- Create Account

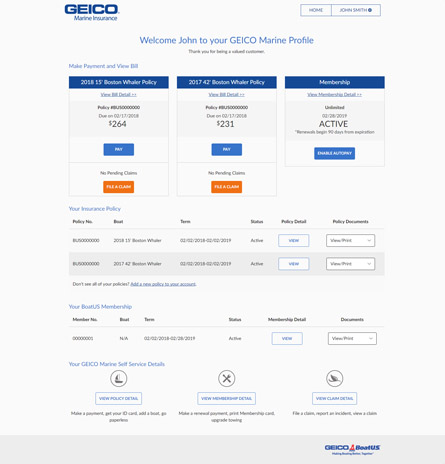

Welcome to Your Account

Make a payment, get your ID card, add a boat

BoatUS Membership

Renew, print BoatUS Membership card, upgrade towing

File a claim, view a claim, upload documents

Manage Accounts

Update contact info, view all your products

Manage your account

Manage your geico boat insurance policies and boatus membership anytime with your account page. for other geico insurance policies, please visit geico.com or contact your local agent..

GEICO and BoatUS - We've teamed up to provide a great policy serviced by boating experts.

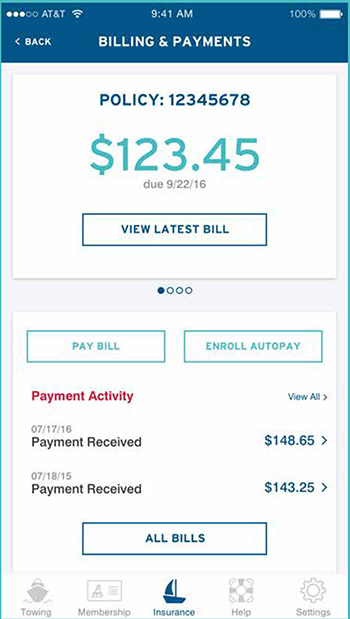

New BoatUS mobile app features

Manage your insurance policies, and boatus membership services anytime through the new boatus app.

Download the New BoatUS App today at BoatUS.com/App

When you use links on our website, we may earn a fee.

Best Boat Insurance of 2024

Table of Contents

- Best Boat Insurance

- Things To Consider When Buying

- How We Chose

Boat insurance is a type of coverage designed to protect boat owners and their personal property in the event of an incident on the water. The best boat insurance companies offer flexible coverage options for a variety of vessels, with reasonable premiums and lots of additional benefits.

Every person who owns or operates a boat should consider carrying boat insurance , as it protects them against personal liability if they’re in an accident, as well as guarding them against loss if something happens to their vessel. In this guide, we’ll explore some of the best companies that offer boat insurance, what they offer, as well as their benefits and drawbacks. We’ll also discuss special coverage options for particular use cases or types of boats.

- Best Overall: Geico Marine »

- Best for Fishing Enthusiasts: Markel »

- Best for Yacht Owners: Chubb »

- Best for Jet Ski and Personal Watercraft Owners: SkiSafe »

- Best for Houseboats: American Family »

- Best for Discounts: Progressive »

Best Overall: Geico Marin e

Insures boats up to 50 feet in length

Gives policyholders access to BoatUS Catastrophe Team

Insures boats valued up to $2.5 million

Doesn’t insure wood or composite boats

Boats more than 40 years old aren’t eligible for coverage

Geico Marine has been writing boat insurance since the 1980s. Originally established as Seaworthy Insurance, the company was bought by financial giant Berkshire Hathaway in 2007.

Under the Geico umbrella, Geico Marine offers insurance designed to meet the needs of the vast majority of boat owners. The list of boats that are ineligible for coverage by Geico is far shorter than those that are. Disqualifying criteria include:

- Boats over 50 feet in length

- Boats over 40 years old (15 years for houseboats)

- Multihull sailboats (catamarans)

- Watercraft made of wood or composite material

- Homemade boats

- Amphibious land boats or hovercraft

- Boats previously deemed a total loss

- Boats valued over $2,500,000

In addition to its strong lineup of coverages, Geico Marine insurance also comes with 24/7 assistance. Additionally, the company has a long-standing association with The Boat Owners Association of the U.S. (BoatUS), including giving policyholders access to the BoatUS Catastrophe (CAT) Team. The BoatUS CAT Team is a group that brings considerable resources to bear – including towboats and cranes – to help BoatUS members and Geico customers recover and salvage their vessels after a natural disaster.

Coverages Offered:

- Not disclosed

Exclusions:

Navigational Limits:

Discounts and Benefits:

Salvage Coverage:

- 24/7 assistance dispatch

- Access to BoatUS Catastrophe Team

Insurer Financial Strength:

- A++ (Superior) rating by AM Best

Best for Fishing Enthusiasts: Markel

Special coverage for rods, reels, and other equipment

Emergency towing and personal property coverage included

Lift and trailer coverage available

Claims can take a few weeks to settle

Some negative customer reviews online

Specialty insurer Markel is another provider of boat insurance. Markel boat insurance policies come with multiple coverages included and even more optional coverages available, including many not available from other insurers. Several of these special coverages are geared towards fishing enthusiasts, including both amateurs and professionals.

Among Markel’s special coverages for fishers are protections for rods, reels, and other personal effects, plus coverage for boat lifts and trailers. The company even offers professional angler liability coverage and tournament fee reimbursement as optional add-ons.

However, according to Markel’s documentation and customer reviews online, the company can take up to several weeks to settle claims. This is somewhat longer than some other providers. Customers have also noted that claims can take longer and be more involved, increasing the time it takes to get boats repaired or replaced.

- Watercraft liability

- Medical payments

- Agreed value watercraft and equipment

- Emergency towing

- Personal effects

- Uninsured/underinsured boater

- Pollution liability

- Replacement cost settlement

- Boat lift

- Trailer

- Fishing equipment

- Professional angler liability

- Tournament fee reimbursement

- Crash damage

- Theft coverage

- Theft away from home

- Wreck removal

- Cost of gas, oil, parts, or a loaned battery in the event of a breakdown

- Experienced boater

- Vanishing deductible for loss-free boaters

- Multi-boat policy

- Outboard propulsion

- Primary operator age 40 and over

- Diesel engine

- Wreck removal coverage included

- A (Excellent) rating by AM Best

Best for Yacht Owners: Chubb

Coverage designed specifically for yacht owners

High coverage limits available for captained vessels

Vessels must be 36 feet longer or greater to qualify for yacht coverage

Crew required for vessels over $3 million

Global insurer Chubb is one of the few large carriers that offers boat insurance designed specially for yachts, including those over 70 feet in length with professional captains and crews.

Yacht insurance from Chubb is available for pleasure cruisers at least 36 feet long (and valued up to $3 million), as well as captained yachts at least 70 feet long and valued at $3 million or more.

Among the niche yacht coverages available from Chubb are:

- Search and rescue

- Longshore and harbor workers’ compensation

- Boat show and demonstration

- Oil Pollution Act

Yacht insurance from Chubb can even include temporary substitute watercraft, so you can still enjoy the water if your yacht is damaged and requires repairs.

- Agreed value

- Liability protection for both owner and crew

- Replacement cost loss settlement

- Uninsured/underinsured boater

- Medical payments

- Search and rescue

- Longshore and harbor workers’ compensation

- Personal property and fishing equipment

- Marina

- Boat show and demonstration

- Precautionary measures

- Bottom inspection

- Oil Pollution Act (OPA)

- Temporary substitute watercraft

- Marine environmental damage

- Emergency towing and assistance

Best for Jet Ski and Personal Watercraft Owners: SkiSafe

Coverage specifically designed for personal watercraft

Vessels are still covered during winter lay-up periods

Water sports liability coverage is included

No coverage for commercial use

$25,000 limit for no-fault medical payments

Specialty provider SkiSafe is one of the biggest personal watercraft insurers you’ve never heard of. The company doesn’t underwrite its own policies; that’s handled by AXIS Insurance Co., a large Bermuda-based insurer. SkiSafe has been around for nearly 50 years and insured more than half a million boaters.

