue bolstering membership, however. They often have meetings where they can tell association members about captives and their advantages.

The approach can be used to offer coverage in areas where insurers have withdrawn or to fill gaps created by policy exclusions. HOAs will also be able to access reinsurance through their captives, opening up that market to their members as well.

“It’s an exciting new business area with significant potential for growth and innovation in the reinsurance sector,” Fears said.

HOAs are uniquely positioned to run an association captive program for personal lines insurance. Many of them already set guidelines for how members must maintain their homes and what vegetation they can and cannot have. These are valuable tools in making properties resilient against natural disasters.

“HOAs can require homeowners to take specific risk mitigation measures,” Fears said.

“By leveraging these assessments, HOAs can ensure that all participants in the captive insurance program adhere to the necessary risk mitigation measures, ultimately reducing the overall risk exposure for the community.”

Utah may be the first state to amend its regulations, but that doesn’t mean these captives are limited to the state. HOAs located anywhere across the country can domicile their captive in Utah, subject to state laws and banking requirements.

If the experiment proves successful, other states will likely amend their regulations to allow for similar systems — especially since natural catastrophes and dwindling homeowners insurance policies are a national problem. Florida is contending with similar issues due to its hurricanes and sinkholes. Tornadoes, hailstorms and derechos have the potential to create the same kinds of problems for the Midwest .

“Coastal properties, in general, face heightened risks,” Fears said. “Assuming Utah’s approach proves successful in attracting captives, I expect this to become one of the most significant trends in the captive insurance market over the next year or so.”

The Best Practices for Personal Lines Captives

Utah’s law is still new, and the best practices for HOA-sponsored captives are still evolving (the first HOA captive hasn’t launched yet). Still, there is a lot that HOAs considering captives can learn from commercial insurance companies.

“The general approach is to follow the lead of traditional carriers while addressing the specific exclusions and risks that commercial policies often fail to cover,” Fears said.

For starters, HOAs will need to determine how much capital they need for their captive. To do that, they’ll need to assess the value of the homes in the program, determine any deductibles and complete a number of other calculations so that they know how much they need. At this stage, they’ll also want to assess how much reinsurance they think the program needs.

“Determining the appropriate amount of capital for a captive is crucial,” Fears said. “The captive must have enough funds to pay claims, which relies on homeowner participation and premium contributions.”

A significant amount of learning will be needed for HOA captives to be successful: “[As] homeowners associations and individual homeowners are often new to the concept of captives, there is a significant educational component involved,” Fears said. Captive managers and consultants can help them learn what it takes to launch a captive and keep it stable in the long term.

“They are well-positioned to outline the necessary steps for forming a captive and obtaining the required licenses,” Fears said.

Finding the Right Captive Management Partners

Utah’s new regulations might be intriguing, but for this to be a viable risk financing solution for homeowners policies, HOAs will need to find the right partners to support their captive.

Strong captive managers, actuaries and other team members are critical to ensuring a captive’s success.

Pinnacle Actuarial Resources has a wealth of experience working in both the captives and the homeowners insurance spaces. Its actuaries are well-poised to help HOAs that are starting down the path of developing their captives.

Actuaries can assess past loss experience and help HOAs set appropriate reserves for their exposures. Pinnacle has already taken steps to establish itself as a leader in this new space. Shortly after Utah amended its regulations, Pinnacle published an article outlining what these changes could mean for the industry.

“It’s clear that this topic has piqued the interest of many in the industry, as it represents a unique and innovative approach,” Fears said. “The volume of inquiries we’ve received since publishing our findings speaks to the relevance and potential impact of this development.”

While these developments are intriguing for the captives space at large, the solutions will need some fine-tuning to help HOAs operate as effective captive owners. Pinnacle feels eager and able to help potential insureds explore these new opportunities.

“We are well-positioned to address these challenges, and I’m optimistic about the potential solutions on the horizon,” Fears said.

To learn more, visit: https://www.pinnacleactuaries.com/ .

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Pinnacle Actuarial Resources, Inc. The editorial staff of Risk & Insurance had no role in its preparation.

IMAGES

VIDEO

COMMENTS

Get Boat Insurance For As Low As $100/Year. One Visit Could Save You Money! Insure Your Boat With Progressive and Save. Get a Free Quote and Buy Now!

Compare the Best Boat Insurance Providers. Get Financial Protection for Your Watercraft. Expert Reviews & Analysis. Ratings Updated July. Trusted by Over 1,000,000 Customers

CALL US TODAY: 1-800-BOAT-INS [800.262.8467] Accidents happen to even the most careful yacht and boat owners, which is why proper boat and yacht insurance coverage is essential. National Marine Underwriters (NMU) can help provide protection specifically designed for your unique boat and yacht insurance needs.

Marine Underwriters of America (MUA) is a one-stop-shop for all of your marine insurance needs. We are the premier underwriter of ocean marine, inland marine, and related property for the commercial and recreational marine customer. With over 200 years of combined marine experience, you will be impressed with our product knowledge, creativity, response, and innovative service. We distribute ...

Above and Beyond Since 1989. Since 1989, Anchor Marine Underwriters has been providing exceptional service to our clients throughout the United States. Our clients include boat and yacht owners, charter operators, commercial vessels, floating property owners, personal lines clients and owners of marine-related businesses. Our knowledgeable ...