Boat insurance from SkiSafe is designed to meet the needs of personal watercraft owners. As a result, coverages are fairly consolidated and focus specifically on the reduced needs of these types of boaters. Naturally, there is a heavy focus on coverage for injuries, including related to water sports. However, there are also special savings related to lay-ups, since the season for personal watercraft can be relatively short compared to other types of boats.

- Physical damage

- Bodily injury

- Medical payments ($25,000 limit for no-fault medical payments)

- Water sports liability

- Commercial use is not covered

- Roadside assistance

- Policies have stated navigational limits

- Owners can’t take vessels to another country without prior approval

- Boating safety course

- Clean driving record

- Restricted navigation territory

- Multi-craft

- Winter layup

- AXIS Insurance Company is rated A+ (Superior) by AM Best

Best for Houseboats: American Family

Special coverage designed specifically for houseboats

Up to $100,000 of personal effects coverage available

Boats up to 54 feet can be covered (40 feet in Georgia)

A marine survey may be required

Must work with a local agent to buy coverage

American Family is unique among boat insurance carriers in that it’s one of few that offers a policy designed specifically for houseboats. Included in American Family houseboat policies are several coverages that cater specifically to these types of vessels, including up to $100,000 for your personal property in case items are stolen, damaged, or fall into the water.

Houseboat insurance from American Family may lack some coverages you might find with other types of vessels, such as emergency towing or parts delivery (these are included in some boat policies from American Family, but it’s unclear from the website whether they’re included in houseboat policies). Additionally, these policies have restrictions specific to houseboats, including horsepower limitations. But, American Family also offers unique discounts particularly helpful for houseboat owners.

- Property damage (liability)

- Medical expenses

- Watercraft equipment

- Houseboat repair cost

- Total loss agreed value

- Houseboats can’t be used as a permanent residence

- Vessels can’t be used for business purposes (separate coverage required)

- Boats must be 54 feet or shorter (40 feet in Georgia)

- Vessel MSRP must be less than $250,000

- 500 horsepower limit for single-engine boats and 1,000 for dual-engine craft

- Boating safety features

- Autopay and paperless

- Premium paid-in-full

- Multi-policy bundling

- Diminishing deductible

Best for Discounts: Progressive

Numerous discounts available

Can buy coverage online

Up to $1,000 of coverage if a pet is hurt or killed in a boating incident

Lots of limits on boat length and value

Many types of vessels are ineligible for coverage

Rounding out our list is insurance giant Progressive, which also has a strong boat insurance offering. Progressive has been insuring boats for more than three decades and insures more than 1 million vessels. Its policies should meet the needs of most owners of boats less than 50 feet long and worth less than $500,000.

Where Progressive really shines, though, is in its list of available discounts. Progressive offers boaters not just the standard discount opportunities available with other insurers, such as multi-policy, multi-boat, or paid-in-full discounts. Progressive also offers savings simply from switching coverage from another country. Additionally, accident forgiveness is also available for incidents both large and small.

- Full replacement cost

- Bodily injury

- Property damage liability

- Water sports

- Total loss replacement (optional)

- Fishing equipment or carry-on item (optional)

- Mechanical breakdown (optional)

- Comprehensive (optional)

- Collision (optional)

- Uninsured/underinsured boater (optional)

- Medical payments (optional)

- Trailer trip interruption (optional)

- Boats less than 10 years old must be worth $500,000 or less

- Boats 11 to 20 years old must be worth $350,000 or less

- Boats more than 20 years old must be worth $75,000 or less

- Boat can’t be used as a primary residence (liveaboards)

- Houseboats must have motors

- Homemade boats without a hull identification number are ineligible for coverage

- Boats can’t have more than two owners

- Boats can’t have steel or wood hulls

- Amphibious land boats, hovercraft, and airboats worth more than $27,000 are ineligible

- Boats must meet published U.S. Coast Guard standards

- Boats must also be 50 feet long or shorter (limits can be 35 feet and $175,000 in value in some states)

- Multi-policy

- Multi-boat

- Responsible driver

- Original owner

- Transfer from another company discount

- Associations (including United States Coast Guard Auxiliary, United States Power Squadron, USAA members in some states)

- Advanced quote

- Pay in full

- Prompt payment

- Safety course

- Small-accident forgiveness

- Large-accident forgiveness

- Disappearing deductibles

- Wreckage removal

- On-water towing (optional)

- A+ (Superior) rating from AM Best

The Bottom Line

Boat insurance is a highly individual product, much more so than auto or home insurance. Because boat owners’ needs vary greatly, it’s important to research providers to find the right carrier for your vessel and use case. Based on our research, we found that Geico is the best insurance company available for the widest array of vessels and the most common types of uses.

Things To Consider When Buying Boat Insurance

- Coverage options : When looking for coverage, be sure to focus on the standard protections included in policies from each carrier, as well as optional add-ons available.

- Policy limits and deductibles : Pay close attention to coverage limit type (such as replacement cost or agreed value), vessel value limitations, and policy deductibles for each carrier.

- Navigational limits : Some carriers have limits on where their coverage is active, though few disclose this information publicly.

- Additional services and benefits: Extra features like 24/7 assistance, emergency towing, or part delivery can add significant value to a boat insurance policy.

- Exclusions and limitations: Many carriers have exclusions for certain activities (such as commercial use), as well as certain types or values of vessels.

- Agreed value vs. actual cash value: Some insurers offer boat coverage up to a specific value or amount agreed upon by the insurer and owner (typically, at the time the policy is written) should a covered incident occur, whereas other companies only may cover the actual cash value of your vessel.

- Discounts and special offers : Multi-policy and multi-boat policies are common, but more niche discounts can offer greater opportunities to save.

How We Chose the Best Boat Insurance

To identify the best boat insurance, we reviewed offerings available from numerous reputable carriers. We focused primarily on those with solid financial ratings and comprehensive coverage options to meet the needs of a wide array of boaters. We then narrowed down our selections to those providers with best-in-class offerings specifically designed to meet certain types of boaters.

WHY SHOULD YOU TRUST US?

At U.S. News 360 Reviews, our contributors and editors have years of experience researching and reviewing complex financial topics including insurance policies. Dock David Treece , the author of this piece and a senior contributor for 360 Reviews, has more than two decades of experience in the finance and insurance industry. He has covered insurance and other financial topics for Forbes, Investopedia, Business.com, and other publishers. He has also written for several insurers, including Progressive.

Based on our research, Geico Marine offers the best boat insurance policies for the greatest number of boat owners and operators.

Boat insurance is not required in most states. However, if you have a loan secured by a boat, most lenders require that you buy boat insurance. Additionally, boat insurance can protect owners and operators against personal liability if they’re involved in an accident.

When you buy boat insurance, you’ll need to provide several pieces of personal information, as well as information about your boat and applicable licenses. Depending on the type of boat and policy, you may also be required to submit a marine survey, which assesses the condition of your vessel.

Boat insurance does not typically have a waiting period before you can file a claim.

Some insurers allow policyholders to insure multiple boats under the same policy, so long as they all have the same owner(s). Many carriers also offer discounts for owners who insure multiple boats with the same company.

Depending on the size, type, and value of the vessel being insured, some carriers require a boat to undergo an inspection (called a marine survey) in order to assess the boat’s condition prior to binding coverage.

U.S. News 360 Reviews takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

- 2024 BOAT BUYERS GUIDE

- Email Newsletters

- Boat of the Year

- 2024 Freshwater Boat and Gear Buyers Guide

- 2024 Boat Buyers Guide

- 2024 Water Sports Boat Buyers Guide

- 2023 Pontoon Boat Buyers Guide

- Cruising Boats

- Pontoon Boats

- Fishing Boats

- Personal Watercraft

- Water Sports

- Boat Walkthroughs

- What To Look For

- Best Marine Electronics & Technology

- Watersports Favorites Spring 2022

- Boating Lab

- Boating Safety

Selecting the Right Insurance Policy for Your Boat or PWC

- By Lenny Rudow

- February 21, 2024

You can choose to work with a major company, such as getting Geico boat insurance or Progressive boat insurance, or you can go to a smaller provider. But one thing is for sure: If you have a boat or PWC, you will need insurance coverage. However, just which coverage is best for your needs can be a be a bit confusing. Just like for homes and automobiles, there are many different levels of coverage, terms and types you’ll need to sort through. Are you ready to dive into the details?

Article at a glance:

- Different types of boat insurance

- Choosing between the insurance options

- How to purchase insurance

Comparing Different Boat Insurance Policy Types

When purchasing boat insurance, you’ll generally need to choose between three different types: agreed hull value, actual cash value, and liability only. Unlike automobile insurance, the type of coverage you get isn’t mandated by law in most states (though it is in Arkansas and Utah). Most people decide which plan to opt for depending on the value of the boat, the age of the boat, how it’s financed, and where they keep or use it.

– LOWER YOUR RATES – Taking a boating safety course won’t just make you a better skipper. It could also help you save big on insurance. Safety Tip Provided by the U.S. Coast Guard

Agreed Hull Value

Insurance policies that cover the agreed hull value specify a valuation of the boat, which will be the amount you receive in case of a total loss. This type of policy tends to cover (and cost) more than the others. Smaller insurance companies might not even offer it, while the big players like Geico boat insurance and Progressive boat insurance generally do. These policies often can be purchased with additional forms of coverage, like fuel-spill liability, towing coverage, or roadside assistance for trailer boaters.

Actual Cash Value

Actual cash value policies are the most common and cover your boat for its current market value. Because they take depreciation into account, they’re generally less expensive than agreed hull value policies. Actual cash value policies can usually be purchased with additional forms of coverage too.

Liability Only

The least expensive option is liability-only boat insurance, which only covers things like medical payments arising from accidents or protection from other boaters who are uninsured. Many marinas and boatyards will require you to have liability coverage at the very least.

– DON’T FORGET THE RADIO – A VHF marine band radio is your first line of communication on the water, allowing you to talk to the Coast Guard and other boat traffic. Use Channel 16 only for hailing and emergencies. Safety Tip Provided by the U.S. Coast Guard

Choosing Boat Insurance Coverage Options

Different policies can cover different events, like theft, hurricane haul-outs or salvage assistance. Depending on where you live, these can be more or less important. Someone in Iowa probably doesn’t need hurricane haul-out coverage, for example, while a boater in Florida most certainly does. You’ll also usually need to meet certain coverage requirements if your boat is financed because the lender will want to know they’ll get paid in case of an incident. Some of the most important options to consider include medical payments, uninsured boater coverage and salvage coverage.

Medical Payments

Most comprehensive policies will include some level of medical-payment coverage, which takes care of expenses in case someone aboard gets injured. These are generally capped at a certain level, which varies by policy.

Uninsured Boater

You can do everything right and still have an accident thanks to someone else. If they don’t have insurance, you’ll be glad you have uninsured boater coverage.

Total Salvage

Salvaging a boat can be very expensive, and laws can require owners of stricken vessels to have them salvaged. These policies usually cover salvage expenses up to the hull value of the boat.

How to Purchase Boat Insurance

In most cases, purchasing boat insurance is just a click away because you can get quotes online and compare the different options on the insurance company websites. With larger, more expensive boats, however, having an accredited surveyor inspect the boat might be necessary. This is usually the case when it comes to getting insurance for used boats.

Discounts for Boater Safety Courses

Boater education doesn’t just keep you and your family safe on the water. It can also help you save big on insurance. Providers offer discounts of up to 15 percent on boat insurance for completing a boating safety course. Check with your provider, and find classes through the Coast Guard Auxiliary or U.S. Power Squadron.

– INVEST TO IMPRESS – A boating course is a great way to gain confidence and boat-handling skills. A little practice now will make it look easy when everyone is watching. Safety Tip Provided by the U.S. Coast Guard

Closing Remarks & FAQ

Beyond any legal or financing requirements, which insurance you opt for is a personal decision, just as it is with a home or automotive policy. Choose more coverage and spend more on the premiums, or choose less and save on the cost, just as long as the decision lets you sleep well at night.

- What are the main types of boat insurance policies? Agreed value, actual value and liability only are the three main types of boat insurance policies.

- What are some typical boat insurance coverages one should consider? The most common are medical payments, uninsured boater, total salvage, towing, hurricane haul-out, fuel-spill liability, theft, roadside assistance and personal-effects coverage.

- How does location factor into boat insurance coverage? It impacts the need for weather-related coverage, and it can require you to have a documented “storm plan” for taking care of the boat when a named storm approaches. Location can also affect theft coverage, uninsured boater coverage and other protections.

- Will boat insurance cover anyone who operates the vessel? This depends on the policy. Most will cover other operators and family members who use the boat with your permission, but they won’t cover renting or leasing your boat to someone.

- Should boat insurance be bundled with other insurance products? It’s up to you, but you can save money by doing so in many cases.

- Is it ever wise to operate a boat without any insurance coverage? That depends on your personal tolerance for risk. That said, it’s far more worrisome with some boats than others. At one extreme, taking a rowboat out on a lake without insurance is probably fine, but casting off the lines on an uninsured million-dollar yacht would certainly seem dicey.

- More: Boating Safety , coast guard , finance and insurance , How-To , Water Sports Foundation

More How To

I Learned About Boating From This: Capsize, Rescue and Lessons Learned

Should You Abandon Ship During a Boat Fire?

38 Top Make-Ready Tips for the Spring Boating Season

On Board With: Andrew Robbins

Boat Test: 2024 Regal 38 Surf

Using Hydrofoils to Improve Boat Performance

We Test Interlux Trilux 33 Aerosol Antifouling Paint

- Digital Edition

- Customer Service

- Privacy Policy

- Cruising World

- Sailing World

- Salt Water Sportsman

- Sport Fishing

- Wakeboarding

Many products featured on this site were editorially chosen. Boating may receive financial compensation for products purchased through this site.

Copyright © 2024 Boating Firecrown . All rights reserved. Reproduction in whole or in part without permission is prohibited.

Boat Insurance from Experts.

Boat insurance from experts.

Your online quote is just minutes away!

- Policies for All Boat Types - Yacht to PWC

- Coverage for Fishing and Watersports Gear

- Unlimited Towing from TowBoatUS

- 24/7 Claims Service from Boating Experts

- Multi-Policy Discounts - Bundle and Save!

BoatUS and GEICO have teamed up to bring boaters a great boat insurance policy at a great price.

You are using an outdated browser. Please upgrade your browser to improve your experience.

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Boat Insurance: Allstate , Progressive , BoatUS , and Geico .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective (meaning two companies are very close) our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don't click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Product name, logo, brands, and other trademarks featured or referred to within our site are the property of their respective trademark holders. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services.

- Boat Insurance

- Geico Review

Geico Boat Insurance Review

The following companies are our partners in Boat Insurance: Allstate , Progressive , BoatUS , and Geico .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity. Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

How is Geico rated?

Overall rating: 3.9 / 5 (very good), geico coverage & benefits, coverage & benefits - 4.5 / 5, geico customer experience, customer experience - 4 / 5, geico financial strength & reputation, financial strength & reputation - 3.5 / 5, company profile.

Our Comments Policy | How to Write an Effective Comment

6 Customer Comments & Reviews

- A++ rating by A.M. Best for financial stability

- Offers up to $1,000,000 liability coverage per person

- Policy includes both boat and trailer coverage

- Provides 24/7 towing, fuel delivery, and digital dispatch

Related to Boat Insurance

Top articles.

- Preparing Your Boat For Hurricane Season

- Common Boat Insurance Claims and How to Avoid Them

- What Does Boat Insurance Cover?