Boat Insurance Quotes on your screen in 90 seconds. United Marine Underwriters Toggle navigation (800) 477-7140 (502) 222-0199 Get Quote smsText ... United Marine Underwriters specializes in protecting this lifestyle. We are specialty marine insurers, catering specifically to meet the needs of boat owners and their boating activities. ...

Marine Underwriters Agency is a leader in yacht and power yacht insurance. Based near Charleston, SC we have an amazing team of talented agents who are experts in the field of watercraft insurance. We think about the details of owning your yacht, and know how to set up policies to reduce your stress and get you the best possible deal on boat ...

The marine insurance leader for over 45 years. Find a Markel marine agent and get a free, no-obligation quote today. If you love your yacht, you'll love our insurance. We've been the yacht insurance leader for over 45 years because we provide coverages that fit your yacht and your lifestyle. Markel yacht insurance can offer distinct ...

Get the on-the-water protection you need with Newcoast yacht insurance services today! ... Their deep experience includes the added advantage of also being current or former yacht program underwriters. Building Relationships. We nurture outstanding personal relationships with our clients, be it the owner, the Captain, the yacht manager, the ...

The Atlass Insurance Group has direct access to most of the leading U.S. and London recreational marine boat insurance and yacht insurance underwriters. Because of our constant communication with the marketplace and ability to access those underwriters, we are able to provide the broadest coverage at the best terms to our clients.

United Marine Underwriters is an insurance agency not an insurance company — this puts you at an advantage when comparing yacht insurance quotes. Benefits that we offer include obtaining multiple yacht insurance quotes as well as individualized customer service. Our agents are here to help you find your best possible yacht insurance quote.

National Marine Underwriters can help provide boat and yacht protection specifically designed for the unique needs of today's boat owners. Written in plain language so that you can fully understand the coverage provided, boat and yacht insurance policies are flexible so we can customize to your particular needs.

United Marine Underwriters is in our 21st year providing boat insurance. You and your Ocean will benefit from the yacht insurance coverages offered at United Marine Underwriters. Get online boat insurance quotes instantly with United Marine Underwriters. We specialize in protecting your Ocean and your lifestyle. Get A Quote.

There are pros and cons to living on a boat, but the pros outweight the cons for many. If you are looking to make the jup and live aboard your boat and need insurance, we can help. Let Marine Underwriters Agency protect you and your yacht while you're living the dream! Call us today or fill out this form to get a quote. Available Coverage

Marine Underwriters Agency is a leader in megayacht insurance. Based near Charleston, SC we have an amazing team of talented agents who are experts in the field of watercraft insurance. We think about the details of owning your megayacht, and know how to set up policies to reduce your stress and get you the best possible deal on boat insurance.

For example, if your water pump is defective, your yacht insurance policy will not offer coverage for replacing or repairing the water pump, but will pay for resulting damage to the engine. To learn more about yacht insurance policies or to schedule an appointment with Atlas Underwriters, please call at (954) 318-7940. View Brochure.

The American Institute of Marine Underwriters (AIMU) has 125 years of service as the trade association representing the United States ocean marine insurance industry as an advocate, educator and information resource. AIMU provides an active program of support services to assist the U.S. marine insurance industry in providing its global ...

Boat Owners Insurance. United Marine Underwriters provides quality protection for virtually any type and size of watercraft at competitive market rates. As an industry leader we understand the investment at stake for boat and watercraft owners, and we strive to protect that investment for you by providing the best boat or watercraft insurance ...

There is evidence of insurance-like risk-transfer agreements from Amsterdam in 1598, Antwerp in 1555, and Barcelona in 1484. And indeed, Marine Insurance: Origins and Institutions, 1300-1850 (Adrian Leonard ed. 2016) cites a 1601 quote from Sir Francis Bacon (1561-1626) that marine insurance had existed from "time out of mind.".

The Inland Marine Underwriters Association [IMUA] is a not-for-profit national trade association comprised of: Members — insurance and reinsurance companies that underwrite a significant portion of the commercial inland marine insurance in the U.S. Associate Members — companies that provide products and/or services to the insurance industry.

Find 8 listings related to Underwriters in San Jose on YP.com. See reviews, photos, directions, phone numbers and more for Underwriters locations in San Jose, CA. ... insurance. Boat Insurance Business Insurance Car Insurance Dental Insurance Disability Insurance Flood Insurance Home Insurance Insurance Liability Insurance Life Insurance. legal ...

We make boat insurance quotes easy. Get a quote online or by phone, quotes on your screen in 90 seconds. Customize your boat insurance quote using our edit and shop options. When you're ready to purchase, we can email the policy within minutes. Our quick quote provides competitive boat insurance rates from the best boat insurance companies.

Terry Raisley , Santa Clara, CA. 479 reviews. In-Person or Virtual. Appointments Available. Email. Make an appointment. Call 24/7. (408) 247-7995 to quote by phone. Quote online.

At MUA, each application is reviewed by an underwriter - someone who knows the business and can get you the most credits possible, thereby keeping your premium as low as possible with the most coverage! Once the online quote form is submitted, one of our marine insurance specialists will contact you within two business hours.

Marine Underwriters Agency, Inc. provides a broad range of comprehensive boat insurance, marine insurance and yacht insurance policies at low rates. From small boats to megayachts, our boat insurance experts can help you find the best marine coverage for your watercraft. We have an exceptional team of professionals to help you with all types of ...

Count a gritty marine insurer as part of the exclusive Supreme Court's 9-0 club; winners by knockout in a hotly contested marine insurance dispute that braved its way from the District of ...