- Or via Email -

Already a member? Login

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Bad Credit

- Best Home Equity Loan Rates

- Best Home Equity Loans

- What Is a HELOC?

- HELOC vs. Home Equity Loan

- Best Free Checking Accounts

- Best High-Yield Savings Accounts

- Bank Account Bonuses

- Checking Accounts

- Savings Accounts

- Money Market Accounts

- Best CD Rates

- Citibank CD Rates

- Synchrony Bank CD Rates

- Chase CD Rates

- Capital One CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Geico Rental Car Insurance

Geico rental car insurance is an optional coverage that helps pay for a rental vehicle if your everyday vehicle needs repairs following an accident

Daniel is a MarketWatch Guides team writer and has written for numerous automotive news sites and marketing firms across the U.S., U.K., and Australia, specializing in auto finance and car care topics. Daniel is a MarketWatch Guides team authority on auto insurance, loans, warranty options, auto services and more.

Rashawn Mitchner is a MarketWatch Guides team editor with over 10 years of experience covering personal finance and insurance topics.

Having your car in the shop for even just a short period can turn into a major disruption if you have no other transportation. Rental reimbursement insurance from Geico can make the process easier by helping to pay for the cost of a rental car.

It’s an optional peace-of-mind coverage that you can add to your everyday auto insurance policy. If you’re involved in an accident, within a day or two, the insurance clears the way for you to rent a car for little to no cost to you.

Geico is one of the best car insurance companies to get this coverage from. This insurance is affordable and gives you a few options for setting your coverage limits, and adjusting them up or down depending on the rental you’ll need and how much you want to pay out of pocket.

Key Takeaways :

- Geico rental car coverage, or rental reimbursement coverage, helps pay for a rental car if your car lands in the shop for repairs after a covered accident.

- When adding this optional coverage, you can select your limits for daily and per-accident coverage — for example, $50 per day and a max of $1,500 per accident.

- Geico’s rental car coverage only covers the cost of the rental. It doesn’t cover gas expenses, security deposits or any additional insurance you buy from the rental car agency.

Compare Car Insurance Rates

Why You Can Trust The MarketWatch Guides Team

The MarketWatch Guides Team is committed to providing reliable information to help you make the best decision possible about insuring your vehicle. Because consumers rely on us to provide objective and accurate information, we created a comprehensive rating system to formulate our rankings of the best car insurance companies. We collected data on dozens of auto insurance providers to grade the companies on a wide range of ranking factors. After 800 hours of research, the end result was an overall rating for each provider, with the insurers that scored the most points topping the list.

Learn more about our methodology and editorial guidelines .

Does Geico Have Rental Car Insurance?

Geico offers rental car insurance among the many optional add-ons of its insurance menu. Often referred to as “rental reimbursement insurance,” this coverage helps pay the cost of renting a car if your vehicle is in the shop for repairs after a covered accident. The insurance costs only a few dollars per month and could save you much more money if you ever need it. If you haven’t rented a car recently, you might be surprised at the cost.

How Much Does Renting a Car Cost?

According to the Consumer Price Index by the U.S. Bureau of Labor Statistics, U.S. rental car costs rose nearly 50% following the pandemic in 2020. While prices have come down since then, they’re still higher than they were pre-pandemic.

The amount you’ll pay for a rental car depends on a number of things, including:

- Type of car: A full-size or luxury car costs more than a compact or economy car.

- Location of pickup: You might pay more when renting a car at an airport or in a popular tourist destination.

- How far in advance you book: You could pay more for last-minute reservations than if you book the vehicle a few weeks or months in advance.

- Driver age: Because insurance companies consider younger, less-experienced drivers a higher risk, they’ll often pay higher rental rates.

The popular travel site Kayak lists rental car prices in the range of $17 to $100 per day. However, depending on the type of car and location, a rental could cost significantly more than that. For example, a top-of-the-line, high-end vehicle like a Lincoln could cost you as much as $250 per day.

What’s Covered by Geico Rental Car Insurance Coverage?

Geico’s rental car insurance covers the cost of renting a car. If you were involved in a covered accident (meaning Geico or the other driver’s insurance is paying your insurance claim) and you need to rent a car while your car gets repaired, Geico’s rental car insurance would help. If you’re not at fault for the accident, the at-fault driver’s insurance will likely pay for your rental car.

It covers the cost of renting a car up to the limits you choose when you buy your policy. Limits vary, but when gathering quotes for rental car insurance, you can expect to see limits like:

- $35 per day ($1,050 max per accident)

- $50 per day ($1,500 max per accident)

- $75 per day ($2,250 max per accident)

If you select $50/$1,500, Geico will pay $50 a day or up to $1,500 total for a given accident — whichever cap you hit first. If you rent a car at $50 per day for five days, the cost would be $250. But if you rent a car at $50 per day for more than 30 days, your coverage would max out at the $1,500 mark. You would have to pay out of pocket for any additional days you need the rental car.

Geico rental car insurance reimburses everything unless you rent a car from Enterprise. In that case, Geico will pay for your rental directly, which means no out-of-pocket cost for you.

When choosing your limits for rental reimbursement insurance, keep in mind the type of vehicle you need day to day. If you’re used to having a luxury car or if you need a larger vehicle, like a van or truck, consider setting higher limits to cover the higher cost of replacing your vehicle.

What Doesn’t Rental Car Reimbursement Cover?

Rental car reimbursement coverage covers only the cost of renting a car when you’re in need of transportation after an accident. It doesn’t cover ancillary expenses, such as:

- Gas for the rental car

- Any additional coverage for the rental car*

- Any security deposit requested by the rental car company

*Geico doesn’t provide additional coverage for the rental car, but if you have collision and comprehensive insurance already on your policy, this will likely transfer to your rental car temporarily.

It’s worth noting that you can only use rental reimbursement coverage if your car is in the shop as the result of a covered accident — meaning your insurance company approved and is paying for your claim.

If your car breaks down or is with the mechanic for routine maintenance, rental reimbursement coverage doesn’t apply. In the case of a standard mechanical breakdown, Geico offers mechanical breakdown insurance .

Is Rental Car Reimbursement Different From Rental Car Insurance?

To answer this question, it’s important that we clarify something, because this is where it gets confusing. As mentioned, Geico’s rental car insurance provides limited reimbursement for the costs of actually renting the car.

However, if you have collision and comprehensive insurance on your Geico policy, these insurance types — not Geico’s rental car insurance — will temporarily insure the rental car while your actual car is in the shop. However, you’ll only get comprehensive and collision coverage.

Geico’s “rental car insurance” is a bit of a misnomer because it’s technically rental car reimbursement coverage . When you see this latter term specifically being used in the insurance industry, it’s referring to your insurer paying you back (partially) for renting the car, but not paying for its damages or your bodily injuries if you get into a car accident.

It’s very common that car insurance companies will automatically protect your rental car anyway under comprehensive and collision coverage. In the industry, the term “rental car insurance” usually means insuring a rental car — not paying for the car’s use over a few days. This is typically offered by rental car companies themselves or by your credit card company.

Where Can I Insure My Rental Car?

Since Geico will only provide whatever amount of comp and collision you already have on your policy for your rental, you may want more coverage. You can often get this through the rental car company itself or your credit card company . The latter only applies if you pay for the rental with a credit card, though.

Check with your credit card company to find out what it covers before deciding whether to buy more rental insurance. You may be sufficiently protected already.

What Is a Collision Damage Waiver?

If you don’t have collision coverage on your auto insurance policy, you sometimes can buy a collision damage waiver (CDW). While it’s not full insurance coverage, a collision damage waiver ensures that you’re not on the hook for any collision damage that may occur to the rental car.

This waiver only applies to collision damage. It doesn’t cover liability-related expenses, including bodily injury and property damage. Additionally, a collision damage waiver doesn’t cover theft. To protect against theft, you’d need to buy what’s known as a loss damage waiver (LDW).

Is Rental Car Coverage Worth It?

Like most insurance coverages, rental car coverage easily pays for itself if you ever need to use it. However, you should consider some things before adding it to your car insurance policy, including:

- Do you have another vehicle you could use if yours were in the shop for repairs for a few days or even a few weeks?

- Can you survive without your car — take public transit, rides from friends — for a few days or weeks?

- Do you drive a large car, like a van or truck, that you’d need to replace with something similar if you rented a vehicle?

- Can you afford to pay a few hundred or even a thousand dollars to rent a car for a week or two?

If you would have a hard time getting through a week or two without your car and you don’t have cash set aside for emergency expenses (like renting a car), then rental reimbursement coverage could absolutely be worth it. Keep in mind that you may be paying for something that you may never need to use. It’s up to you how much risk you’re comfortable with.

Geico Rental Car Insurance: The Bottom Line

Rental car insurance from Geico is an optional coverage that’s easy to add to your auto policy and could be worth the money if you need to use it.

If your car’s ever in the shop for repairs following a covered accident, rental reimbursement insurance would pay the cost of renting a new one in the interim and could save you a few hundred dollars or more. If you don’t have money set aside for emergencies like this, rental car reimbursement could be a worthwhile investment.

However, rental car reimbursement coverage isn’t just offered by Geico. You can find these coverages with State Farm, Progressive and others. Check out our reviews for State Farm or Progressive . You can also compare the providers with each other or with Geico:

- Progressive vs. State Farm

- State Farm vs. Geico

- Geico vs. Progressive

Geico Rental Car Insurance: FAQs

Below are frequently asked questions about Geico rental car insurance.

What is the number for Geico?

Geico’s main phone number is 1-800-207-7847 . If you experience long wait times on the phone, you can also use the virtual assistant or chat features on the company’s website. If you have a Geico policy already, you can log into your policy online to add rental reimbursement insurance. If you’re not sure if you have this coverage, you can always check with your car insurance agent.

What is Geico car rental insurance?

Car rental insurance from Geico helps cover the cost of renting a car if yours is in the shop for repairs after a covered accident. You can only use it if you’ve already filed a claim that was approved and is being processed. Geico car rental insurance has daily and per-accident caps, meaning it will only pay for your rental car up to the limits you choose.

What does Geico cover?

Best known for providing affordable car insurance nationwide, Geico also offers all of the following protection products: motorcycle, ATV, umbrella, homeowners, renters, condo, co-op, RV, life, boat, personal watercraft, flood, mobile home, overseas, travel, commercial, business, identity protection, snowmobile, collector car, Mexico car, pet, jewelry, medical malpractice, earthquake and event insurance.

Our Methodology

Because consumers rely on us to provide objective and accurate information, we created a comprehensive rating system to formulate our rankings of the best car insurance companies. We collected data on dozens of auto insurance providers to grade the companies on a wide range of ranking factors. The end result was an overall rating for each provider, with the insurers that scored the most points topping the list.

Here are the factors our ratings take into account:

- Cost : Auto insurance rate estimates generated by Quadrant Information Services and discount opportunities were both taken into consideration.

- Coverage : Companies that offer a variety of choices for insurance coverage are more likely to meet consumer needs.

- Reputation and experience: Our research team considered market share, ratings from industry experts and years in business when giving this score.

- Availability: Auto insurance companies with greater state availability and few eligibility requirements scored highest in this category.

- Customer experience: This score is based on volume of complaints reported by the NAIC and customer satisfaction ratings reported by J.D. Power. We also considered the responsiveness, friendliness and helpfulness of each insurance company’s customer service team based on our own shopper analysis.

Our credentials:

- 800 hours researched

- 45 companies reviewed

- 8,500+ consumers surveyed

*Data accurate at time of publication.

Related Articles

- Bahasa Indonesia

- Slovenščina

- Science & Tech

- Russian Kitchen

Moscow-City: 7 surprising facts about the Russian capital’s business center

1. Guinness World Record in highlining

The record was set in 2019 by a team of seven athletes from Russia, Germany, France and Canada. They did it on September 8, on which the ‘Moscow-City Day’ is celebrated. The cord was stretched at the height of 350 m between the ‘OKO’ (“Eye”) and ‘Neva Towers’ skyscrapers. The distance between them is 245 m. The first of the athletes to cross was Friede Kuhne from Germany. The athletes didn't just walk, but also performed some daredevil tricks. Their record is 103 meters higher than the previous one set in Mexico City in December 2016.

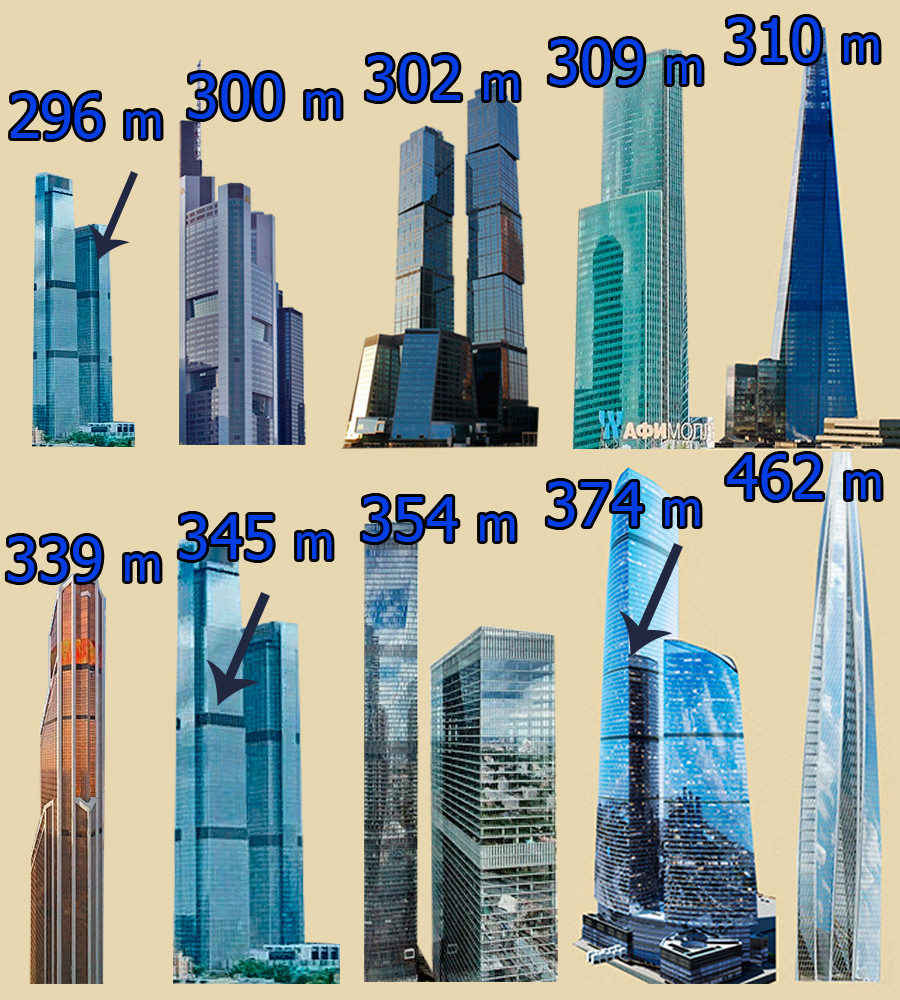

2. Domination of Europe's top-10 highest skyscrapers

7 out of 10 Europe’s highest skyscrapers are located in Moscow-City. Earlier, the ‘Federation Tower’ complex’s ‘Vostok’ (“East”) skyscraper was the considered the tallest in Europe.

Left to right: the lower of the ‘Neva Towers’ (296 m), Commerzbank Tower in Frankfurt (300 m), Gorod Stolits (“City of Capitals”) Moscow tower (302 m), Eurasia tower (309 m), The Shard’ skyscraper in London (310 m), Mercury City Tower (339 m), Neva Towers (345 m).

However, in 2018, the construction of the 462 meter tall ‘Lakhta Center’ in Saint-Petersburg was completed, pushing ‘Vostok’ (374 m) into 2nd place. The 3rd place is taken by OKO’s southern tower (354 m).

3. The unrealized ‘Rossiya’ tower

If all the building plans of Moscow-City were realized, the ‘Lakhta Center’ in St. Petersburg wouldn't have a chance to be Europe's highest skyscraper. Boris Tkhor, the architect who designed the concept of Moscow-City, had planned for the ‘Rossiya’ tower to be the tallest. In his project, it was a 600 meter tall golden cylindrical skyscraper ending with a spire that was inspired by traditional Russian bell towers. Then, the project was reinvented by famous British architect Sir Norman Foster. He had designed ‘Rossiya’ as a pyramid ending with a spire. The skyscraper itself would have been 612 meters tall, and the height including the spire would have reached 744,5 meters (for comparison, the ‘Burj Khalifa’ in Dubai, UAE, would have been just 83,5 meters taller). Unfortunately, the investors faced a lot of economic problems, due to the 2008 financial crisis, so the ‘Rossiya’ skyscraper was never built. A shopping mall and the ‘Neva Towers’ complex was constructed at its place in 2019.

4. Changed appearance of ‘Federation Tower’

In its first project, the ‘Federation Tower’ was designed to resemble a ship with a mast and two sails. The mast was to be represented by a tall glass spire with passages between the towers. It was planned to make a high-speed lift in it. The top of the spire was going to be turned into an observation deck. But the ship lost its mast in the middle of its construction. Experts at the Moscow-city Museum based in the ‘Imperia’ (“Empire”) tower say, that the construction of the spire was stopped, firstly, due to fire safety reasons and secondly, because it posed a threat to helicopter flights – the flickering glass of the spire could potentially blind the pilots. So, the half-built construction was disassembled. However, an observation deck was opened in the ‘Vostok’ tower.

5. Open windows of ‘Federation Tower’

We all know that the windows of the upper floors in different buildings don’t usually open. Experts say that it’s not actually for people’s safety. Falling from a big height is likely to be fatal in any building. The actual reason is the ventilation system. In a skyscraper, it’s managed with a mechanical system, and the building has its own climate. But in the ‘Zapad’ (“West”) tower of the ‘Federation Tower’ complex, the windows can open. The 62nd and last floor of the tower are taken up by a restaurant called ‘Sixty’. There, the windows are equipped with a special hydraulic system. They open for a short period of time accompanied by classical music, so the guests can take breathtaking photos of Moscow.

6. Broken glass units of ‘Federation Tower’

The guests of the ‘Sixty’ restaurant at the top of the ‘Zapad’ tower can be surprised to see cracked glass window panes. It is particularly strange, if we take into consideration the special type of this glass. It is extremely solid and can’t be broken once installed. For example, during experiments people threw all sorts of heavy items at the windows, but the glass wouldn’t break. The broken glass units of ‘Zapad’ were already damaged during shipment . As each of them is curved in its own way to make the tower’s curvature smooth, making a new set of window panes and bringing them to Russia was deemed too expensive . Moreover, the investors had financial problems (again, due to the 2008 financial crisis), so the ‘Vostok’ tower even stood unfinished for several years. Eventually, the cracked window panes were installed in their place.

7. The highest restaurant in Europe

‘Birds’, another restaurant in Moscow-City, is remarkable for its location. It was opened at the end of 2019 on the 84th floor of the ‘OKO’ complex’s southern tower. Guests at the restaurant can enjoy an amazing panoramic view at a height of 336 meters. On January 28, the experts of ‘Kniga Recordov Rossii’ (“Russian Records Book”) declared ‘Birds’ the highest restaurant in Europe, a step toward an application for a Guinness World Record.

If using any of Russia Beyond's content, partly or in full, always provide an active hyperlink to the original material.

to our newsletter!

Get the week's best stories straight to your inbox

- The evolution of Russia's No. 1 news program - from the USSR to now

- The Khodynka tragedy: A coronation ruined by a stampede

- ‘Moskvitch’: the triumph and sad end of a famous Moscow car plant (PHOTOS)

This website uses cookies. Click here to find out more.

How To Find the Best Car Insurance While Serving in the Military

B ased on our analysis, USAA and GEICO stand at the pinnacle among car insurance providers for military families and veterans due to their customer satisfaction and military-centric benefits and savings. Read our detailed examination of these military car insurance carriers and the offerings they extend to our servicemen, servicewomen and their families.

On This Page

What is military car insurance, how do i qualify for military car insurance, which companies provide car insurance for military members, what should i do with my car insurance if i’m deployed, how to get military car insurance.

When we say military car insurance, we’re referring to an auto insurance policy that not only meets your state’s insurance requirements but also has added perks or car insurance discounts exclusive to our veterans and active duty members. These bonuses might include a discount on your premium while deployed or even special deals on entertainment and travel.

Eligibility for qualifying for military car insurance or a discount can vary by company but will typically require you to be serving or have served in one of the U.S. military branches. Active or retired Department of Defense (DoD) employees, service academy students, officer candidates nearing commissioning and honorably discharged or retired veterans are all examples of who may qualify for military car insurance. Qualifying family members, such as spouses, children, widows, widowers or unmarried former spouses, may also be eligible for coverage.

Service members have a couple of car insurance companies to choose from that provide unique coverage for military members.

USAA stands as a leading provider of car insurance for veterans, active duty personnel and their families. In fact, USAA serves only military families and unless you’re an active duty personnel, a veteran or married to or the child of one, you cannot buy a USAA auto policy.

USAA’s diversified offerings encompass basic car insurance, roadside assistance and rideshare protection , along with specialized plans for motorcycles, boats and RVs. For those stationed on base, a 15% discount on comprehensive coverage is available when vehicles are housed at a military facility . Active duty personnel can also receive a 60% car insurance discount if they are storing their vehicle long-term , such as while they are deployed. [1] In addition, some auto policies will insure personal belongings inside your car for up to $250 — this type of coverage is usually excluded by other carriers. [2]

Members also enjoy exclusive deals on entertainment, retail and car maintenance , positioning USAA above the competition. The legacy discount extends veteran advantages to family as well, affording a 10% price cut for drivers below 25 , ensuring the support transfers to the next generation. [1]

Most impressively, USAA excels in customer satisfaction , clinching top accolades from J.D. Power in 2023 across all surveyed regions. [3] Scoring included their SafePilot telematics program, emerging as a prime choice for safety-conscious drivers aiming for further rate reductions, underlining USAA’s commitment to rewarding safe driving practices.

Earning the second spot for providing the best car insurance for military members is GEICO , a company with a commitment to serving our U.S. military members that traces back to 1936. [4] The company adopts a tailored approach for its military clientele, offering a diverse range of auto insurance products and services. At the heart of this personalized service is the GEICO Military Center , a dedicated team that includes veterans who are on hand to respond to inquiries, formulate discounts and provide service options that resonate with the distinct needs of U.S. troops, whether stationed domestically or abroad.

Central to the military program is the base military discount of 15% and the emergency deployment discount of up to 25% , extended to military members venturing into imminent danger pay areas as designated by the DoD. [5][6][7] In instances where military duties call for long-term vehicle storage, GEICO exhibits flexibility by potentially suspending coverage for the duration of deployment . Additionally, many states offer discounts to members affiliated with professional military associations such as the Association of the United States Army, Fleet Reserve Association and Armed Forces Benefit Association.

A focal point of military-centric service is the military center situated in Virginia Beach, Virginia, dedicated to catering to the needs of active duty, guard, reserve and retired military personnel as well as their families. Extending its reach globally, GEICO has established offices worldwide to ensure military and government personnel stationed abroad receive the necessary assistance and support, reflecting GEICO's unwavering commitment to serving the military community.

Though not on par with USAA when it comes to overall customer satisfaction, GEICO had a solid showing in the 2023 J.D. Power study, scoring above average in five out of 11 regions. [3] Notably, GEICO is the highest-rated auto insurance carrier in the New England region , which includes Maine, Vermont, New Hampshire, Massachusetts, Connecticut and Rhode Island and tied for the highest rating in its division for usage-based insurance (UBI).

Kemper, Liberty Mutual and Farmers

We wanted to highlight Kemper, Liberty Mutual and Farmers because these three companies offer a car insurance discount to military personnel, although the exact discount amount is not specified on their websites.

It is imperative to communicate with your insurance provider about your deployment to explore options such as reducing coverage to the minimum required or opting for a military deployment discount like the ones offered by USAA and GEICO, thereby preserving a continuous coverage history and avoiding lapses .

You may also consider suspending your policy to avoid monthly premiums on an unused car , provided the car is securely parked. As we discussed earlier, GEICO does have this as an option for military members. The ability to suspend coverage may depend on your place of residence, so it’s essential to confirm this with your insurer.

Additionally, check your state’s DMV website to see if you need to fill out an “affidavit of non-use,” a document that informs the state that your vehicle won’t be driven for a while.

How To Get Insurance Reinstated When You’re Back From Deployment

Contacting your insurance company promptly upon return and updating them about your change in status is crucial. Review your coverage options , adjust your policy as needed and ensure that all the necessary documentation is updated and accurate. This proactive approach will facilitate a smooth transition and reinstate optimal coverage swiftly. Remember: driving without insurance is illegal in most states and can result in fines, the suspension of your license and even jail time.

If you're seeking cheap car insurance, SmartFinancial recommends collecting quotes from at least three to five insurers, as qualifying for a military discount does not guarantee the cheapest policy. Another car insurance company may offer a more affordable policy even without applying a military discount. SmartFinancial eases the shopping process by having you fill out one form with your coverage needs and budget so you can quickly obtain a personalized policy. Enter your zip code below for your FREE military member car insurance quote.

Do military members get cheaper car insurance?

Military members can receive cheaper car insurance coverage due to exclusive discounts and benefits offered by specialized providers in recognition of their service and sacrifices.

Which states require car insurance military discounts?

Louisiana and Montana require car insurance companies to provide a discount for National Guard members. [8][9] Louisiana specifically requires insurance companies to offer a 25% discount. [8]

Does the military provide car insurance?

The military does not directly provide car insurance. However, military members have access to specialized insurance providers like USAA and GEICO, which can offer tailored policies and discounts to meet their unique needs.

Is USAA insurance for military members only?

USAA car insurance is available only to military members, veterans and their families. It is renowned for its commitment to delivering exceptional value, service and support to those who have dedicated their lives to safeguarding our nation.

- USAA. “ Auto Insurance Discounts .” Accessed September 28, 2023.

- USAA. Auto Insurance Insurance Product Information Document ,” Page 1. Accessed October 26, 2023.

- J.D. Power. “ Auto Insurance Customer Satisfaction Plummets as Rates Continue To Surge, J.D. Power Finds .” Accessed September 28, 2023.

- GEICO. “ About GEICO’s Military Insurance .” Accessed September 28, 2023.

- GEICO. “ Military Car Insurance & Coverage Discounts .” Accessed September 28, 2023.

- GEICO. “ Car Insurance Discounts - Savings on Auto Insurance .” Accessed September 28, 2023.

- Defense Finance and Accounting Service. “ Imminent Danger Pay .” Accessed September 28, 2023.

- Louisiana Legislature. “ HLS 23RS-470 ,” Page 2. Accessed September 28, 2023.

- Montana Legislature. “ Rate Reduction for Military Defensive Drivers - Effective Period - Exclusions .” Accessed September 28, 2023.

State Farm review 2024: Auto, property, home and life insurance all under one roof

As of 2022, State Farm is the largest writer of property and casualty insurance based on direct premiums written, taking up over 9% of the market. It’s based in Illinois, and it sells a variety of insurance products, including personal and commercial policies. Its rates are in line with industry averages, but recently, State Farm has made headlines for pulling its operations out of some states, so some consumers won’t be able to get coverage through the insurance giant.

In this State Farm insurance review, learn about the company’s availability, products, rates and reputation. All rates and fees listed are current as of March 15, 2024.

State Farm at a glance

- Homeowners insurance: $157 per month for a $300,000 home

- Small Business Insurance: $40 to $66 per month for a business owners policy (BOP) with $1 million in liability coverage

- Vehicle Insurance: $131 per month for a 30-year old driver and $50,000/$100,000/$50,000 coverage

Who is State Farm good for?

Whether you’re shopping for insurance for your home or car or are exploring coverage options for your business , State Farm could be a good choice. It sells both commercial and personal insurance products, including auto, property and liability coverage.

State Farm is best for those who need to purchase more than one type of insurance; bundling your home, auto, renters or life insurance policies together can help you save a substantial amount of money. According to the company, those who bundle auto and homeowners insurance save up to $1,073 per year.

Who shouldn’t use State Farm?

Although State Farm is licensed to sell insurance in all 50 states, it has paused or ceased operations in certain locations. It no longer issues new policies to residents of Massachusetts or Rhode Island, and in 2023, it announced it would no longer issue personal or business policies in California due to the increased risks of disasters and rising construction costs. If you live in one of those states, you’ll need to find another insurance provider.

State Farm sells its policies through its agents, and you have to contact an agent to get a quote and purchase most forms of coverage. For those who prefer a digital buying experience, that limitation can be frustrating.

State Farm rates and products

State Farm sells multiple personal and commercial insurance policies to protect you, your property, your business and your family.

State Farm Vehicle Insurance

State Farm sells personal passenger vehicle insurance for cars, motorcycles, boats, recreational vehicles (RVs) and ATV and off-road vehicles. It offers some products that aren’t commonly offered, such as rideshare insurance and boat rental liability insurance.

Depending on your needs, you can buy one or more of the following coverages:

State Farm Property Insurance

State Farm sells property insurance for homeowners, renters and landlords. However, its online quote tool is only available for some products and consumers in certain states, so you’ll have to contact an agent to get an idea of cost for other locations or products. According to quotes from several comparison sites, State Farm’s homeowners insurance premiums were about $1,800 per year for a $300,000 home, slightly higher than the national average of $1,754.

State Farm Small Business Insurance

State Farm is a leading provider of small business insurance . In fact, J.D. power ranked State Farm second

out of 13 insurers in its U.S. Small Commercial Insurance Study that evaluated insurers on customer satisfaction.

It sells a variety of small business insurance products, including business owners’ policies (BOPs) at $636 per year on average, commercial auto, professional liability and workers’ compensation insurance.

State Farm Life Insurance

State Farm sells term, whole and universal life insurance policies in all states except Massachusetts. Depending on your age, health and the amount of coverage you need, you may be able to get life insurance without a medical exam.

State Farm doesn’t provide information about its rates for whole or universal life insurance online, so you have to contact an agent for a quote. But for term life insurance, its premiums for a $250,000, 30-year policy start at $230 per year, which is typical for the industry.

The State Farm platform and customer support

Due to State Farm’s user-friendly website and mobile app, it was the top-ranked larger insurer in the J.D. Power 2023 U.S. Insurance Shopping Study. You can use its site and app to file claims or get roadside assistance, and it also has agents you can contact for personalized advice and support.

For those who prefer to handle issues over the phone, State Farm has 24/7 customer service available. You can call to file a claim, pay your bill or contact emergency roadside assistance.

[Note: Your customer satisfaction level may vary based on your State Farm agent. The author and editor of this article both have personal insurance through State Farm, and neither of them have had to wait longer than a few hours to hear back from their local agents about any policy questions or insurance products.]

What is State Farm’s reputation for paying claims?

In general, State Farm has a strong reputation for paying out claims to policyholders. It was ranked fifth out of 24 insurers in the J.D. Power 2023 U.S. Auto Claims Satisfaction Study, and it was ranked sixth out of 17 insurers in the 2023 U.S. Property Claims Satisfaction Study. In both cases, State Farm scored higher than the industry average.

However, the company was poorly graded in The Crash Network’s 2024 Insurer Report Card. The study surveyed over 1,100 auto repair shops and graded 88 insurers based on how well those companies handle claims after an accident. The Crash Network gave State Farm a “C-” grade, and it was ranked 73rd out of 88 insurers.

Its low grade isn’t abnormal for a large insurer; The Crash Network said none of the 10 largest insurance companies scored better than a “C+.” But if you’re a policyholder, you may find that State Farm is slower to process claims or communicate with you as your car is being repaired than a smaller insurer would be.

State Farm user reviews

State Farm has more negative reviews than is typical for the industry. With the National Association of Insurance Commissioners (NAIC), the State Farm Fire & Casualty Company — which handles about $27 billion in annual premiums — had a complaint index of 1.64, meaning it received more complaints than the expected amount for a company of its size.

With the Better Business Bureau (BBB), it has a 1.18 out of five rating based on approximately 1,500 reviews. Some complaints mentioned slow claims processing times or confusing information, emphasizing how the customer experience can be impacted by the service provided by local agents.

Compare State Farm alternatives

Is state farm right for you.

State Farm is a top insurer for its range of products, discount programs and the number of agents it has nationwide. If you are shopping for multiple types of coverage — such as needing a new homeowners and auto insurance policy — you may be able to save money by taking advantage of State Farm’s multi-policy discounts.

However, customer reviews are mixed, and your experience may be affected by the level of service your local agent provides. State Farm provides limited information about its policies and rates online, so those who like to get quotes and purchase coverage independently may prefer an insurer that has more digital options, such as Geico or Lemonade.

Frequently asked questions

Is state farm leaving florida .

Although other insurance companies— including Farmers — have stopped issuing homeowners policies in Florida, State Farm is not following their lead. In 2023, State Farm issued a statement reaffirming its commitment to serving customers in the Sunshine State.

Who gets State Farm’s best rates?

To qualify for the lowest rates, you likely need to be eligible for State Farm’s discount programs. Depending on your circumstances, you may be eligible for multi-policy, safe driver or home security discounts.

How many agents does State Farm have?

The insurance company says it has approximately 19,000 agents across the country.

EDITORIAL DISCLOSURE : The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends ™ editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.

You are about to leave geico.com

When you click "Continue" you will be taken to a site owned by , not GEICO. GEICO has no control over their privacy practices and assumes no responsibility in connection with your use of their website. Any information that you provide directly to them is subject to the privacy policy posted on their website.

The Insurance Savings You Expect

See how much you could save! Let's get started by entering your ZIP Code:

Motorcycle/ ATV

View More Insurance Types

Start My Quote

Continue Your Saved Quote

Find an Agent Near You

More Insurance Types

Select a vehicle insurance type

Motorcycle/ATV

Collector Auto

Mexico Auto

Select a property insurance type

Mobile Home

Select another insurance type

Identity Protection

You're getting an auto quote today!

Want to bundle your policy?

Add property insurance and you could save even more.

Retrieve saved quote:

Let's start with auto!

After your auto quote, we'll help you get a property quote.

Continuing to auto quote in 10 seconds…

Important Information: If you currently have an active flood insurance policy, please call us for the most accurate quote at (800) 566-1575 .

If you don't currently have an active flood policy, click "Continue" to get a quote online.

GEICO Insurance Agency, Inc. has partnered with to provide insurance products. When you click "Continue" you will be taken to their website, which is not owned or operated by GEICO. GEICO has no control over their privacy practices and assumes no responsibility in connection with your use of their website. Any information that you directly provide is subject to the privacy posted on their website.

Call (888) 395-1200 or log in to your current Homeowners , Renters , or Condo policy to review your policy and contact a customer service agent to discuss your jewelry insurance options.

- New user? Activate account .

- Get the GEICO Mobile App .

Need to pay a bill, make a change, or just get some information?

With just a few clicks you can access the GEICO Insurance Agency partner your boat insurance policy is with to find your policy service options and contact information.

Need to make changes to your life insurance policy ?

Helpful life insurance agents, who can assist you in servicing your policy, are just a phone call away.

Need to pay a bill, make a change, or get information about your coverage?

Simply, login to your auto policy to manage your umbrella policy.

Our experienced agents can help you with any paperwork and to manage your policy. Call us if you have any questions about this valuable coverage.

Need to make changes to your travel policy ? You can make a payment or view your policy online anytime.

Need to make changes to your overseas policy ?

From overseas: call an agent in your country .

You can also email [email protected] .

Need to pay a bill, make a change, or just get some info?

With just a few clicks you can look up the GEICO Insurance Agency partner your Business Owners Policy is with to find policy service options and contact information.

With just a few clicks you can look up the GEICO Insurance Agency partner your General Liability Policy is with to find policy service options and contact information.

With just a few clicks you can look up the GEICO Insurance Agency partner your Professional Liability Policy is with to find policy service options and contact information.

Access your policy online to pay a bill, make a change, or just get some information.

Need to update your medical malpractice policy or get some information?

- Sign up for online access

Manage your American Modern Insurance Group ® policy online or speak to an agent for Assurant or American Modern Insurance Group ® .

Need to update your pet policy or add a new pet?

If your policy is with Jewelers Mutual Insurance Group, log in here .

For all other policies, log in to your current Homeowners , Renters , or Condo policy to review your policy and contact a customer service agent to discuss your jewelry insurance options.

Purchased Mexico auto insurance before?

Login for quick access to your previous policy, where all of your vehicle information is saved.

With just a few clicks you can look up the GEICO Insurance Agency partner your Earthquake policy is with to find policy service options and contact information.

Need to make changes to your event insurance policy ?

Helpful event insurance agents, who can assist you in servicing your policy, are just a phone call away.

Need to make changes to your bicycle insurance policy ?

Helpful bicycle insurance agents, who can assist you in servicing your policy, are just a phone call away.

Don't have a GEICO Account?

With just a few clicks you can look up the GEICO Insurance Agency partner your insurance policy is with to find policy service options and contact information.

has partnered with to provide insurance products. When you click "Continue" you will be taken to their website, which is not owned or operated by GEICO. GEICO has no control over their privacy practices and assumes no responsibility in connection with your use of their website. Any information that you directly provide is subject to the privacy posted on their website.

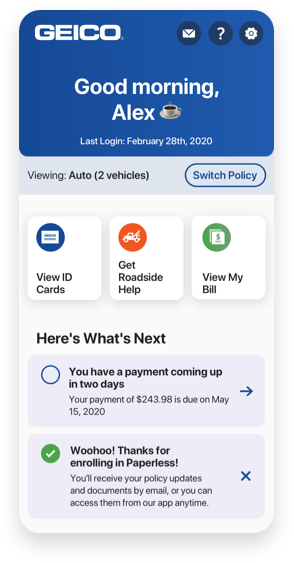

Get Instant Access to Claims and Your Policy

Log In to Your Policy

Report a Claim

Track a Claim

Request Roadside Assistance

Insurance for Your Everyday Needs

Customized to fit you.

Vehicle Insurance

Whether you're on the road, the trail, or the water we're here to help you get the insurance you need.

Property Insurance

We can help with insurance for your home and belongings whether you own or rent.

Business Insurance

Business insurance can be tricky. Finding the right protection doesn't have to be. GEICO can help you find what you need.

Additional Insurance

Protect more of what you love. GEICO offers a variety of additional insurance such as life, umbrella, travel, overseas, pet, and more.

See Why People Switch to GEICO

Years of Experience

Average Annual Savings*

Customer Satisfaction Rating*

The #1 Rated Insurance App

The GEICO Mobile app gives you peace of mind at your fingertips.

- Get ID cards

- Call for roadside assistance

- File a claim

- Pay your bill

Explore GEICO Living

Articles and more for your reading pleasure.

Driving and Safety Tips

Saving Money

Protect Your Home

GEICO Commercials